Back

Naveen Ramakrishna

Collaboration Create... • 1y

Earnings 5LPA IN THAT MOST OF PEOPLE DON'T HAVE 1000₹ SAVINGS IN THEIR BANK ACCOUNT ALSO HOW THAT PEOPLE WILL ELIGIBLE TO PAY TAXES THIS SHOULD BE REFORMED AND INCLUSIONS NEEDS TO BE DONE IN TERMS OF PERSONAL EXPENDITURE INCLUSION OF PAYING PERSONAL LOANS INTEREST, AUTO LOAN INTEREST, CONSUMER LOAN INTEREST, ETC THE PEOPLE ARE CHARGED THRICE FOR A PARTICULAR AMOUNT WHICH ALREADY PAID IF ANYONE TAKING AUTO LOAN THEY HAVE DEDUCTED TAX AND CHARGES FOR PROCESSING AGAIN THEY NEED TO PAY GST WHILE TAKING CAR/BIKE WHILE PAYING INTEREST HIS ERANINGS ARE GONE BUT THEY ELIGIBLE TO PAY TAX FOR HAVING SALARY INCLUDED IN TAXLSLABS FUNNY TAXING RIGHT

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

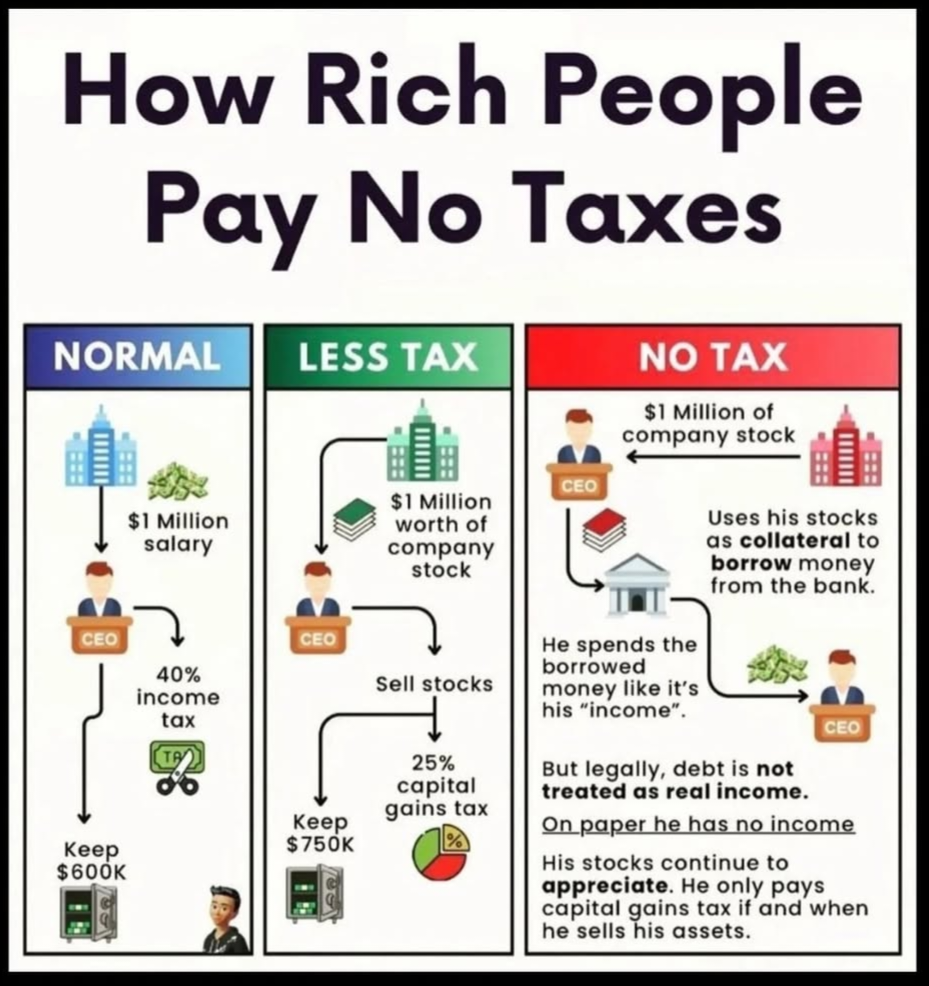

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Medial User

Hey I am on Medial • 11m

Change my mind: A middle-class person who cannot afford to buy a home in a metro city takes a loan and spends a lifetime paying EMIs, while the government incentivizes this through tax deductions. This is a pure strategy to enrich the real estate t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)