Back

Arcane

Hey, I'm on Medial • 10m

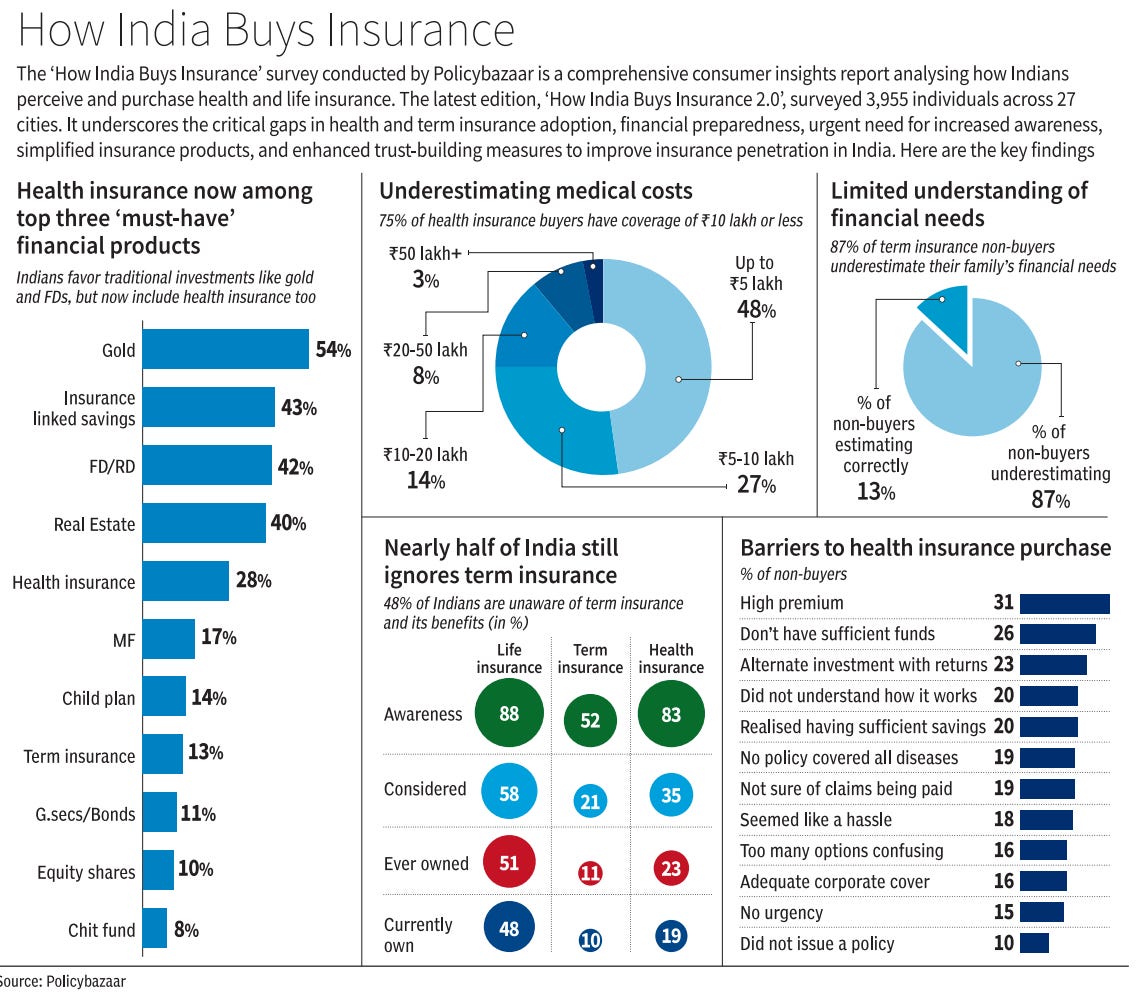

A QUICK SNAPSHOT OF HOW INDIA BUYS INSURANCE 1/ Health insurance is slowly rising up as a financial product. It is now among the top, beating even equity, mutual funds & govt bonds. 2/ However, an interesting thing to note is how much medical costs are underestimated in India. 48% of policyholders have health insurance coverage of ₹5 lakh or less and 75% have coverage of ₹10 lakh or less. So, even if Health insurance is rising, most people are still underinsured. 3/ People buy gold but skip Term Insurance because gold is emotionally valuable to them. In fact, 48% Indians aren't even aware about Term Insurance and its benefits. Also, Awareness ≠ Ownership. 52% are aware about Term Insurance, but only 10% own it. 4/ Insurance is not an investment, but people treat it like one. They get disappointed when they don't see any returns. High premiums, insufficient funds and alternate investment options that feel rewarding push them away from a good insurance product. What could make Insurance, especially term and health, a high priority product?

Replies (4)

More like this

Recommendations from Medial

Mohammad Asaad Sayed

My mind to me a king... • 1y

Health Insurance in India: The Emerging Boom 🚀 1. Market Trends : -Rising health awareness + pandemic lessons = surge in demand. -Govt push (Ayushman Bharat) + digital platforms = wider reach. 2. Key Players : -Traditional insurers (LIC, HDFC Ergo

See Morevishal Kumar

Hey I am on Medial • 1y

Just out of curiosity, Is there any super app which is simple yet gives u a dashboard for everything such as your CIBIL, FAMILY HEALTH INSU, TERM INSURANCE, VEHICLE INSURANCE, YOUR TERM DEPOSITS INFO ETC...and Gives you a combined score in term of ho

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)