Back

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

Got a great product, team, and traction but VCs are still passing?here are 6 common reasons: * Market Size Too Small: Your concept's proven, but is the total addressable market large enough for VC-level returns (10x+)? VCs seek massive scale, not ju

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

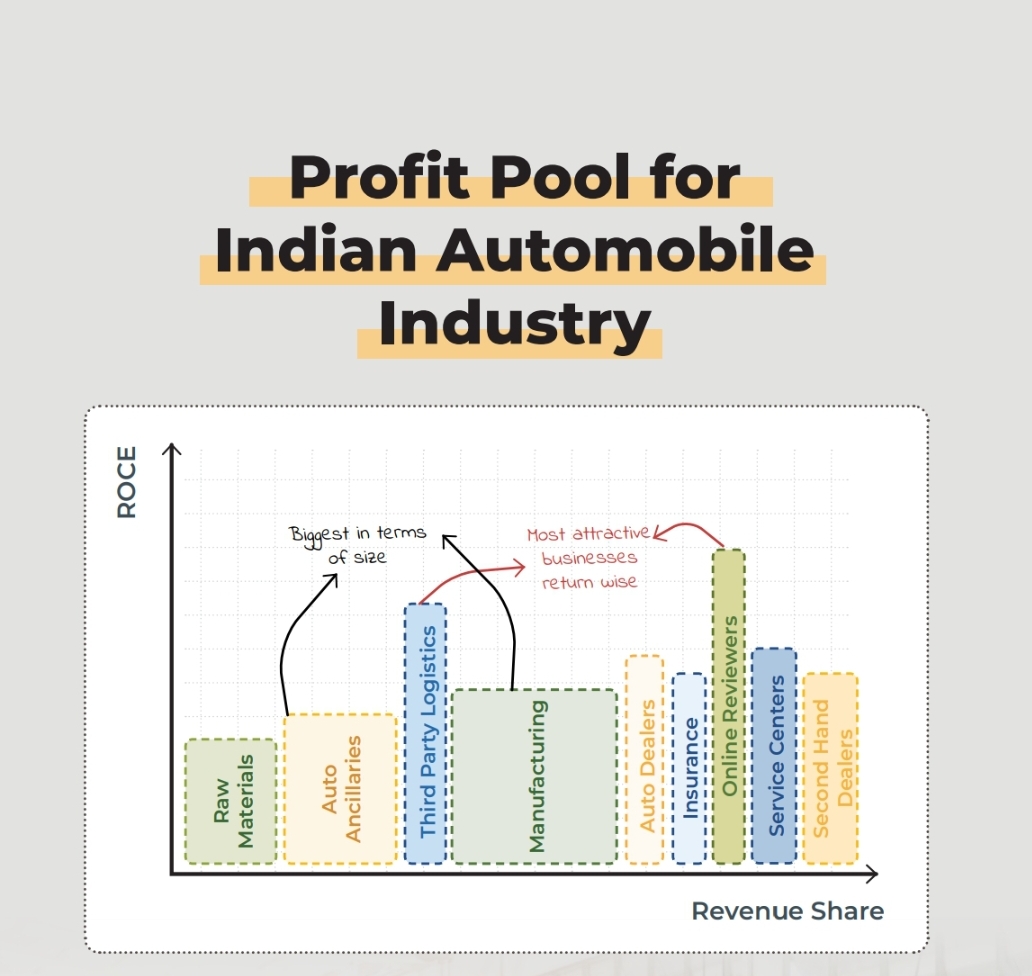

🚗💰 Where’s the Money in the Indian Automobile Industry? 💡 Not all auto businesses are created equal! 🔍 Some dominate in size, while others shine in returns. 📊 Biggest in size: 🚚 Third-Party Logistics & Manufacturing 💸 Most attractive return

See More

Jewelpik App

House of jewellery b... • 7m

How Photography Angles Change Perception of Jewelry Weight & Size The way you photograph jewelry can drastically change how customers perceive size, weight, and value. Here's how angles affect perception: Top-down shots can make pieces look bigger

See MoreVishwa Lingam

Founder of Simulatio... • 7m

🚫 Why VCs Reject Your Pitch — Even If It’s a Solid One 💡 You're not alone if your startup pitch got rejected by a VC. But here's the hidden truth most won’t tell you: VCs have limited capital from their LPs (Limited Partners) & they’re under pre

See MoreNimesh Pinnamaneni

•

Helixworks Technologies • 11m

💥 A VC turned $6.4m into $1.3b in 5 yrs — there’s a lesson here for founders💥 Cyberstarts just turned a $6.4M seed investment in Wiz into $1.3 BILLION after Google’s $32B acquisition—a mind-blowing 222x return in just 5 years! 🚀🔥 This is why VC

