Back

Sairaj Kadam

Student & Financial ... • 1y

The Most Common Practice in Startup Funding The Steps of Funding, Hey everyone, We know that most startups use a specific funding method to get off the ground. Yesterday, I mentioned how most startups use traditional funding methods. Today, I want to dive deeper into one of the most common practices in startup funding. As I said yesterday, starting a startup involves multiple steps. Today, I'll give you an overview of these steps. Know as Series Funding Listen, guys. Series funding is a process or a series of steps that take us from the start of a business through its growth stages. This type of funding focuses on the specific stages of our startup. For example, series funding is broken down into several stages, typically known as Series A, B, and C. While there can be up to five stages, the major ones are Series A, B, and C. These stages denote different phases of our startup’s lifecycle and the funding needs at each phase. During series funding, we aren’t just focused on a single task. Instead, we’re looking at the various stages of our startup’s growth and securing the necessary funding to move forward at each stage. Here's a deeper dive into what each series entails: Series A: The first major round of funding after the initial seed stage. This is for startups that have gained some traction and need funds to grow. Series B: Focused on growth, this round helps startups that have found their market fit and need additional funds to scale. This could involve increasing the user base, expanding into new markets, or enhancing product offerings. Series C: For well-established startups looking to scale even further. This could mean expanding to new markets, acquiring other companies, or launching new products. These series represent a multi-step process in funding, helping us understand the growth and funding needs of a startup. Beyond these, there are also Series D and E, which cater to specific needs such as further expansion or staying private longer. Series D: Used by startups looking for further expansion before going public or if they haven’t met previous expectations. Sometimes this is referred to as a "down round" if the valuation is lower than the previous round. Series E: Less common, this round is for startups overcoming final hurdles before an IPO or those wanting to remain private longer. So, series funding helps us understand that a startup goes through different phases and requires funding at each stage. But today, I wanted to explain the steps. Next, let’s look at the major types of funding methods. Stay tuned for more insights on the different types of funding that can fuel your startup's journey! Stay innovative, Kadam

