Back

More like this

Recommendations from Medial

Atharva Deshmukh

Daily Learnings... • 1y

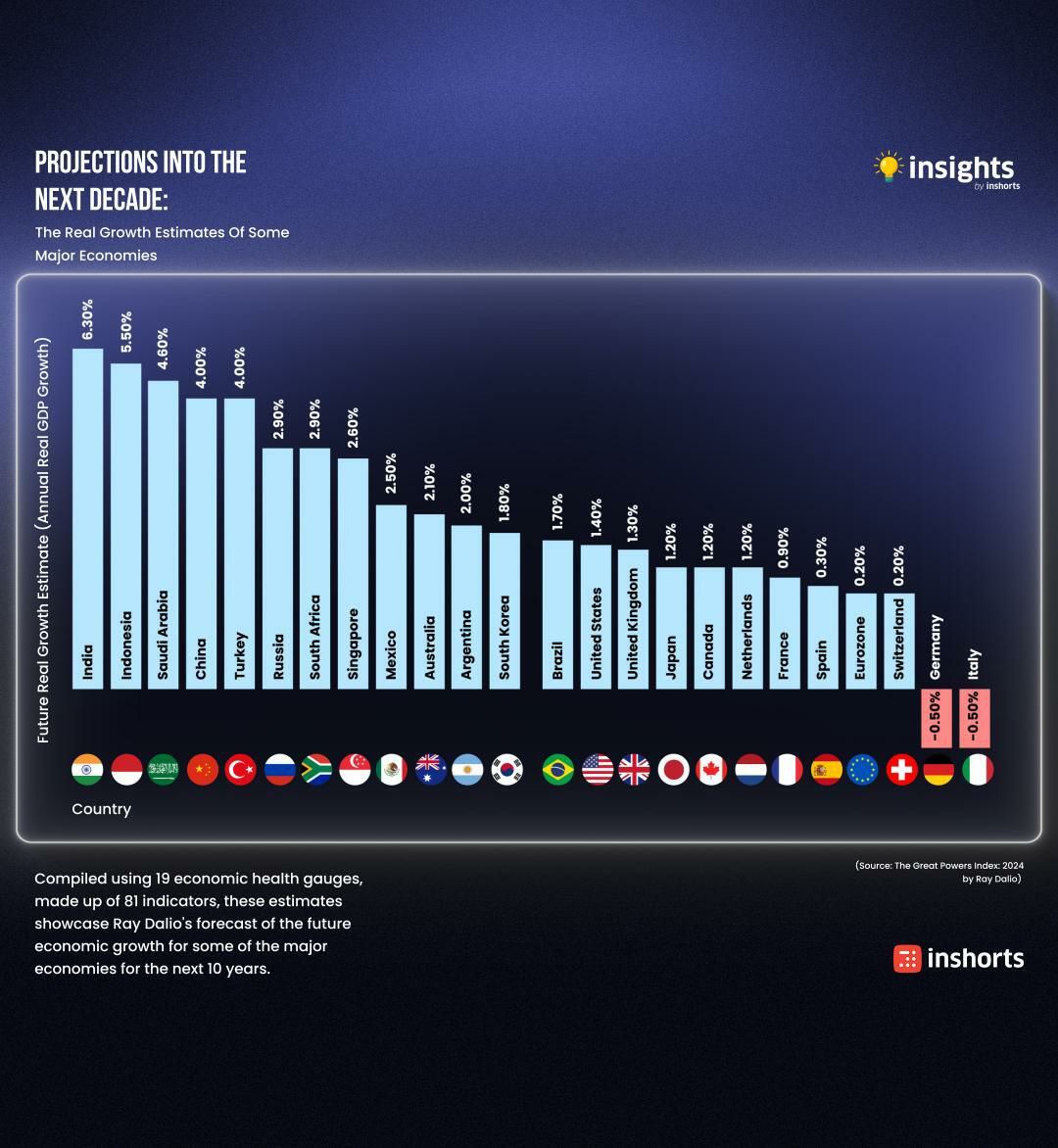

PESTLE Framework:- The framework analyzes external factors influencing a business. 1] Political:- Government policies, regulations, stability, tax policies, trade traffic 2] Economic:- Economic growth, inflation, exchange rates, interest rates 3]

See MoreAakash kashyap

Building JalSeva and... • 1y

❗❗Important For All ❗❗ A $450 million Indian startup, Zest Money, shut down due to strict RBI regulations, highlighting the risks of external factors in business. 🚀 $450 million valuation: Zest Money was a leading player in the buy now pay later s

See More

Bharath Varma

Sailing the sea to g... • 1y

Boss and a Leader in 10 points each: Boss * Drives tasks and completion * Relies on positional authority * Issues directives and commands * Motivates through external factors (rewards/punishments) * Dictates solutions to problems * Makes unila

See More

Only Buziness

Everything about Mar... • 1y

Why Do Startups Fail? The blog explores the reasons behind startup failures and Key insights include: 1. Ideation Stage: Lack of market research can lead to product-market mismatch 2. Launch Stage: An ineffective business model can hinder scal

See More

Vansh Khandelwal

Full Stack Web Devel... • 6m

In this blog, I examine the enduring success of Parle-G, a biscuit brand established in 1939, which has become a household staple in India. The brand's resilience stems from its focus on consumer utility, positioning itself as an affordable source of

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Ever wondered what happens before a startup secures funding? Let's deconstruct it Valuation is key in funding rounds – is it art or science? For early-stage startups, it's a mix. Common Valuation Methods: DCF: Future cash flows discounted to present

See More

Prem Siddhapura

Unicorn is coming so... • 1y

Growth Principle One: Be The Best At Getting Better At its core, this principle emphasizes the power of continuous improvement. While flashy growth hacks might make headlines, sustained success comes from committing to getting better every single da

See More

Shiv Bharankar

Seize the day" • 1y

Government vs. Corporate Jobs: What’s Your Call? Have you ever wondered why so many students spend years chasing government jobs, sacrificing their youth for that one shot at stability? On the flip side, corporate jobs seem easier to get, but the gr

See MoreVedant SD

Finance Geek | Conte... • 1y

Stayzilla: A Bangalore Startup's Demise Stayzilla, a once-promising Bangalore-based startup in the budget accommodation space, collapsed in 2017 due to a combination of factors: * Unsustainable Growth: Rapid expansion strained resources and proved

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)