Back

Praveena J

Stay Hungry, Stay Fo... • 1y

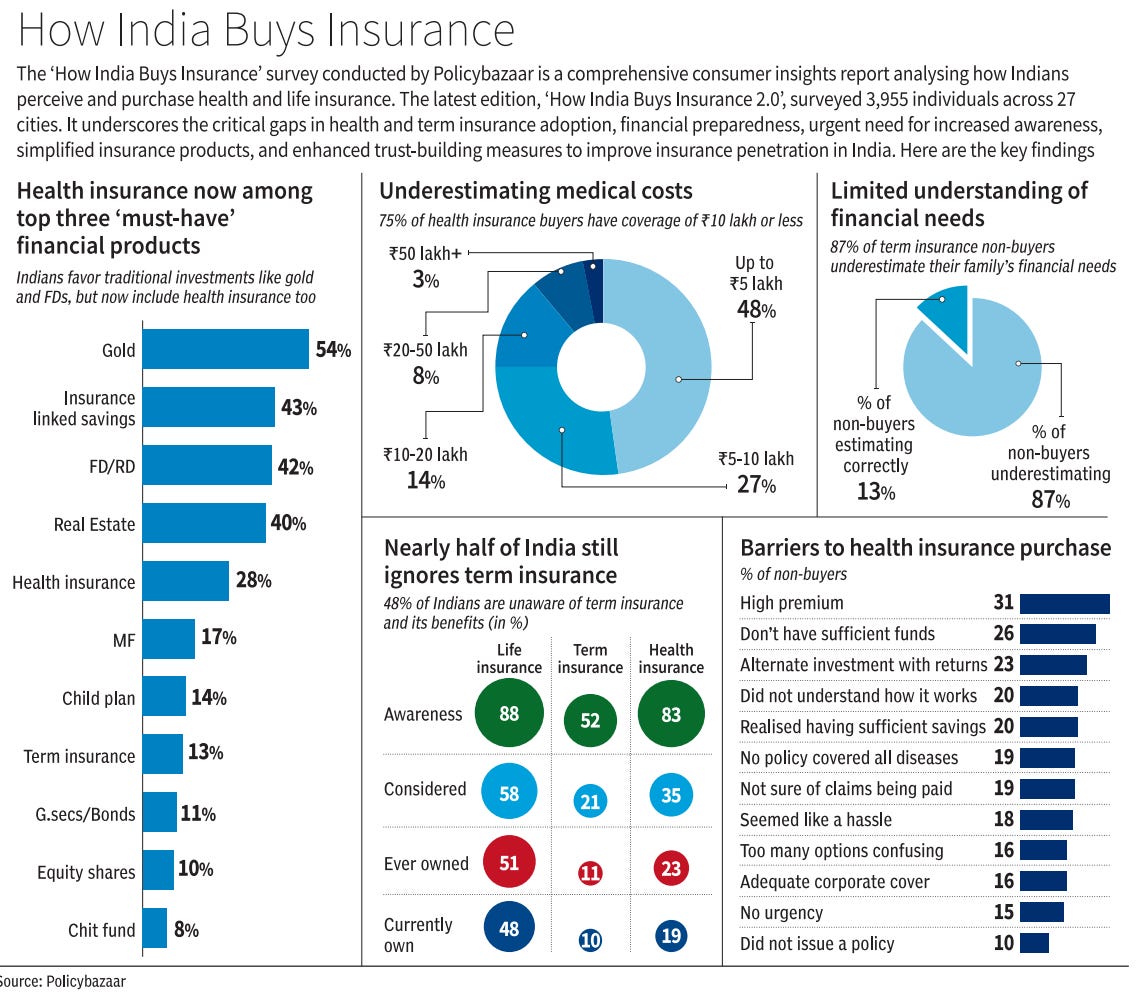

Guys everybody knows that insurances ( health, life and retirement) covers will cover the money for the covers only, but nobody gives the fixed expenses of his family, which is emergency funds, which i think most of the people doesn't know about. May be recently due to the stock markets, mutual funds and investment penetrations in India, certain percentage of people might be having/building their emergency funds, but what if due to their health failures, they may take more than few months to again start earning. Also, the percentage of people who are building emergency funds are very less compared to the total working people in India. So, this might be a market gap for the insurtech companies to provide the insurance+ fixed expenses of the person's family by charging them more premiums. As we know, all the insurance companies sell the fears not insurances, this might also become a separate category of insurance. I know there are pension schemes and other also, But tell me your POV :).

