Back

Suraj

CEO & Chairman • 1y

I hope you are aware of pre-money and post money valuation. I mean if you raise 50 lakh INR pre money then post money can be like 1 Crore INR for VCs to consider your offer. These are the ones prevailing for 2.5 % stake or equivalent depending upon traction metrics, validation, cap table and financial projection of atleast 3 years

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

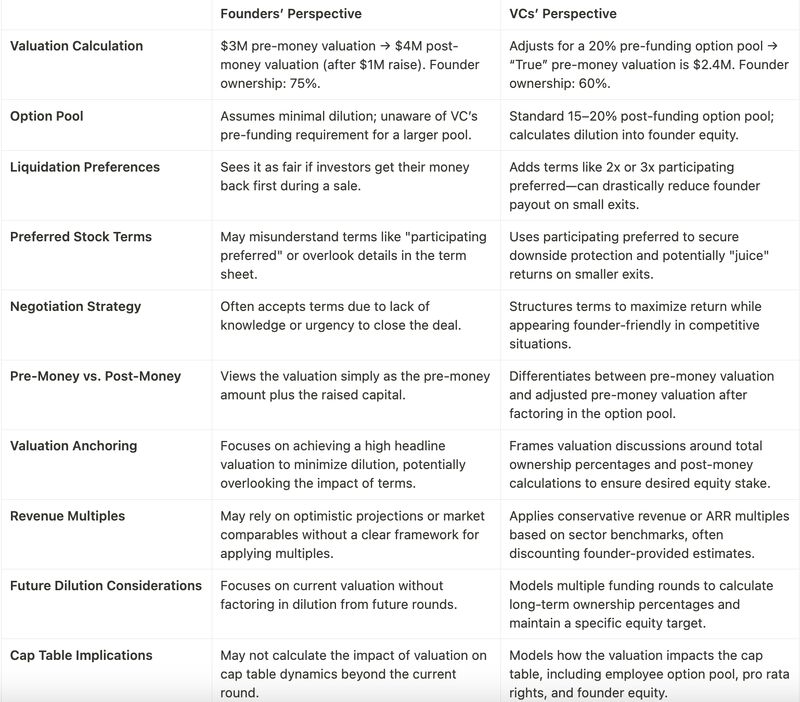

Venture Capital (VC) term sheets often include clauses that can have significant implications for founders and the future of their startups. Below are some critical clauses that founders should carefully evaluate: 1. Valuation and Equity Pre-Money

See MoreNikhil Raj Singh

Entrepreneur | Build... • 6m

Have you watched Silicon Valley or not this is one of the BEST scenes ever. Richard: We could charge a subscription and actually make money. Russ Hanneman: “NO. You say you're pre-revenue. Because when you say you have revenue, people ask: “How m

See More

Gyananjaya Behera

Helping an Idea to S... • 1y

Volt Money Partners PhonePe To Offer Loans Against MFs - Partnership Announcement: Volt Money has partnered with PhonePe to offer loans against mutual funds through the PhonePe app, with loan sizes ranging from INR 25,000 to INR 5 Cr. - Integration

See More

Vipin Titoria

Entrepreneur | Build... • 9m

The Entrepreneur’s Funding Journey (aka "The Hunger Games: VC Edition") 1. Idea stage: “This is going to revolutionize the world.” 2. Prototype stage: “It almost works. On Tuesdays. If you pray.” 3. Pitch stage: “We’re pre-product, pre-revenue,

See More

Aanya Vashishtha

Drafting Airtight Ag... • 10m

Raising Pre-Seed Money? Here’s What No One Tells You Pre-seed funding’s brutal—investors want traction before you’ve barely started. Here’s the secret: strong personal branding can tip the scales. Early founders who share their vision online,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)