Back

Replies (1)

More like this

Recommendations from Medial

Sanjeev Antal

OG Founder & CEO - P... • 1y

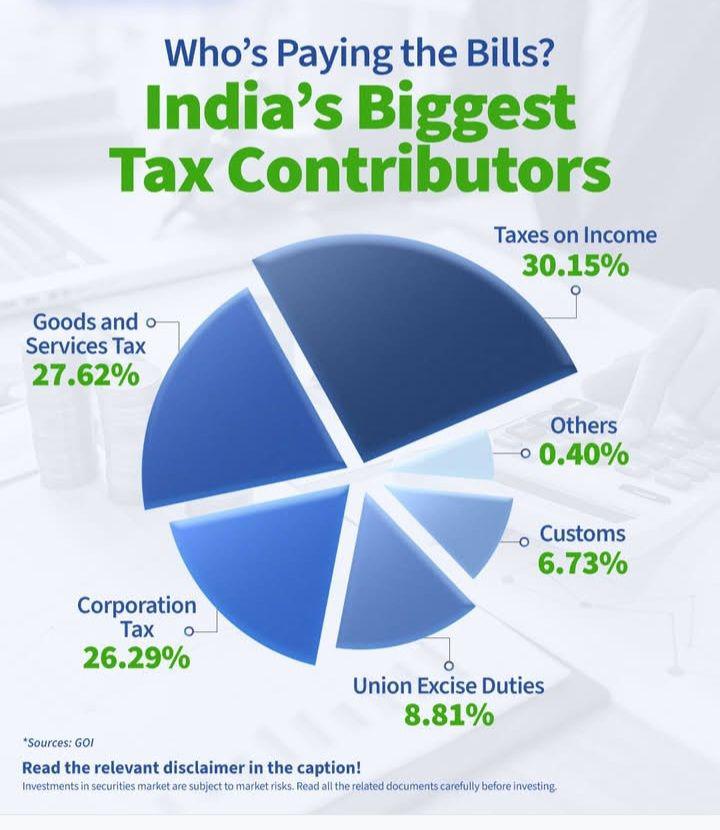

🚨 GST Council Introduces 'Track and Trace' Mechanism 🚨 The GST Council has approved a 'track and trace' system to combat tax evasion in specific industries. Cigarettes and pan masala are expected to be the initial focus of this initiative. Key H

