Back

Varun Bhatia

•

My Student Club • 1y

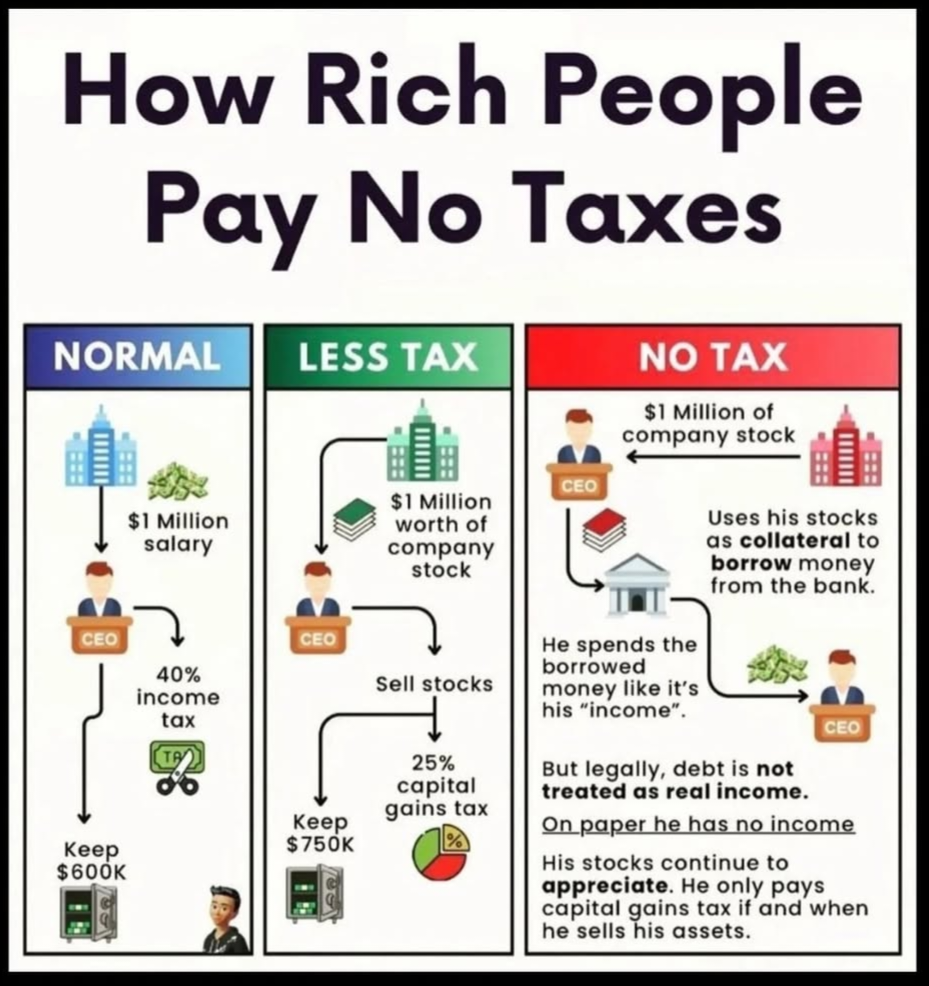

The reason might be they don't want to show profits, they would pay royalty and other charges in different names to the parent company where they will have to pay less taxes while Indian tax rates are quite high.