Replies (5)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

Not sure if this idea is as good as I think or not . Basically i want to create a new kind of investment fund . Which is Export Investment funds, We will finance the Exporters with funds to fulfill the shipments . And the money will be invested by ge

See MoreSAHA Realtors

Rediscovering lifest... • 7m

Real Estate Lease Agreements A lease is a written legal agreement between landlord and the tenant that helps to establish the following : *How much the tenant will pay in rent. *How long the tenant is legally committed to stay. *Any additional payme

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 🎯Types of Expenses for VC? 🎯What is a Self-Managed Fund? 🎯Organisational Expenses: These are costs for VC Funds which includes such as Incorporation Costs, Statutory Compliance Cost of the Funds, Placement Commissions, Distri

See MoreSumith Pala

Hey I am on Medial • 4m

Hey buddies, I’m working on building a personal finance operating system that helps individuals manage and grow their money more effectively. The idea is to guide users from learning to action — based on their income and expenses, we’ll help them wi

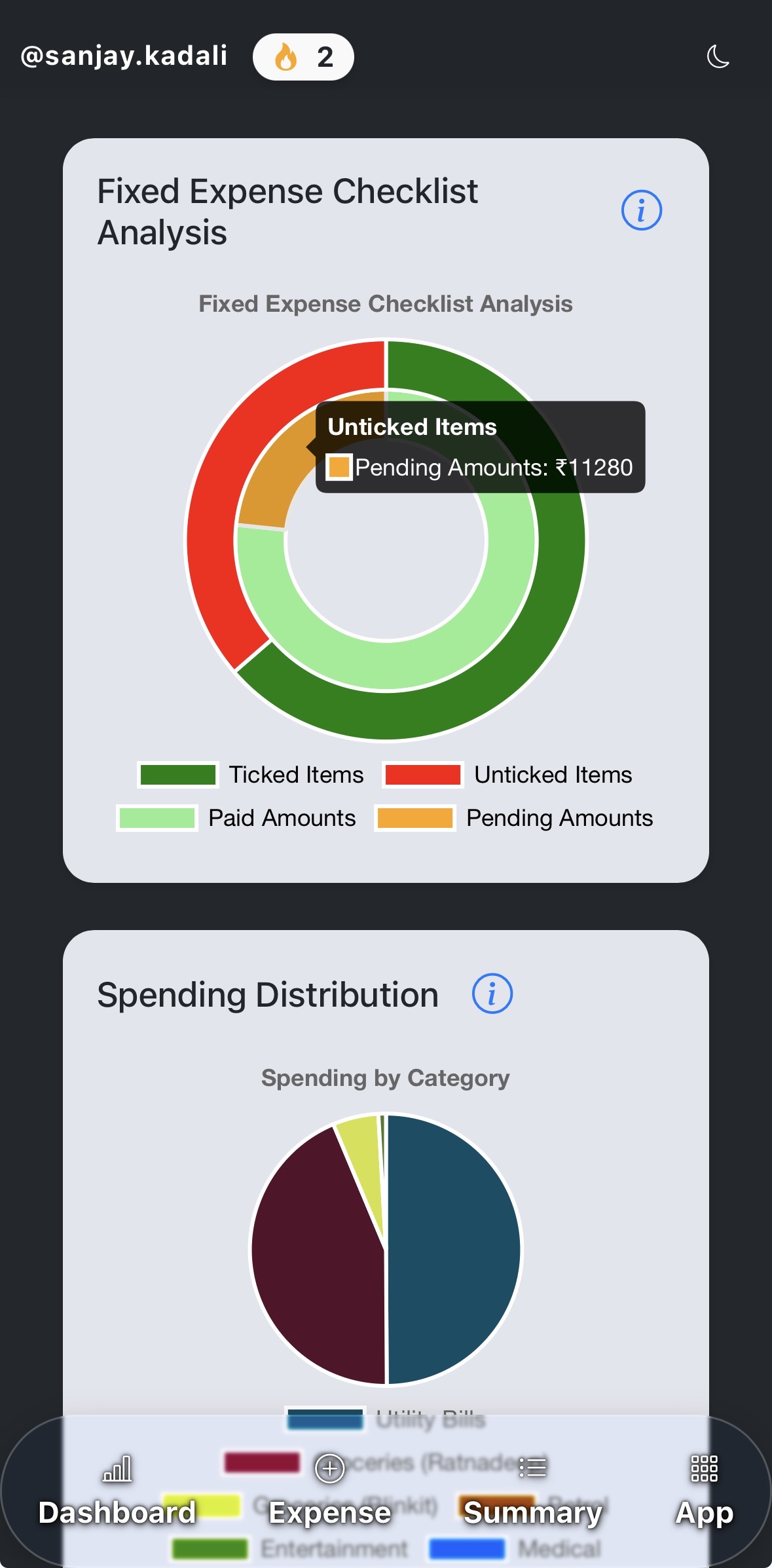

See MoreSanjay Kadali

•

Health Catalyst • 4m

Fixed Expense Checklist: Pennywise lets users maintain a list of fixed expenses on a monthly basis... This visual representation helps users to be aware of pending and paid items for the month Adding a snip of it to this post. Please comment down i

See More

Rohan Saha

Founder - Burn Inves... • 10m

Many traders and investors often overlook fixed income instruments, but having a portion of the portfolio in debt is essential for stability. Buying bonds in India is very easy, yet people do not give much consideration to bonds or debt mutual funds.

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)