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Sai Vishnu

Income Tax & GST Con... • 11m

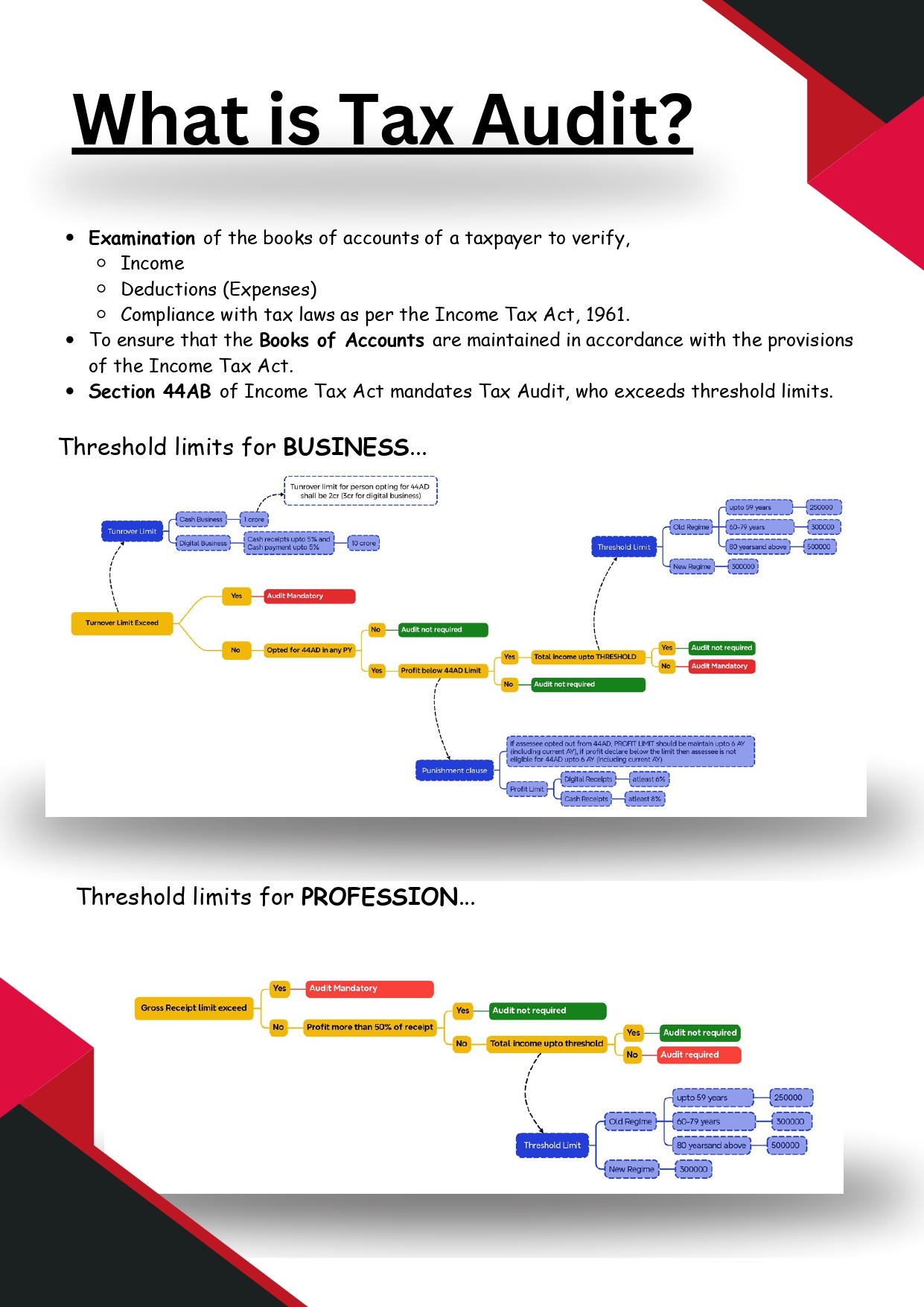

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

CA Kakul Gupta

Chartered Accountant... • 1y

Breaking Chains, Building Clarity! 💡🏛️ Just write about the New Income Tax Bill 2025, and it feels like history in the making! 📖✨ Finance Minister Nirmala Sitharaman has introduced a bill that promises to simplify, modernize, and revolutionize In

