Back

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates I. Sector-Agnostic Early-Stage Investments • Focused on providing the first institutional check to startups. • Early signs of traction and revenue are required. • Typical investment size: ₹1-8 crore in exchange for 8-18% equity. II. Credit Opportunities for SMEs • Credit financing of up to $5 million for a period of 3-5 years. • Targeting SMEs with an annual turnover of approximately $50 million. • Preference for profitable companies engaged in export supply chains to Europe. III. Growth-Stage Investments & Co-Investments • Typical ticket size: $500K - $1 million (₹4-8 crore). • Ability to deploy additional capital of up to $5 million as companies scale. • Seeking companies raising Pre-Series A or Bridge to Series A rounds. • Open to co-investment alongside other funds participating in larger Series A rounds. • Investment focus includes: • Indian consumption trends • Defense sector • Financialization & automation

Replies (1)

Amruth

Hey I am on Medial • 9m

hi Vivek Joshi , I have a revolutionary and practical idea of business to make money , I am in idea stage and till now explained 100s of investors but no one funded , but every one agreed with my idea and profits , it's not as easy as you say to get funds in india, if you are interested msg me in what's app 6461703874 and let's begin a new journey, and if you take this bet on i can assure you this is the best investment you have ever done

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

We are actively seeking groundbreaking startups to established industry players. Our mandates are: Early-Stage Catalyst: We provide the first check (₹1-8 Crore for 8-18% equity) to visionary founders. Looking for startups with early market traction

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

We're actively seeking startups to established players, with flexible mandates designed for impact. * Early-Stage Catalyst: We provide the crucial first institutional check ($1-8 Crore for 8-18% equity) to visionary founders with early market tracti

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Our flexible mandates are designed for impact. Early-Stage Catalyst: the crucial first institutional check (₹1-8 Crore for 8-18% equity) to visionary founders. Looking for startups with early market traction and a clear path to revenue. Strategic C

