Back

Vivek Joshi

Director & CEO @ Exc... • 7m

We're actively seeking startups to established players, with flexible mandates designed for impact. * Early-Stage Catalyst: We provide the crucial first institutional check ($1-8 Crore for 8-18% equity) to visionary founders with early market traction and clear revenue paths. We back potential, early on. * Strategic Credit for SMEs: Unlocking Growth Potential. Tailored credit solutions (up to $5 million over 3-5 years) for profitable SMEs (~$50 million annual turnover), especially those with strong export supply chain links to Europe. We bridge capital for scaling and market opportunities. * Growth Equity & Collaborative Scaling: Investing alongside founders and other funds. Initial tickets from $500K-$1 million ($4-8 Crore), with capacity for significant follow-on capital (up to $5 million). Seeking companies raising Pre-Series A or Bridge rounds. Actively co-invest in larger Series A rounds. Strong interest in Indian Consumption, Defense, Financialization & Automation.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

We are actively seeking groundbreaking startups to established industry players. Our mandates are: Early-Stage Catalyst: We provide the first check (₹1-8 Crore for 8-18% equity) to visionary founders. Looking for startups with early market traction

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Our flexible mandates are designed for impact. Early-Stage Catalyst: the crucial first institutional check (₹1-8 Crore for 8-18% equity) to visionary founders. Looking for startups with early market traction and a clear path to revenue. Strategic C

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates I. Sector-Agnostic Early-Stage Investments • Focused on providing the first institutional check to startups. • Early signs of traction and revenue are required. • Typical investment size: ₹1-8 crore in exchange for 8-18% equi