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

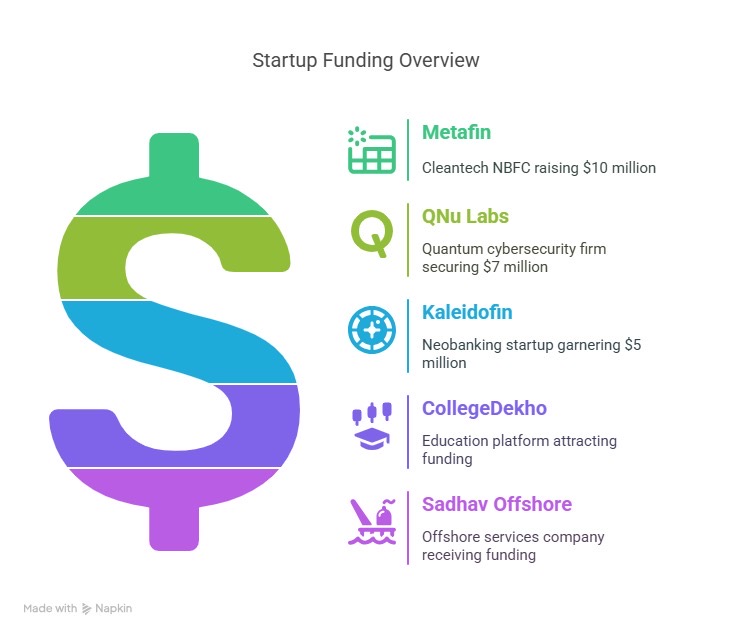

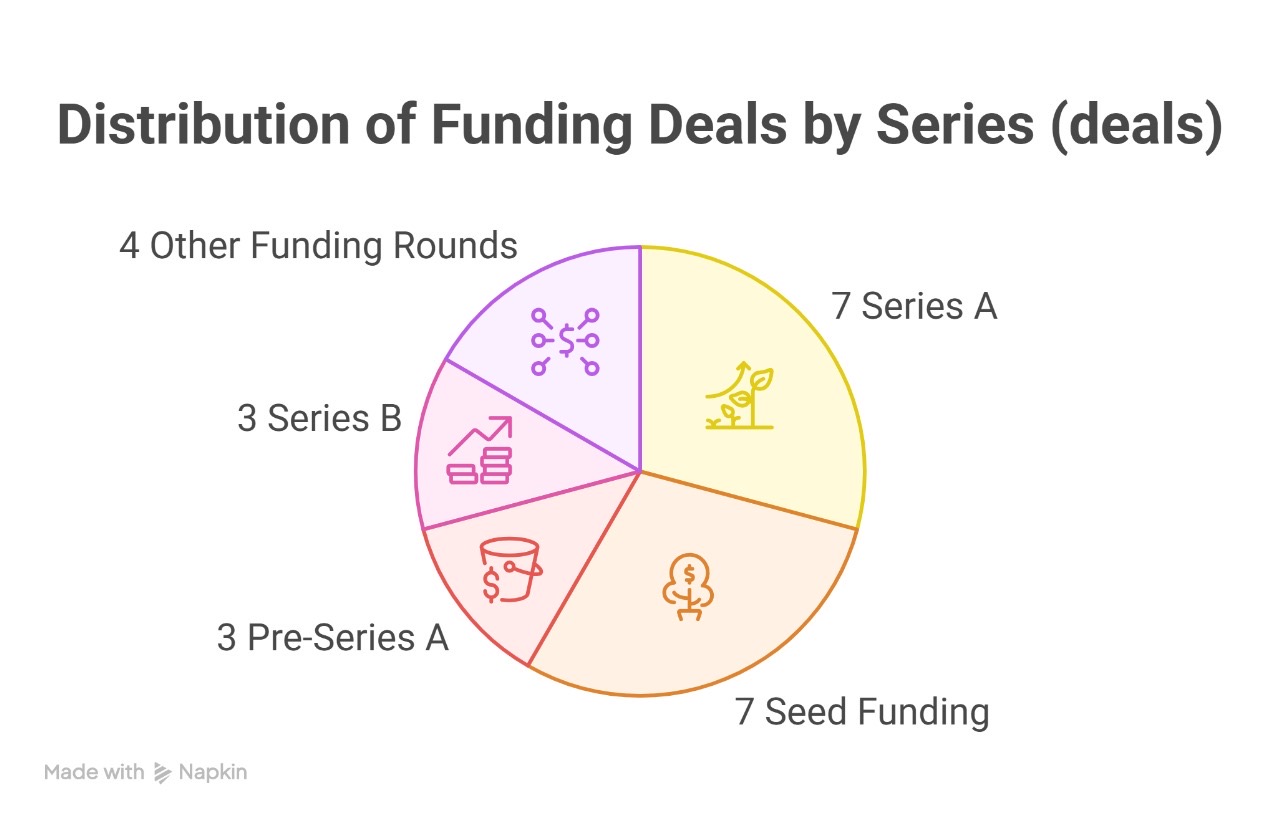

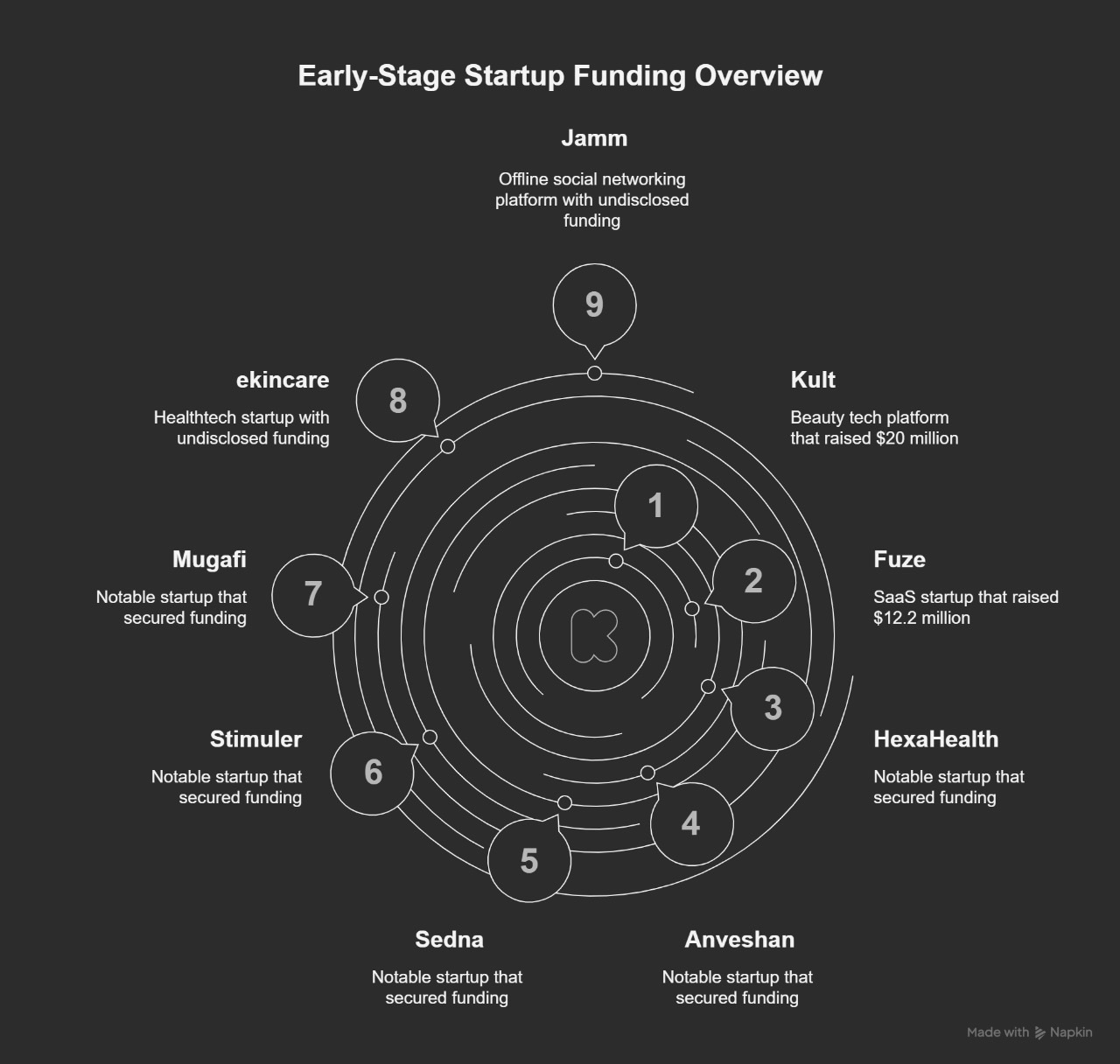

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity

See More

Omkart

A SMM posting useful... • 10m

What does Series-A Funding round mean? For the