More like this

Recommendations from Medial

Havish Gupta

Figuring Out • 2y

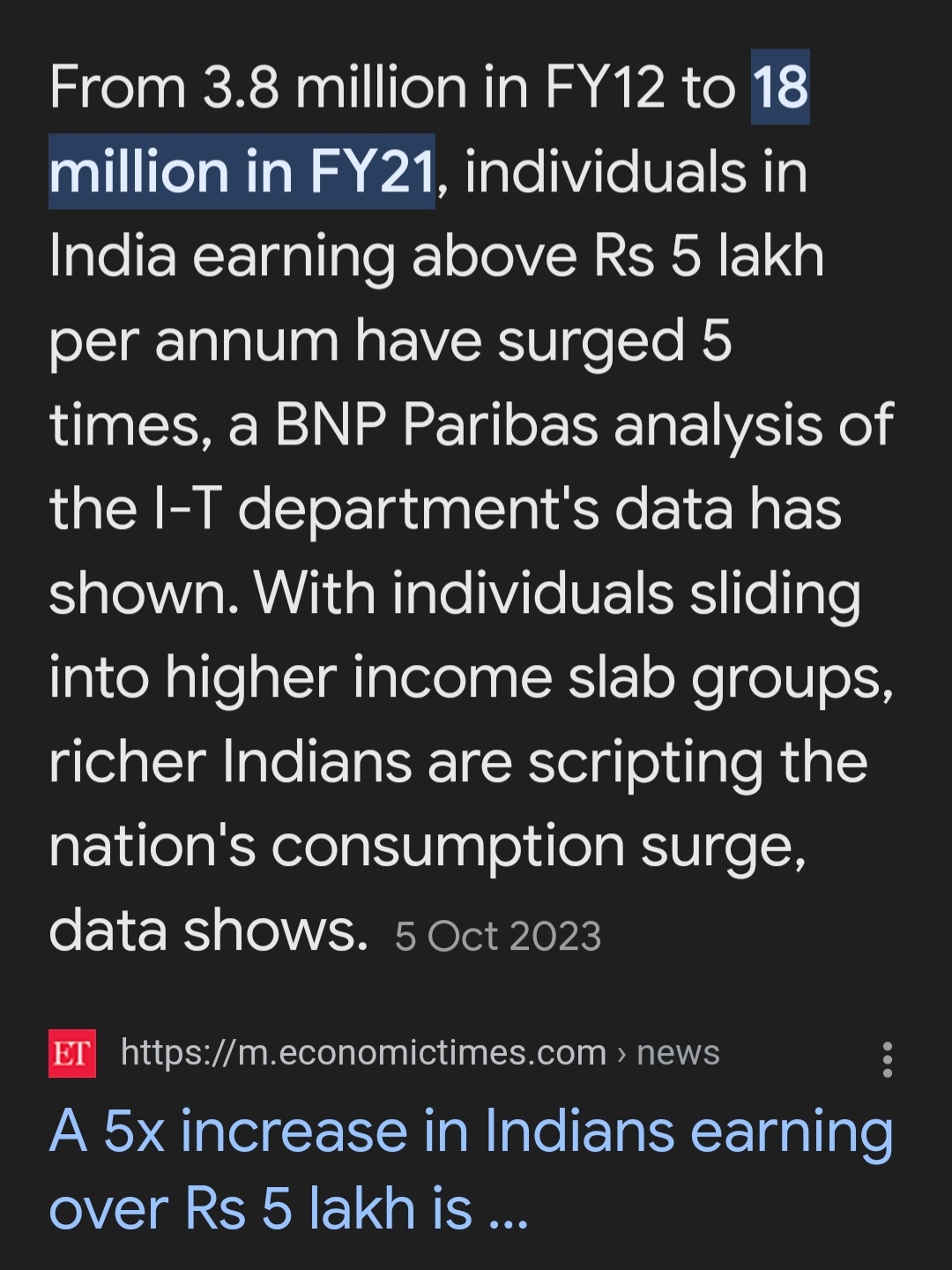

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Account Deleted

Hey I am on Medial • 9m

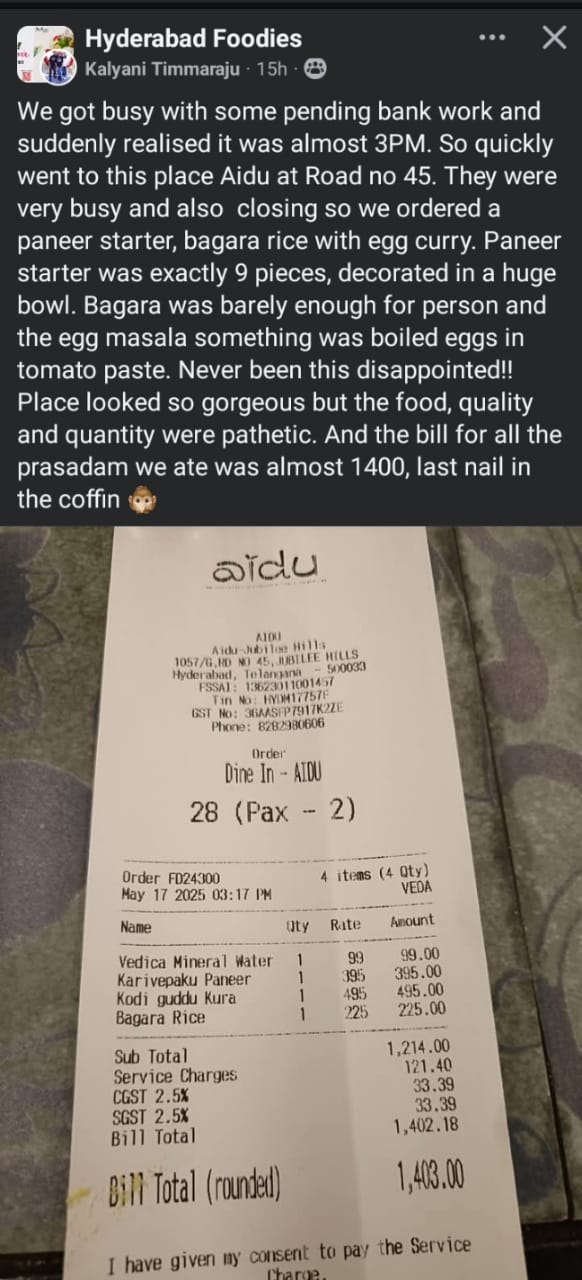

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)