See More

Account Deleted

Hey I am on Medial • 9m

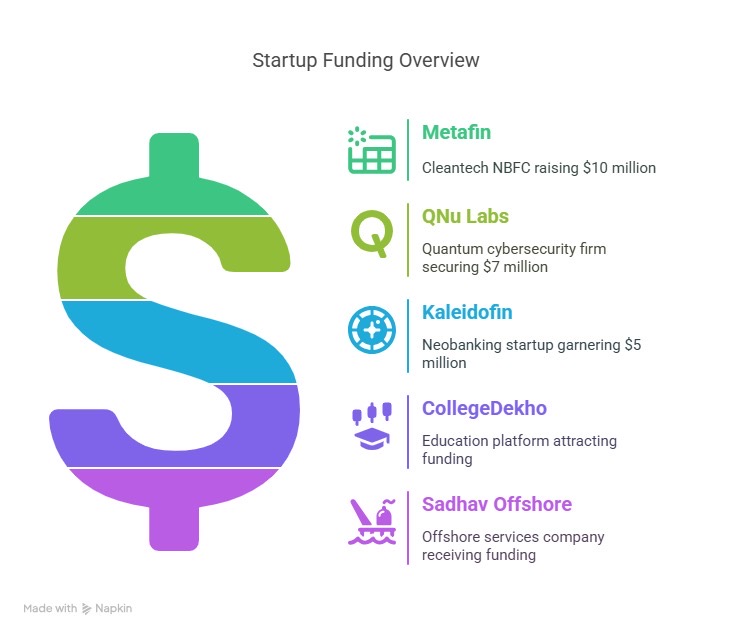

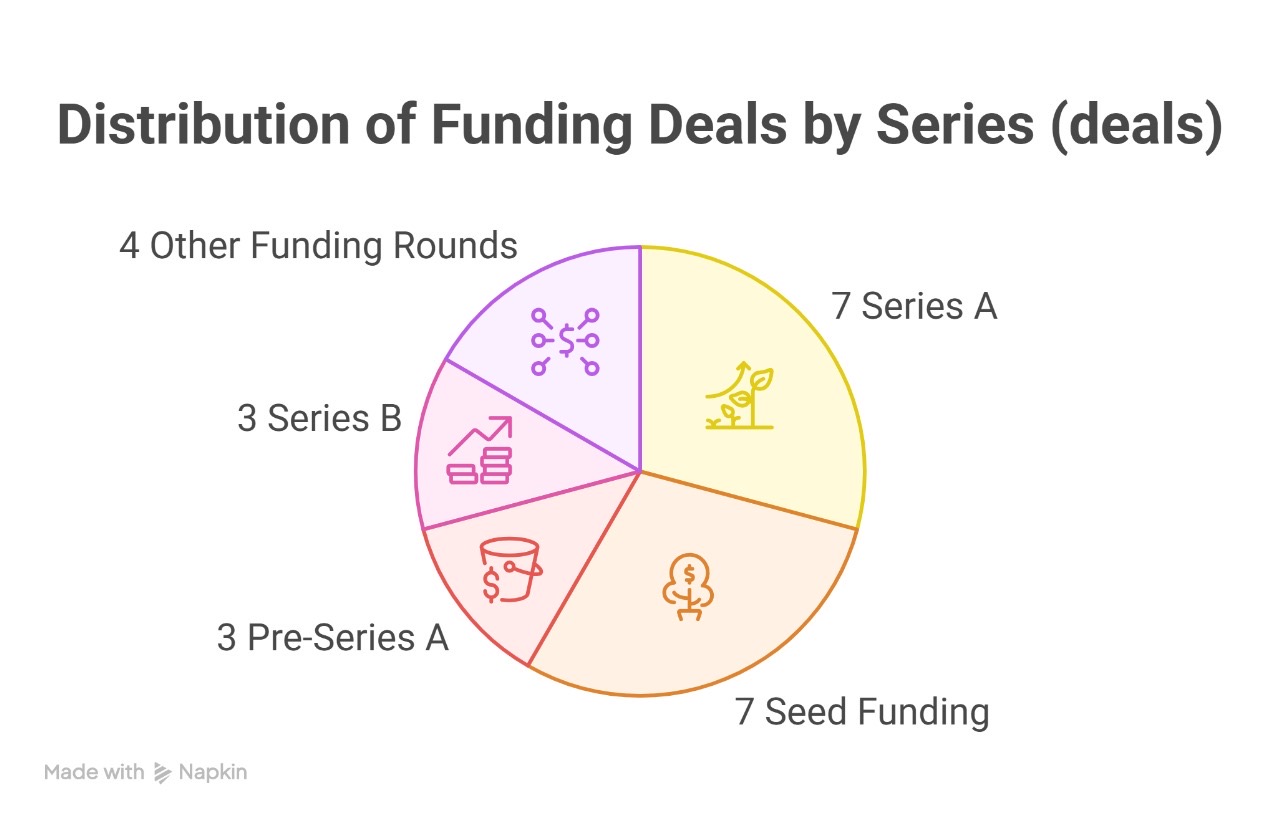

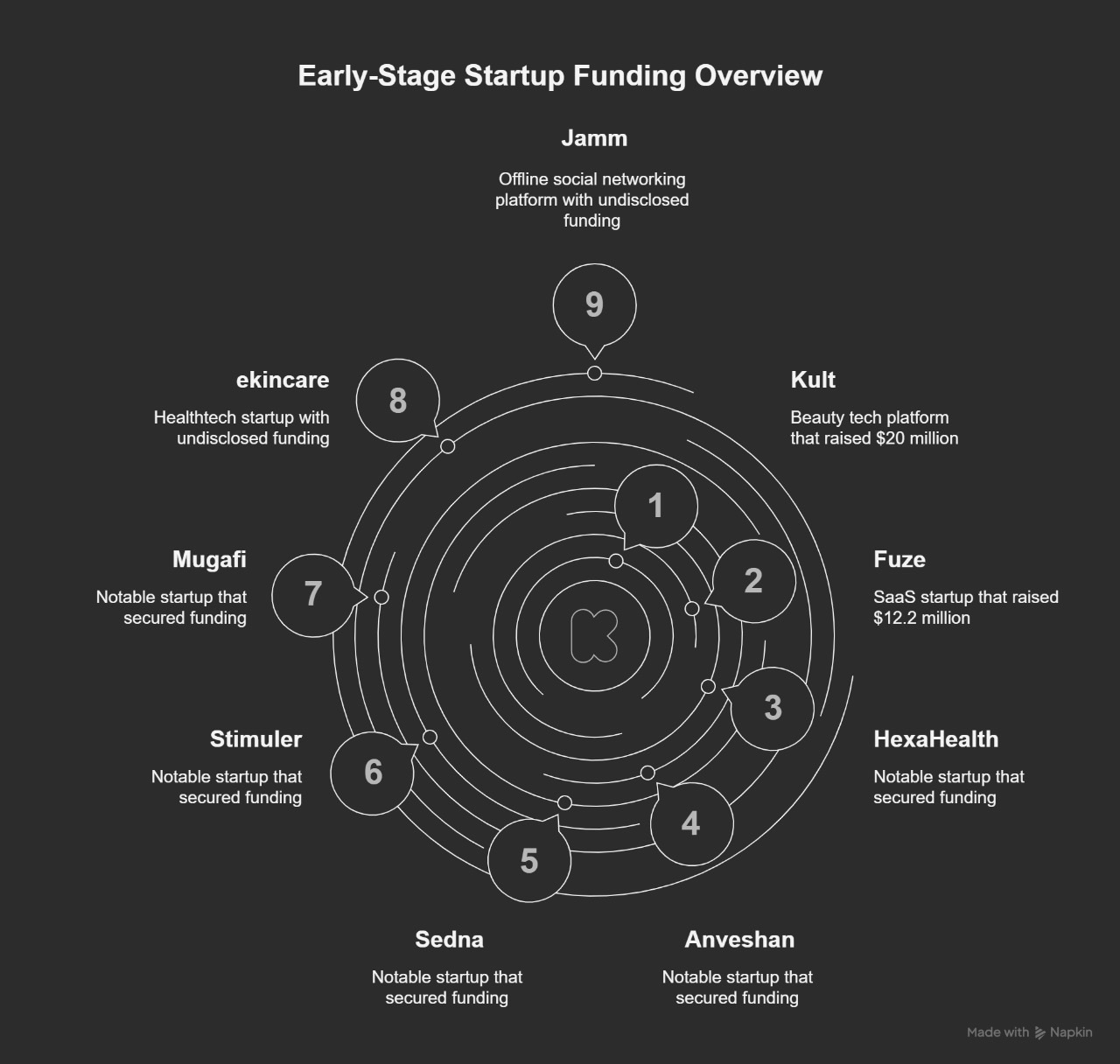

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity

See More

Ashish Singh

Finding my self 😶�... • 1y

In 2024, Zepto raised over $1.35 billion across multiple funding rounds, significantly boosting its valuation to $5 billion. Key rounds included $665 million in June and $350 million in November, marking it as a leader in the quick commerce sector am

See More

Account Deleted

Hey I am on Medial • 1y

Recent updates on #Funding 1) Saudi VC firm Waad Investment onboards Omani Investment Authority’s technology arm for $200 million fund 2) Jashvik Capital acquires majority stake in Laxmanrekha insecticide maker 3) Mizuho nearing a majority stake a

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)