Back

The next billionaire

Unfiltered and real ... • 1y

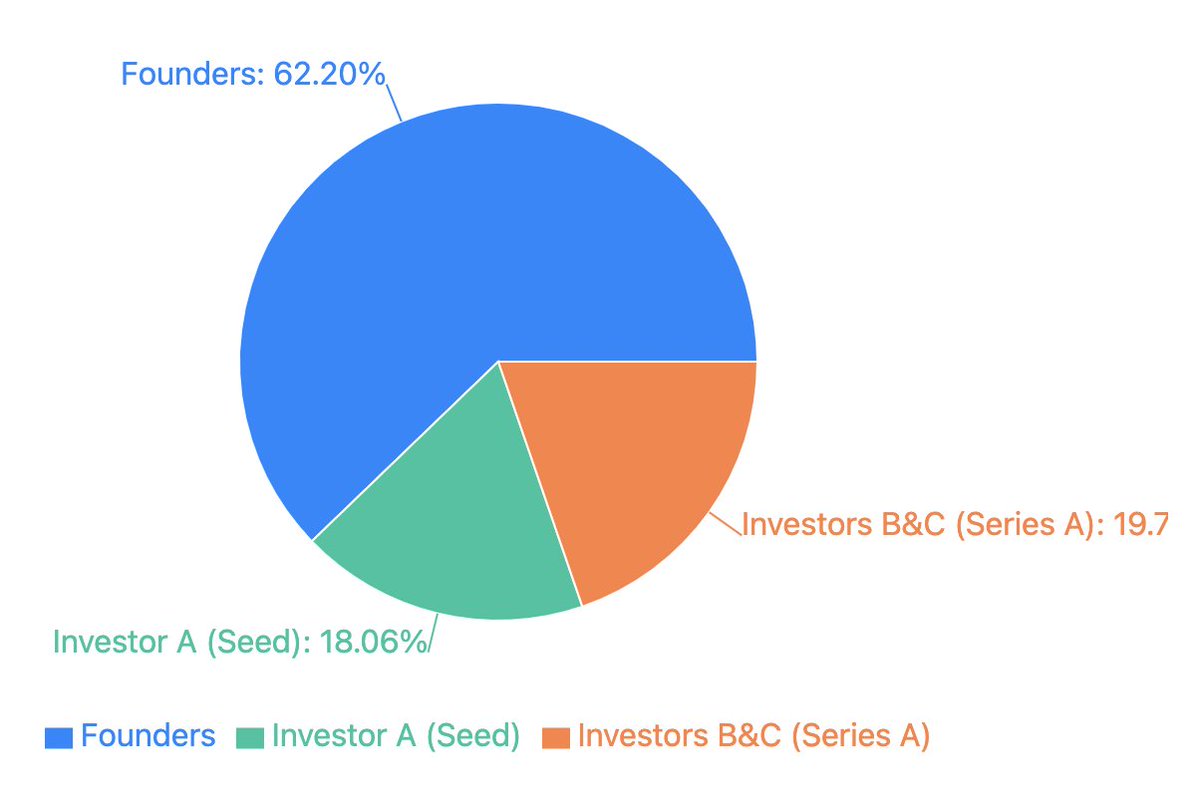

quick math on minimalist outcome: - raised $2M seed from peak (assuming 20 - 25% dilution) - raised $15M series a from peak + unilever ventures at a $76M val. - in talks to be acquired by HUL for $350M - founders to make $217M - seed investors get $63M (~9-12x based on that dilution assumption) - series a investors get $69M (4.6x) - even assuming a 2:1 [peak : unilever] split in the series a investment, peak's total proceeds would be $109M. - assuming if peak had invested out of sequoia capital india's sixth fund (2018) which was $700M, proceeds from minimalist is about 15% of the total fund size * lots of assumptions but this is the gist of non-unicorn outcomes for mega funds in india [investor a, b = peak; investor c = unilever] credits : @ anmolm_/x

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 1y

How did two boys from Jaipur sell their company to HUL for 3200 CR? ➡️ October 2020—Mohit and Rahul Yadav launch Minimalist in Jaipur, a Tier 2 city. They challenge misleading skincare claims with a science-backed approach inspired by The Ordinary.

See More

Account Deleted

Hey I am on Medial • 1y

The Whole Truth Raises $15M in Series C Round Led by Sofina Clean-label health food brand The Whole Truth (TWT) has secured $15 million in a Series C round led by Sofina, with continued support from existing investors, including Z47, Peak XV Partner

See More

sia shetty

Unlocking Business I... • 12m

Case Study: Minimalist – Revolutionizing Skincare Through Transparency and Innovation Introduction to Minimalist Founded in October 2020 by Jaipur-based siblings Mohit Yadav and Rahul Yadav, Minimalist emerged as a disruptor in India’s beauty and per

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)