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Account Deleted

Hey I am on Medial • 9m

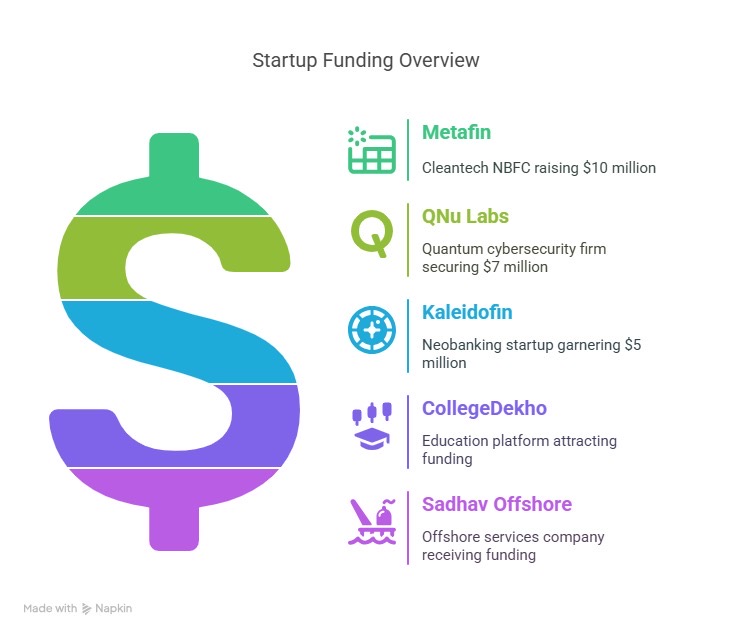

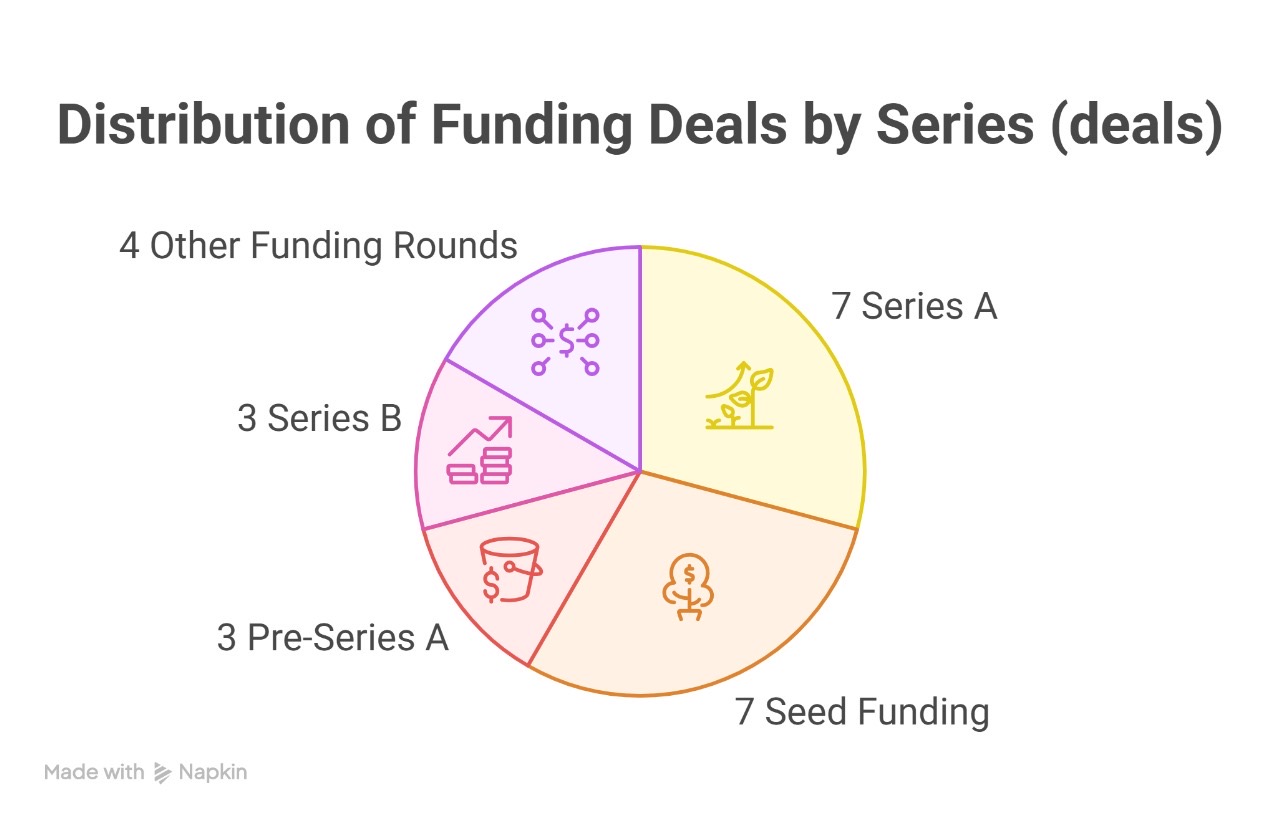

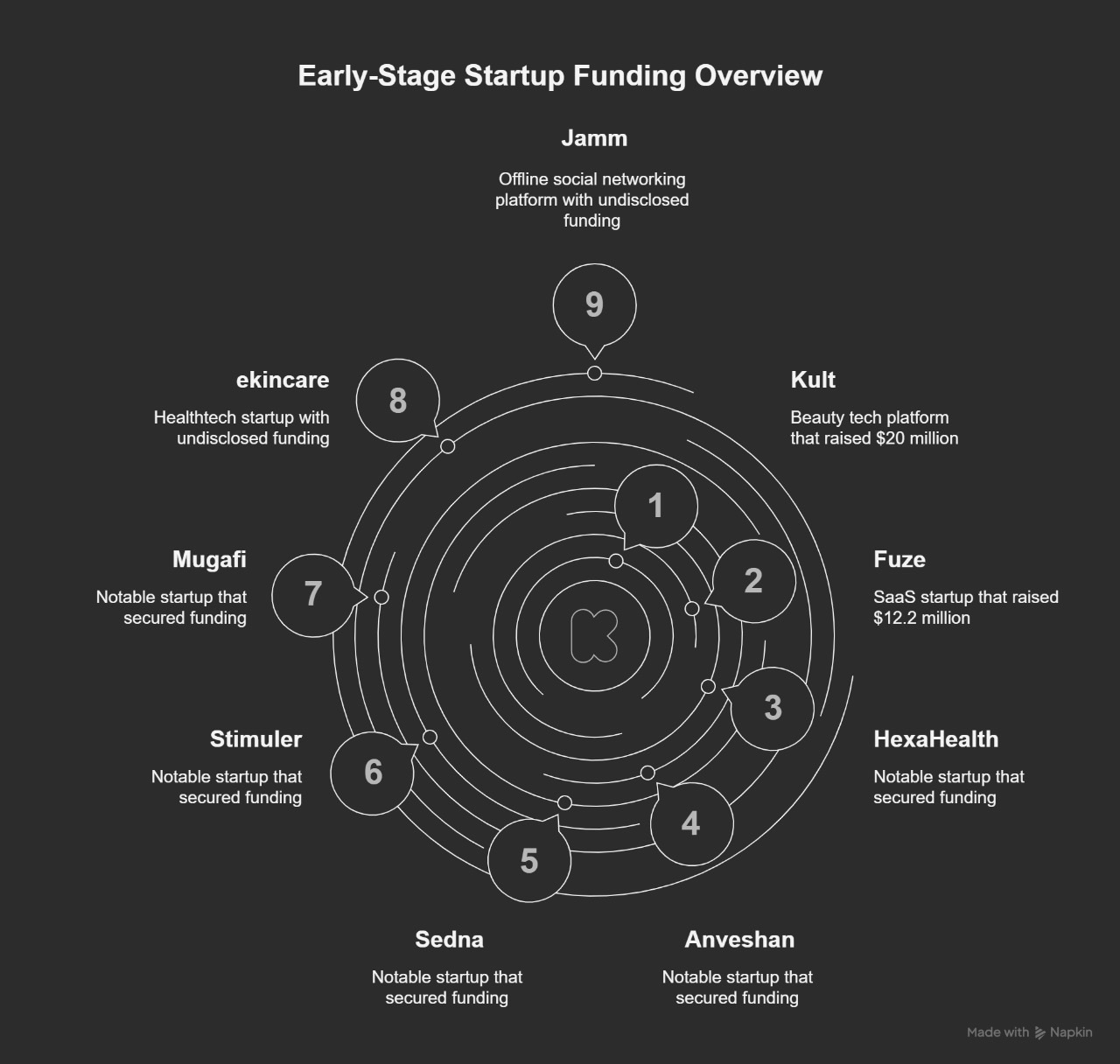

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity

See More

Ashish Singh

Finding my self 😶�... • 1y

In 2024, Zepto raised over $1.35 billion across multiple funding rounds, significantly boosting its valuation to $5 billion. Key rounds included $665 million in June and $350 million in November, marking it as a leader in the quick commerce sector am

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)