Back

Gyananjaya Behera

Helping an Idea to S... • 1y

Volt Money Partners PhonePe To Offer Loans Against MFs - Partnership Announcement: Volt Money has partnered with PhonePe to offer loans against mutual funds through the PhonePe app, with loan sizes ranging from INR 25,000 to INR 5 Cr. - Integration and Reach: This collaboration allows Volt Money to tap into PhonePe’s vast user base of 535 million, enhancing its distribution capabilities. - Strategic Benefits: Both companies aim to provide affordable loans and leverage mutual funds as a secure asset class for lending, reflecting the growing trend in digital lending. - Company Background: Volt Money, founded in 2022, offers loans against mutual funds and raised $1.5 Mn in pre-seed funding from investors like Titan Capital. - Market Context: The digital lending market in India is rapidly expanding, driven by increasing smartphone and internet penetration, with an expected market size of $720 Bn by 2030.

Replies (3)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

PhonePe IPO Is Coming! • PhonePe is planning an IPO to raise capital at a valuation of $8-10 billion. • In 2023, PhonePe raised $200 million from Walmart at a pre-money valuation of $12 billion. • PhonePe dominates the UPI payments business with a

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 6m

Digital lending platform Fibe.India (Formerly EarlySalary) has raised INR 225 Cr (about $25 Mn) in debt from a host of financial institutions, including Franklin Templeton Alternative Investments Fund, India👇 Fibe said in a statement that it has is

See More

Vikas Acharya

Building Reviv | Ent... • 11m

Yenmo Raises ₹9.2 Crore to Expand Instant Loan Services Yenmo, a Bengaluru-based startup, has raised ₹9.2 crore in funding, led by Y Combinator with support from Pioneer Fund, Zaka VC, and other investors. What Does Yenmo Do? Yenmo offers instant lo

See More

Poosarla Sai Karthik

Tech guy with a busi... • 7m

UPI on Credit? PhonePe’s Boldest Bet Yet In partnership with HDFC Bank and NPCI, the card is powered by Rupay and allows UPI payments through credit. NPCI had enabled this back in 2022, but PhonePe had to wait almost ten months to get RBI approval.

See MoreRohan Saha

Founder - Burn Inves... • 1y

The RBI is increasingly cracking down on unsecured lending. The NPAs (Non-Performing Assets) of unsecured loans are also increasing rapidly. Companies that used to provide loans against salaries are now changing their business models. The NPAs of MSM

See MoreHemanth Varma

''Money can't buy ha... • 1y

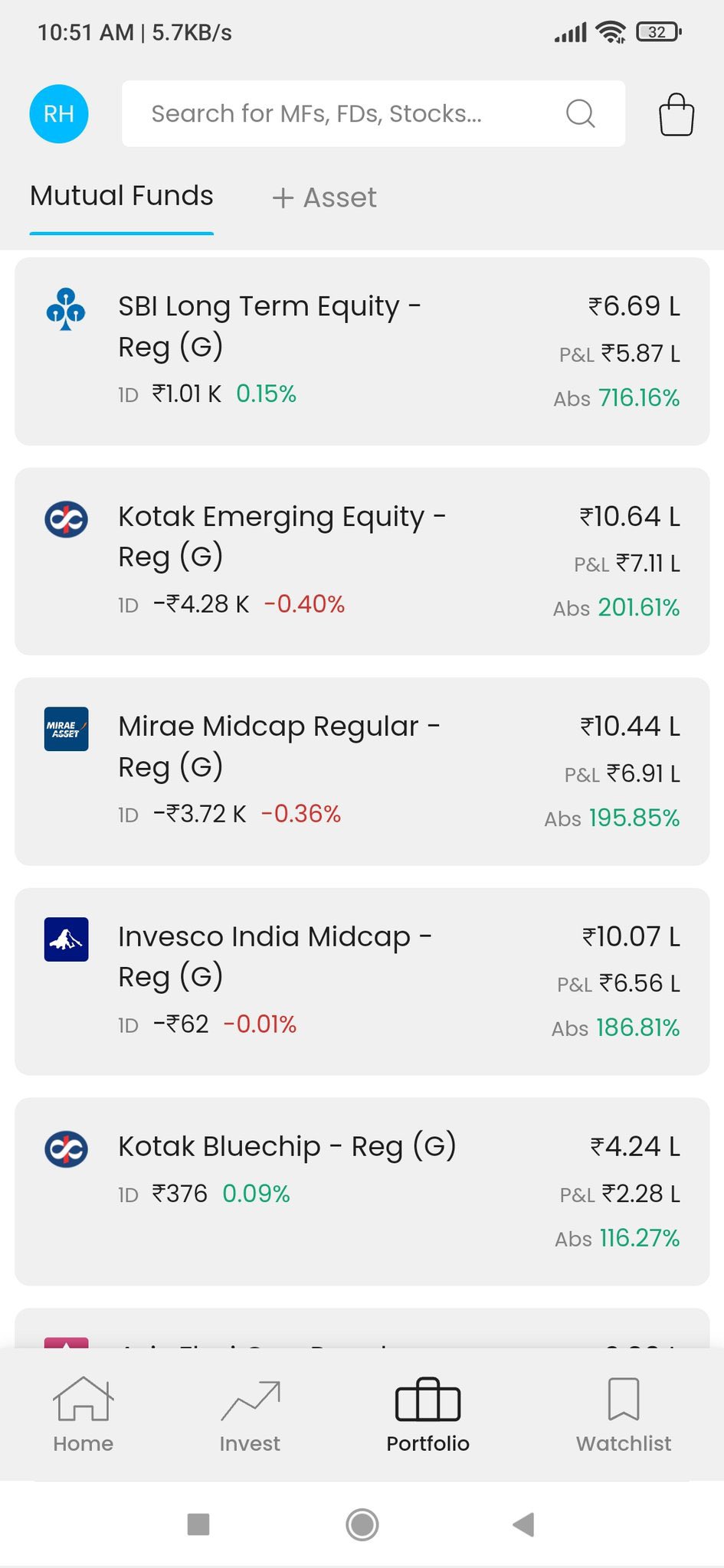

can mutual fund be a profitable investment? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its po

See More

Rohan Saha

Founder - Burn Inves... • 12m

The stock market isn’t that easy. In the last six days, I’ve seen two cases where people committed suicide due to their stock market losses, and the common factor in both was leverage. Taking loans to work in the market isn’t wrong, but managing thos

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)