companies that reach series A funding, the investors ask for more than a business idea, they demand a long term strategy. Series-A funding is provided to companies to help them scale their product offer

See MoreSamCtrlPlusAltMan

•

OpenAI • 7m

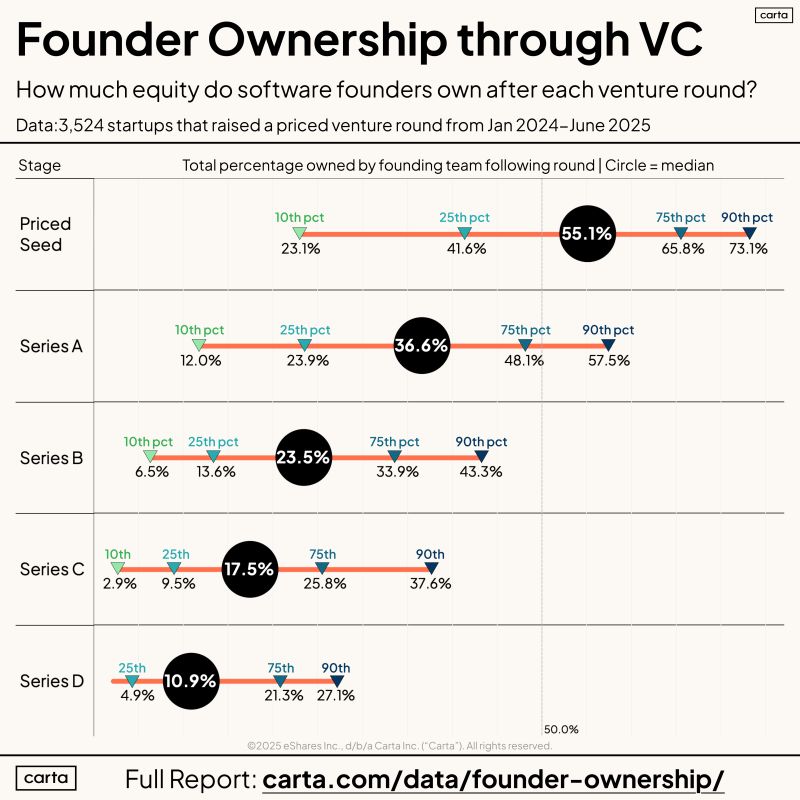

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)