See MoreSanskar

Keen Learner and Exp... • 1y

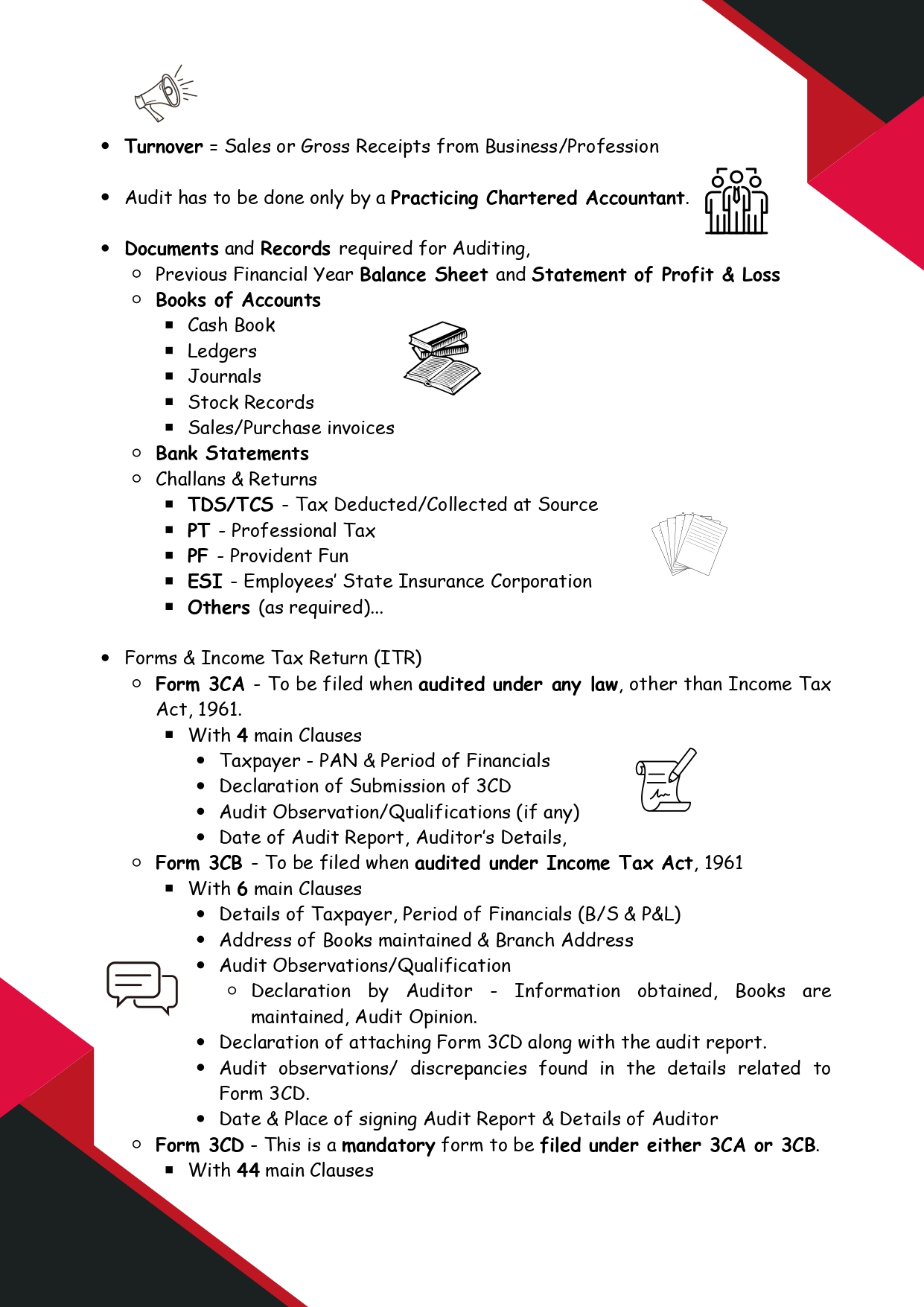

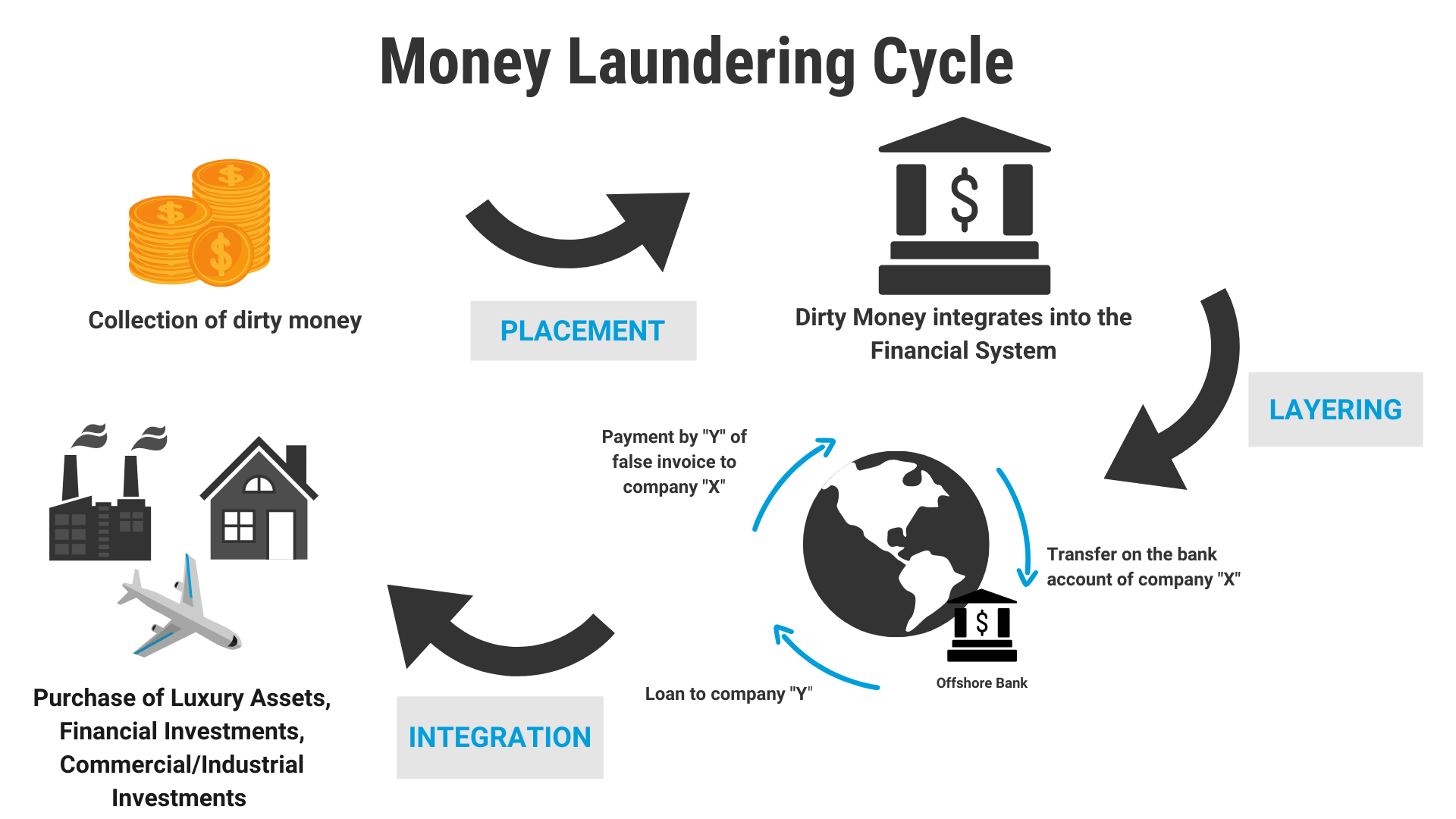

In 2016, a German journalist Bastian Obermayer has published 11.5M documents online. These documents contained details about financial tax evasion and money laundering of the VIPs and VVIPs. This list contained the names of 11 world leaders, politic

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)