Back

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

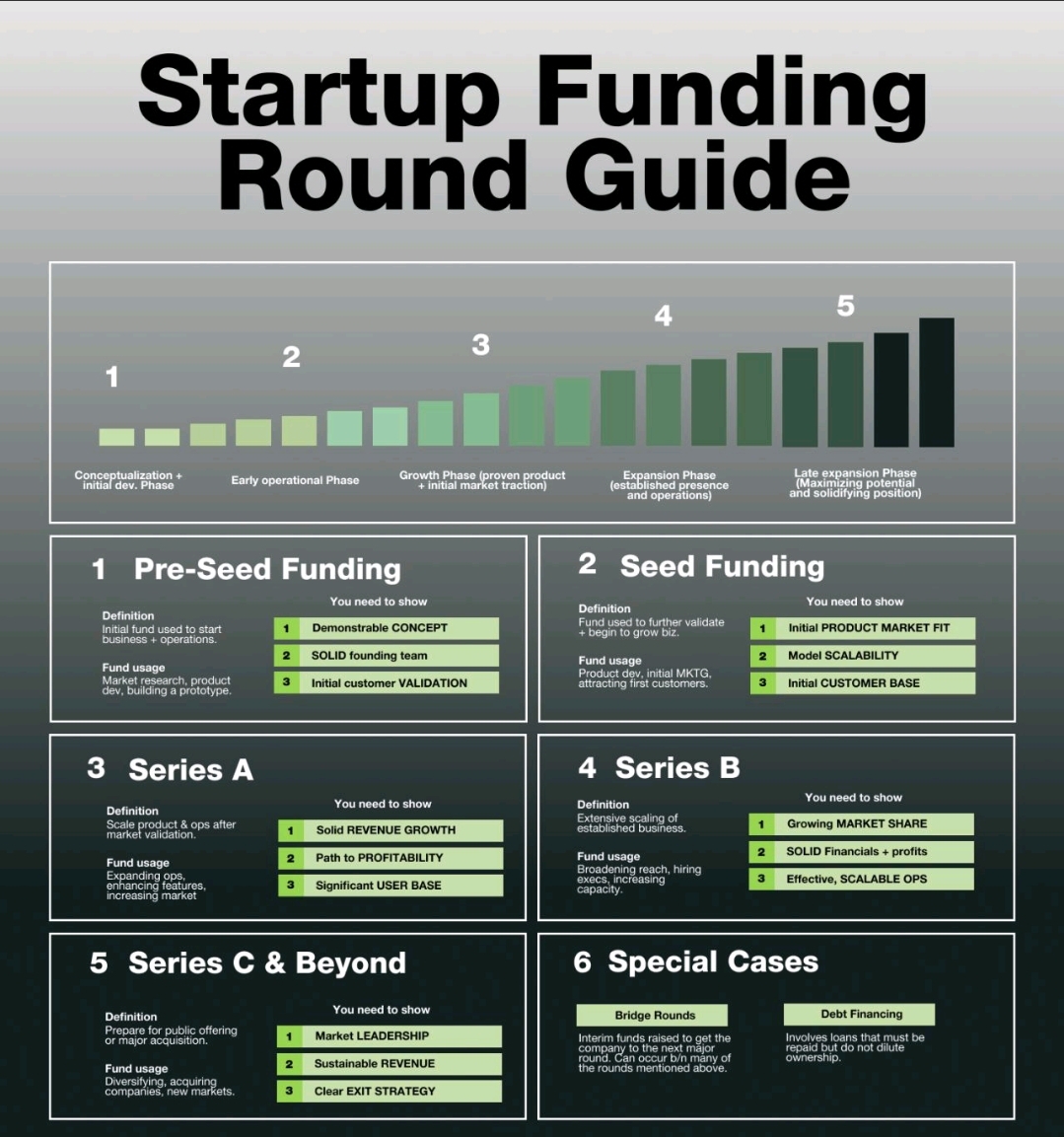

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Mr khan

Smart. Sustainable. ... • 1y

Zepto - 2024 Success Zepto ek 10-minute grocery delivery service hai jo India mein rapidly grow kar rahi hai. Iska focus high-speed delivery aur customer satisfaction par hai 2024 mein, Zepto ne Series C funding round mein $200 million raise kiye, au

See MoreAccount Deleted

Hey I am on Medial • 2y

• Today's Topic Is : Stages Of Funding Rounds • Before discussing the funding rounds, let's understand why funding is necessary : • Funding is necessary to start any company or to build MVP or Testing the Products. •Types of Funding Rounds: 1.

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

5 Stages of Startup Funding 1. Pre-seed funding stage ★ Is your idea viable? ★ Has your idea been done before? ★ How costly is your venture? ★ What kind of business model will you use? ★ How will you get started? 2. Seed funding stage ★ Product

See More

Sairaj Kadam

Student & Financial ... • 1y

The Most Common Practice in Startup Funding The Steps of Funding, Hey everyone, We know that most startups use a specific funding method to get off the ground. Yesterday, I mentioned how most startups use traditional funding methods. Today, I wan

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)