Back

Account Deleted

Hey I am on Medial • 9m

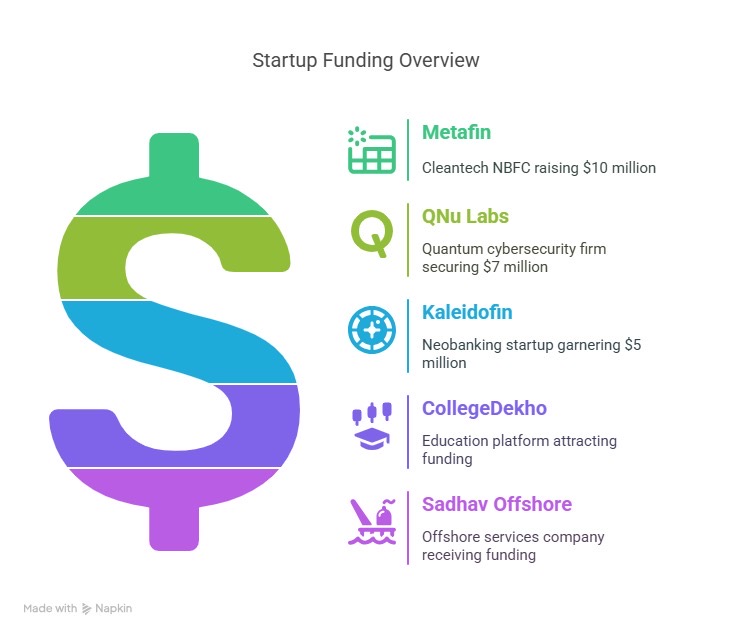

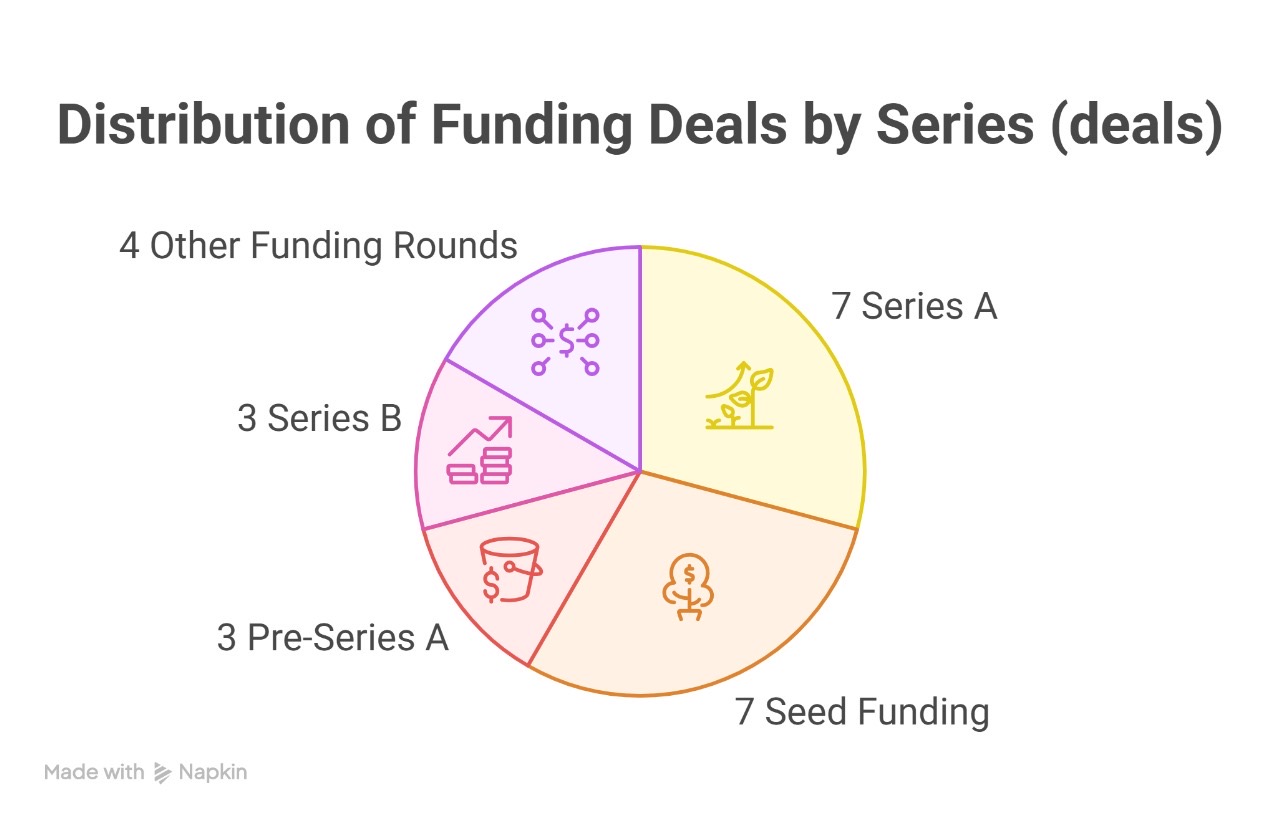

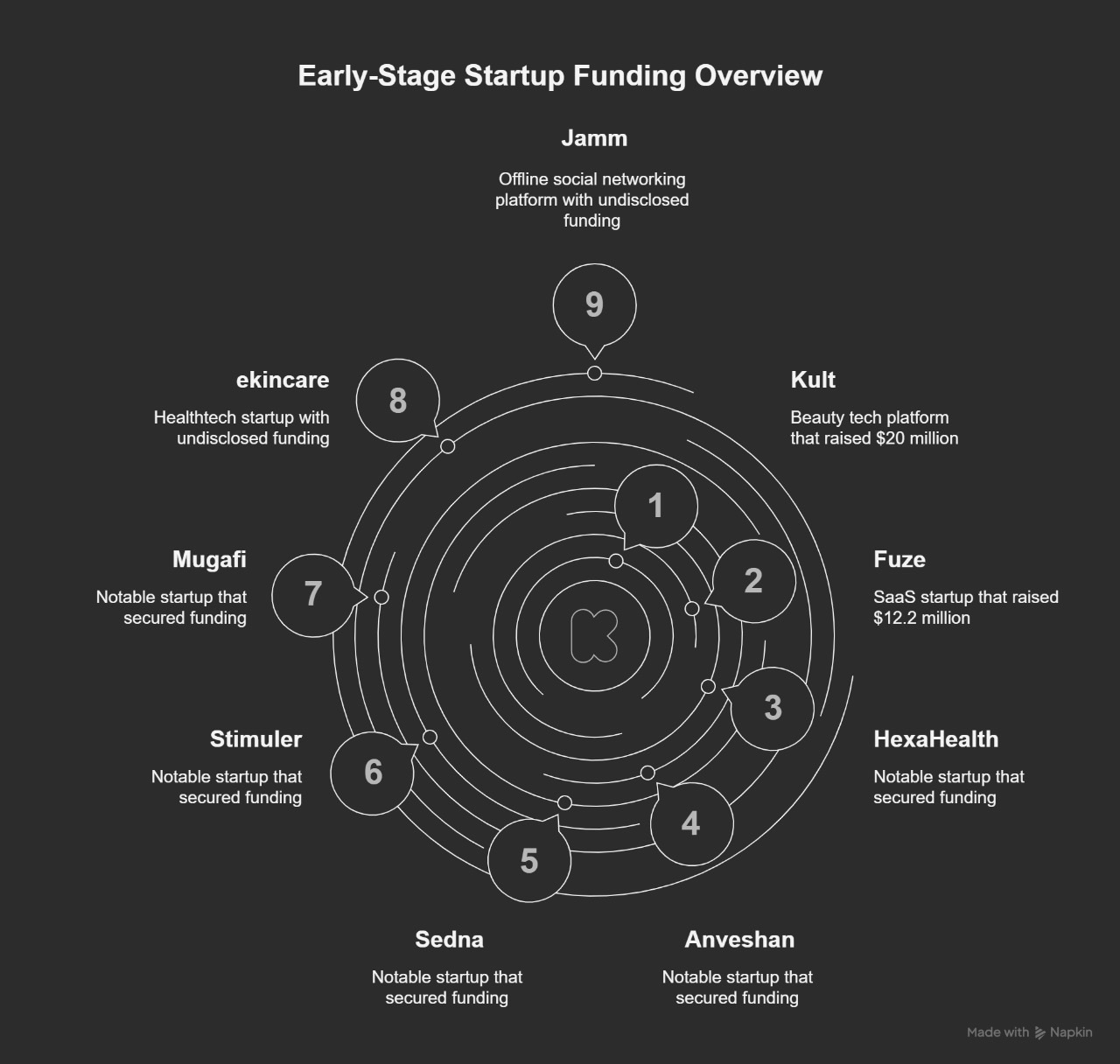

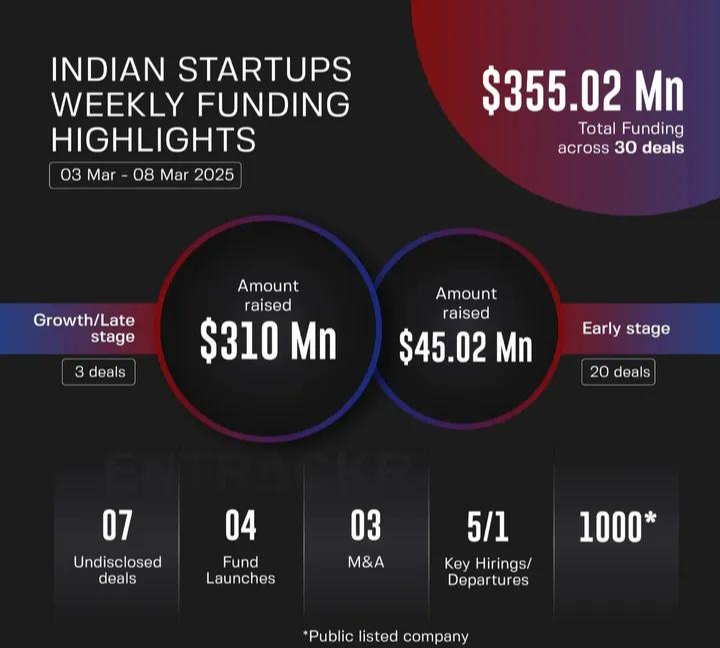

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity spanned both growth-stage and early-stage startups, signaling broad investor interest across maturity levels. Startups in the growth and late-stage category secured close to $30 million, led by a diverse mix of sectors. Next, Early-stage startups dominated the week, with 18 ventures raising a total of $72.98 million #Quick analysis on Funding Stage • Series A and Seed rounds were the most common, with 7 deals each, showcasing a healthy appetite for early momentum investments • Other funding types included Pre-Series A and Series B rounds, reflecting a balanced spread across fundraising stages

Replies (2)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Investment Mandates I. Sector-Agnostic Early-Stage Investments • Focused on providing the first institutional check to startups. • Early signs of traction and revenue are required. • Typical investment size: ₹1-8 crore in exchange for 8-18% equi

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

We are actively seeking groundbreaking startups to established industry players. Our mandates are: Early-Stage Catalyst: We provide the first check (₹1-8 Crore for 8-18% equity) to visionary founders. Looking for startups with early market traction

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

We're actively seeking startups to established players, with flexible mandates designed for impact. * Early-Stage Catalyst: We provide the crucial first institutional check ($1-8 Crore for 8-18% equity) to visionary founders with early market tracti

See More

Account Deleted

Hey I am on Medial • 10m

Between March 31 and April 5, Indian startups brought in a total of $144.4 million across 22 deals. That’s just a slight bump around 0.5% - compared to the $143.7 million raised by 16 startups the week before. Among the investors, Peak XV Partners, Y

See MoreMohammed Zaid

building hatchup.ai • 8m

Cluely, the controversial San Francisco-based AI startup that markets itself as an undetectable" assistant for cheating on job interviews and exams, has secured $15 million in Series A funding led by Andreessen Horowitz, bringing its estimated valuat

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)