See More

VIJAY PANJWANI

Learning is a key to... • 3m

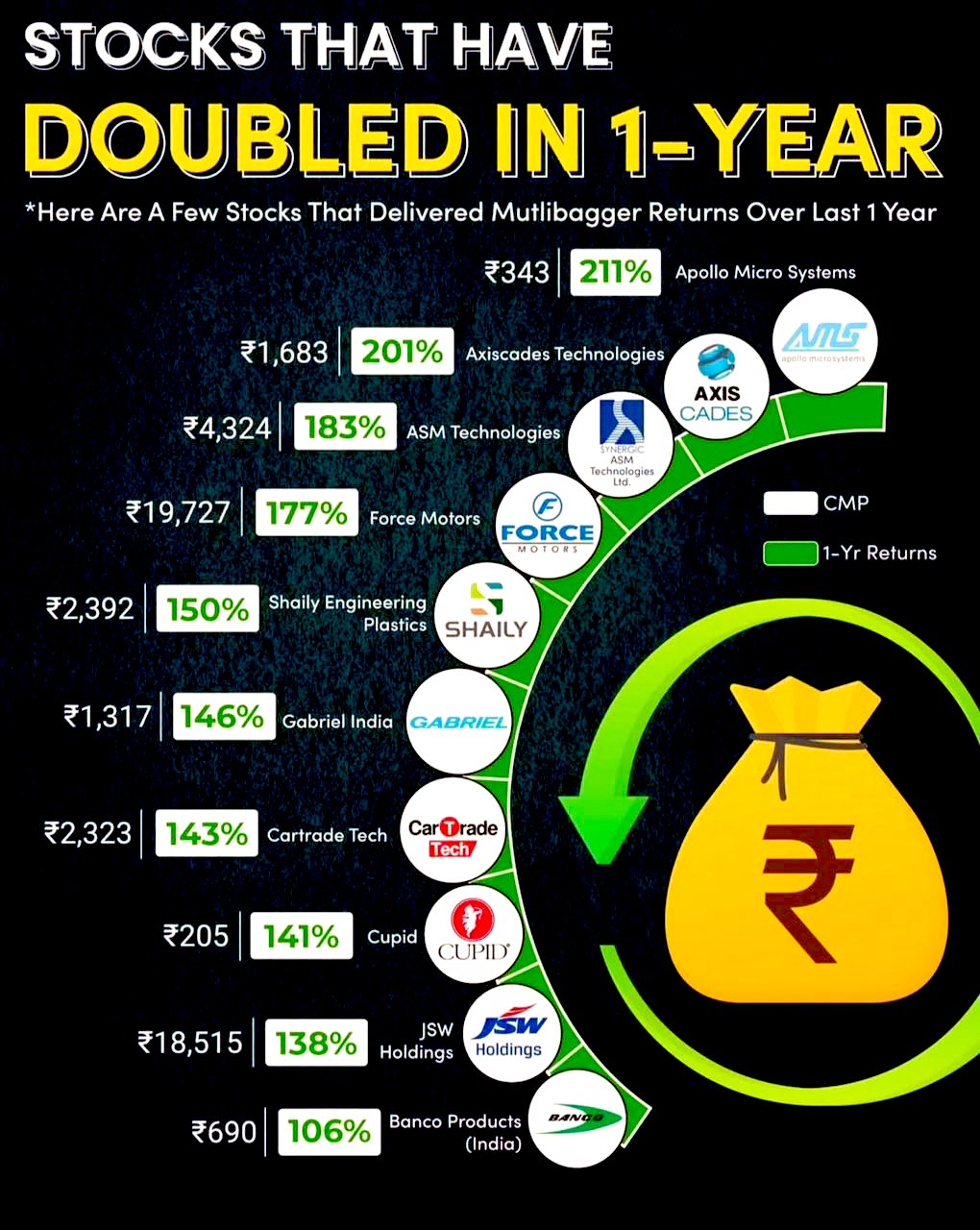

STOCKS THAT HAVE DOUBLED IN JUST 1 YEAR! 💰📈 These Indian stocks delivered massive multibagger returns in the last 12 months 🔥 From Apollo Micro Systems (+211%) to Banco Products (+106%), investors are smiling all the way to the bank 😎 💹 Top P

See More

Santhosh Gandhi

Decoding Venture Cap... • 12m

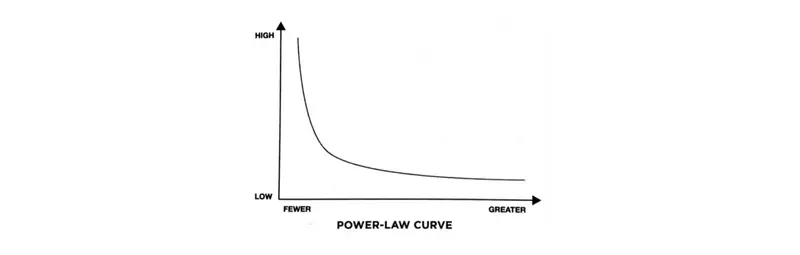

If you’ve ever wondered why VCs invest in risky startups instead of safe businesses, it’s because of something called the power law. And trust me, if you understand this, you’ll see why most VCs don’t care if 90% of their startups fail! Think about

See MoreVivek Joshi

Director & CEO @ Exc... • 6m

Fundraising can be tough, and the last thing you need is to be scammed by a fake VC. To protect yourself and your business, always remember these key checks: * Due Diligence: A legitimate VC will have a verifiable track record of investments and a s

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)