Back

Havish Gupta

Figuring Out • 1y

So it's easy.. 140k-65k = 75k. So if you could invest all of it in index, assuming 12% return, makes about 96.75 lakh. (But that is if you invest whole 75k and that too whole in stock market) And now you can either keep those existing 7lakhs in equity or keep them in FDs for emergency funds. And even with assuming 8% return, it become 12 lakh. So 96lakh+12lakh = 1.08 crore which is your goal. But remember 1) first the value of that 1cr would be less because of inflation 2) i have assumed that you put your entire savings into mutual funds. But i recommended investing that 7-8 lakh in FDs as emergency funds 3) i didn't assumed appraisal as that would make the goal easy but since you would and should spend on vacations as well. It's ok if I don't count that. DM me, we'll have a better talk there.

Replies (1)

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 1y

How is Kumbh Mela making a revenue of 4 lakh CR? i) Kumbh Budget - 7500 CR (Rs 5400 - UP govt., Rs 2100 - Centre) ii) Total Expected Indian visitors - 40 CR iii) Estimated Indian National Spending - Rs 5000/- (Golgappe, Sweet Corn, Water etc.) iv)

See MorePRATHAM

Experimenting On lea... • 6m

Top three investments with zero to low risk in which you can earn 7 to 9% are: first, FDs; second, Liquid Mutual Funds; and third, Arbitrage Funds. Liquid Fund is a day fund which invests in super ultra short-term instruments like T-Bills in the mon

See MoreManish M Tulasi

•

Mitra Robot • 11m

Mutual Funds: A Closer Look at the Real Returns Many people say that mutual funds are a great investment, but have we truly calculated the real returns, considering all factors like inflation and taxes? Let me break it down with a simple example.

See MorePraveena J

Stay Hungry, Stay Fo... • 1y

Guys everybody knows that insurances ( health, life and retirement) covers will cover the money for the covers only, but nobody gives the fixed expenses of his family, which is emergency funds, which i think most of the people doesn't know about. May

See MoreThe next billionaire

Unfiltered and real ... • 1y

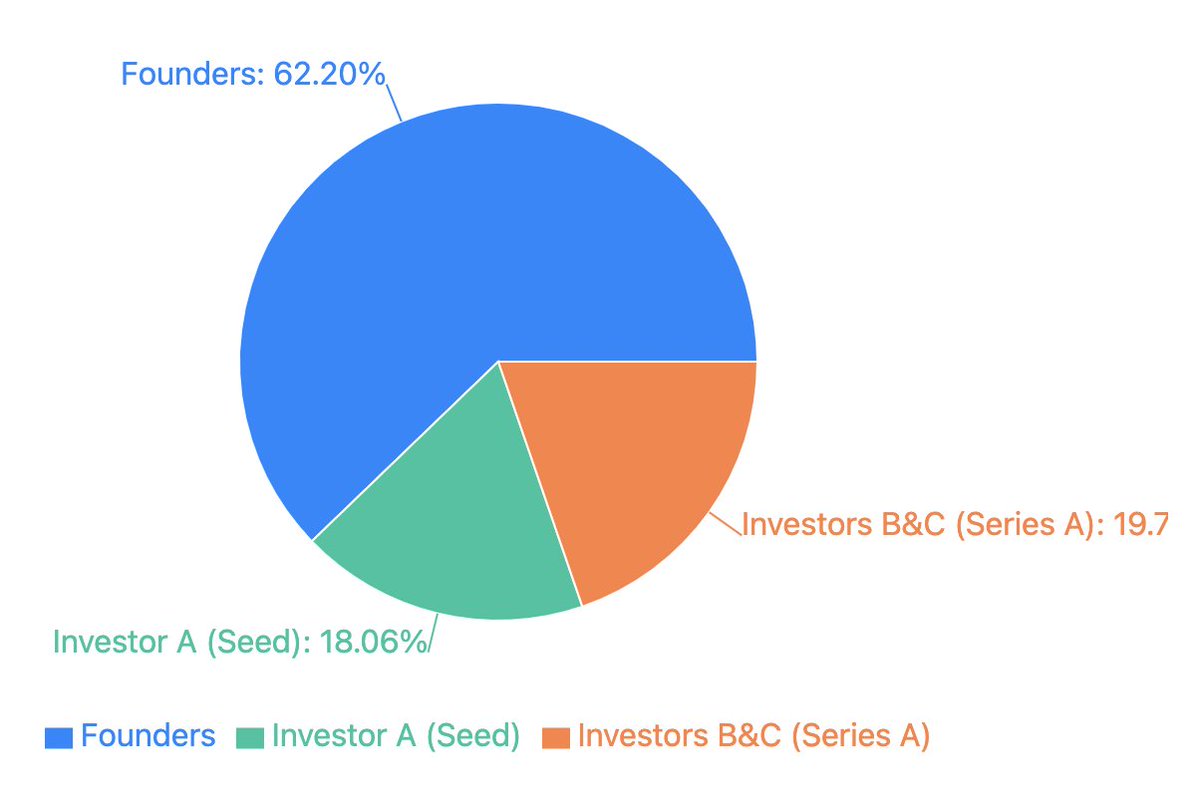

quick math on minimalist outcome: - raised $2M seed from peak (assuming 20 - 25% dilution) - raised $15M series a from peak + unilever ventures at a $76M val. - in talks to be acquired by HUL for $350M - founders to make $217M - seed investors get $6

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Kush Katara

I Help Start-up Foun... • 1y

What would be your approximate Customer Lifetime Value (CLV)? You run a mobile app that offers premium subscriptions for ₹500 per month. Last year, you acquired 1,200 new customers, and your marketing spend for customer acquisition was ₹1.2 lakh.

See MoreDownload the medial app to read full posts, comements and news.