Back

Havish Gupta

Figuring Out • 1y

Why does even a 1000cr market isn't enough for a VC So most businesses generate maximum Profit Margin of 20%. That on a ₹1000cr ($150 M) is ₹200cr which is enough for an founder to retire. But if you think from a VC's point of view, the max valuation a ₹1,000cr revenue company can get is ₹10,000cr ($1.5 B) which is aldredy a 10 times revenue multiple. Now $1.5B valuation may look great but for a VC who owns about 10% stake, it's just $150 M. And also what we have considered is that 1) the Startup managed to get an 100% market share 2) A 10 times Revenue Multiple is considered (which won't be more than 3 today) 3) The founder diluted 10% equity which he may not irl (probobly) So in reality it doesn't make any sense. And also majority of the buisness ideas we think of are aldredy saturated or it's market size is much less than this. So probobly that's why your funding was rejected. What do you think?

Replies (21)

More like this

Recommendations from Medial

Aarihant Aaryan

Prev- Founder & CEO ... • 1y

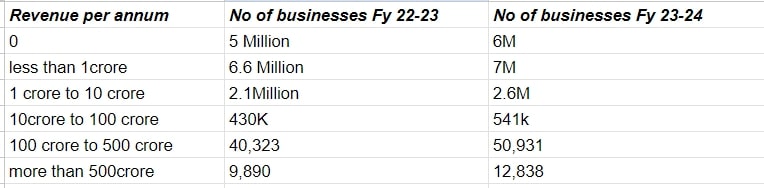

Many assume most of the small businesses in India don't make money, which is true as 30% of Indian SMBs don't. But there is an interesting trend, that has shaped in the last 12 months. Indian business ecosystem has added "500k" businesses to the 1

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)