Back

Laxit Rana

•

Repute • 1y

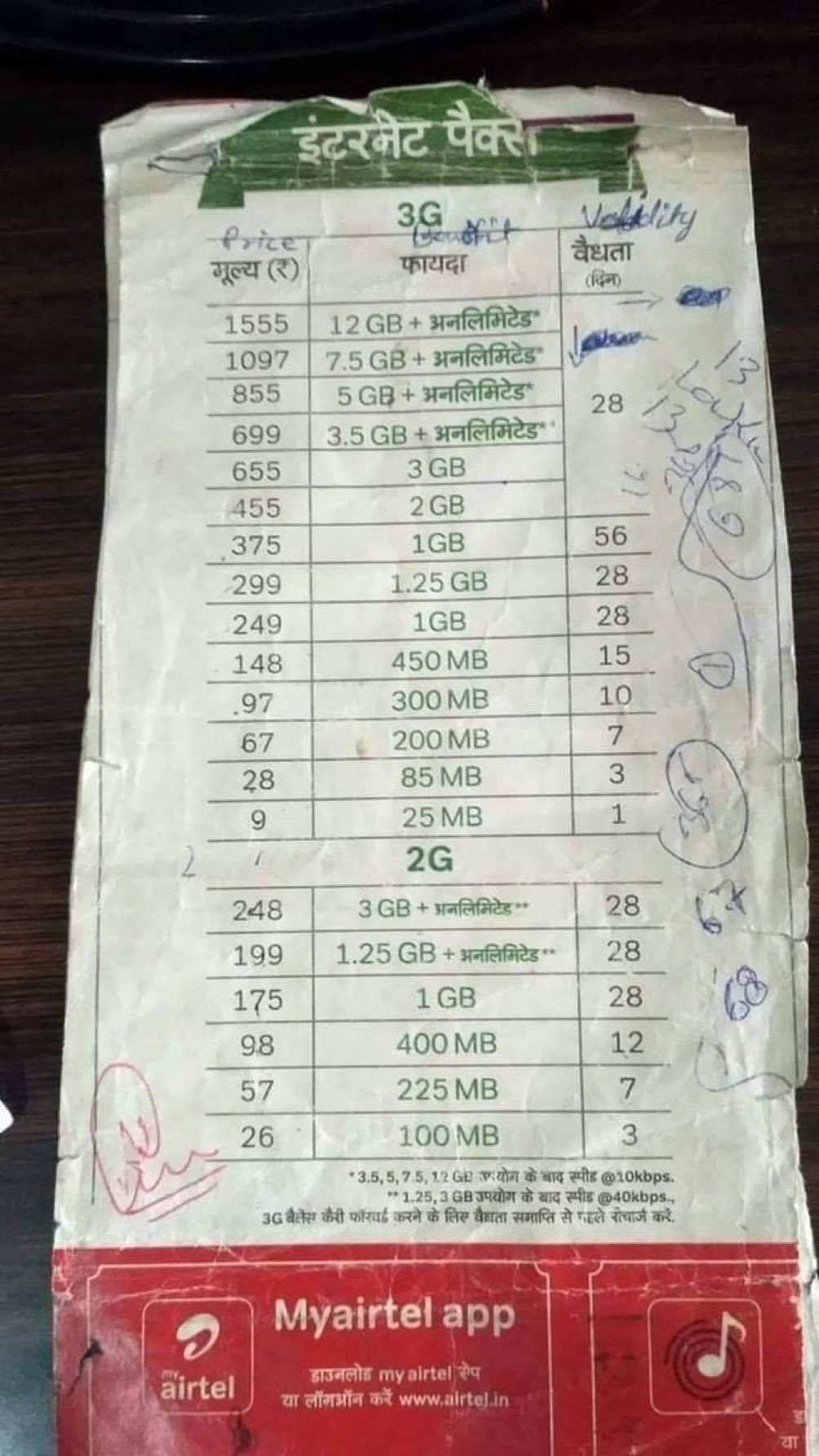

Why UPI will always be free for Users :- In my last post where I decoded revenue model of UPI payment platforms like PhonePe and GPay, many of you expressed concern that "soon they will charge money per transaction" However that is not the case. Let's understand this with an example of Jio. Before the Jio era, companies like Vodafone , Airtel and Idea were leading providers in India. When Jio entered the market, it faced a big challenge of gaining users in an already saturated market. To overcome this, Jio didn’t just offer low prices it offered free services. Why?Because even if Jio had charged a meager amount, competitors would have quickly matched or lowered their prices to retain their users, making it hard for Jio to attract a large customer base.But evern when all this was going none of the other players started providing services for free. But why did Jio eventually start charging after acquiring users even when they had wealth of motta bhai Ambani ? That’s because in the telecom sector, charging customers is the only path to profitability. If there had been other ways to make money, competitors would have offered free services too and monetized elsewhere. This is D2C model , where customers directly pay for the service How are UPI platforms different ? Unlike telecom, UPI platforms have alternative streams(as we discussed in last post) moreover we typically visit telecom apps like MyAirtel or MyJio only when we need to recharge perhaps once every 1-3 months.Telecom providers don’t have frequent opportunities to cross-sell other services or show ads due to this low user engagement. When BharatPe entered the market it offered free user-to-merchant transactions. Seeing this, other players like PhonePe, Paytm, and GPay stopped charging for those transactions too (same was not the case in telecom sector), knowing they could earn through other means. Can they all start charging again ? It’s highly unlikely. If any UPI platform starts charging per transaction, another player could simply offer free services, and customers would quickly switch. Unlike telecom, switching between UPI apps is extremely easy as it doesn’t involve buying a new SIM card, completing KYC, or physically changing anything on your phone. And there is some government angle to this as well (NPCI and stuff), but we can save that discussion for another pos as it’s a deep topic on its own.

Replies (24)

More like this

Recommendations from Medial

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

“How Jio made it’s competitors go out of Business” Disruption Diaries #2 Reliance Jio was launched on Sep 2016.Initially Jio provided free data services for several months to attract many customers. Before Jio data was expensive,and Voice call and

See More

Aarihant Aaryan

Prev- Founder & CEO ... • 1y

Mukesh Ambani's Jio isn't streaming IPL for free, Infact Jio made more than 3,300 crores in revenue. Jio used a famous business strategy called as loss leader strategy Loss leader strategy is where a product is sold at a low price or for no pric

See MoreBigLoot IN

BigLoot.in - Where S... • 1y

Reliance Jio hiked its tariffs in July 2024, but despite this move, the company lost approximately 10.9 million customers in the second quarter. On the other hand, BSNL managed to gain 2.9 million new users in July. This shift highlights that Indian

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)