Back

Santhosh Gandhi

Venture Capital Focu... • 11m

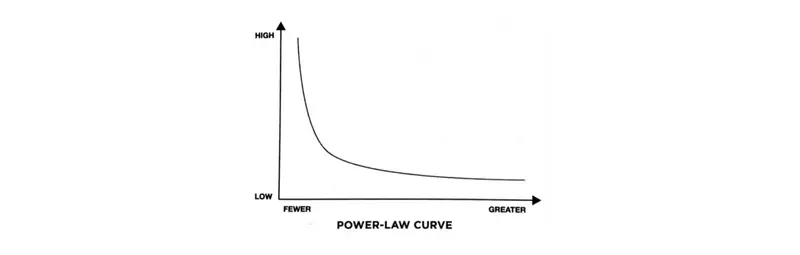

If you’ve ever wondered why VCs invest in risky startups instead of safe businesses, it’s because of something called the power law. And trust me, if you understand this, you’ll see why most VCs don’t care if 90% of their startups fail! Think about movies. If a producer invests in 10 films, 7 might flop, 2 might break even, and 1 could become a blockbuster that makes 100 times the budget. That one hit pays for all the failures and makes huge profits. That’s power law in nutshell. Now, Let's apply this to startups. If a VC invests ₹10 crores in 10 startups, and 9 return nothing, but 1 startup grows 100x and becomes worth ₹1000 crores, that’s a 10x return overall. But if they only pick 'safe' startups that give small returns, they might never get that one big win. This is why every startup doesn't need VC money. Even if your business is profitable, if it doesn’t promise massive scale and power law returns, VCs won’t be interested.

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 7m

🚀 Inside a VC Mentorship: What I Learned About How VCs Think. Recently, I had the privilege of attending a focused mentorship session from VC Partner Manik Gruver at Macwise Capital, alongside a few fellow founders. The session offered deep, behind

See More

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

💥 A VC turned $6.4m into $1.3b in 5 yrs — there’s a lesson here for founders💥 Cyberstarts just turned a $6.4M seed investment in Wiz into $1.3 BILLION after Google’s $32B acquisition—a mind-blowing 222x return in just 5 years! 🚀🔥 This is why VC

See More

Parul Verma

Hey I am on Medial • 1y

Hi, I m searching for some investors who are searching for the best safe and legal platform. Tronking India Pvt ltd Best Investment Plateform 3% monthly return on investment After 12 months u will get best returns more details contact 7827971424

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-15 What are Additional Returns? What is the Catch-Up Clause? In Developed Markets, The structure is in 2-20% where 2 is Management Fees & 20 is Additional Returns.Additional Returns & 2-20 structure is not ideal in Indian AIF Market

See MoreSanskar

Keen Learner and Exp... • 1y

Here are some free platforms where you can connect with venture capitalists (VCs): 1. Gust: connects startups with investors, including VCs. 2. Angel List: AngelList is a popular platform that connects startups with investors, including VCs. 3. F6S:

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)