Back

Anonymous 1

Hey I am on Medial • 1y

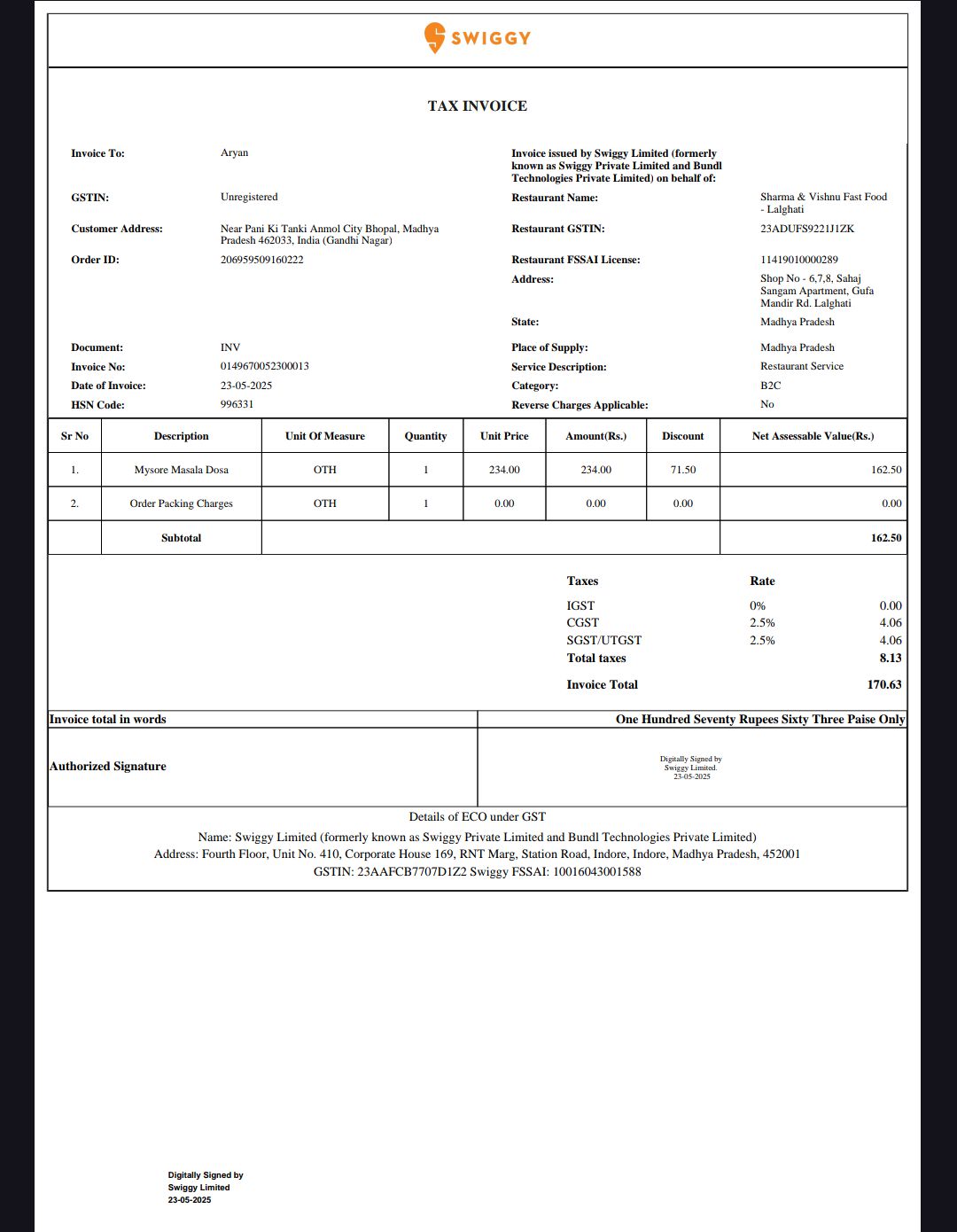

My view is that If you put that amount on your parent's account then it will be shown as their income and taxable ,for GST no. the amount must be above 20 lpa. You may watch any video on utube to start your shop over amazon

Replies (1)

More like this

Recommendations from Medial

umang vaishnav

You make it choices ... • 5m

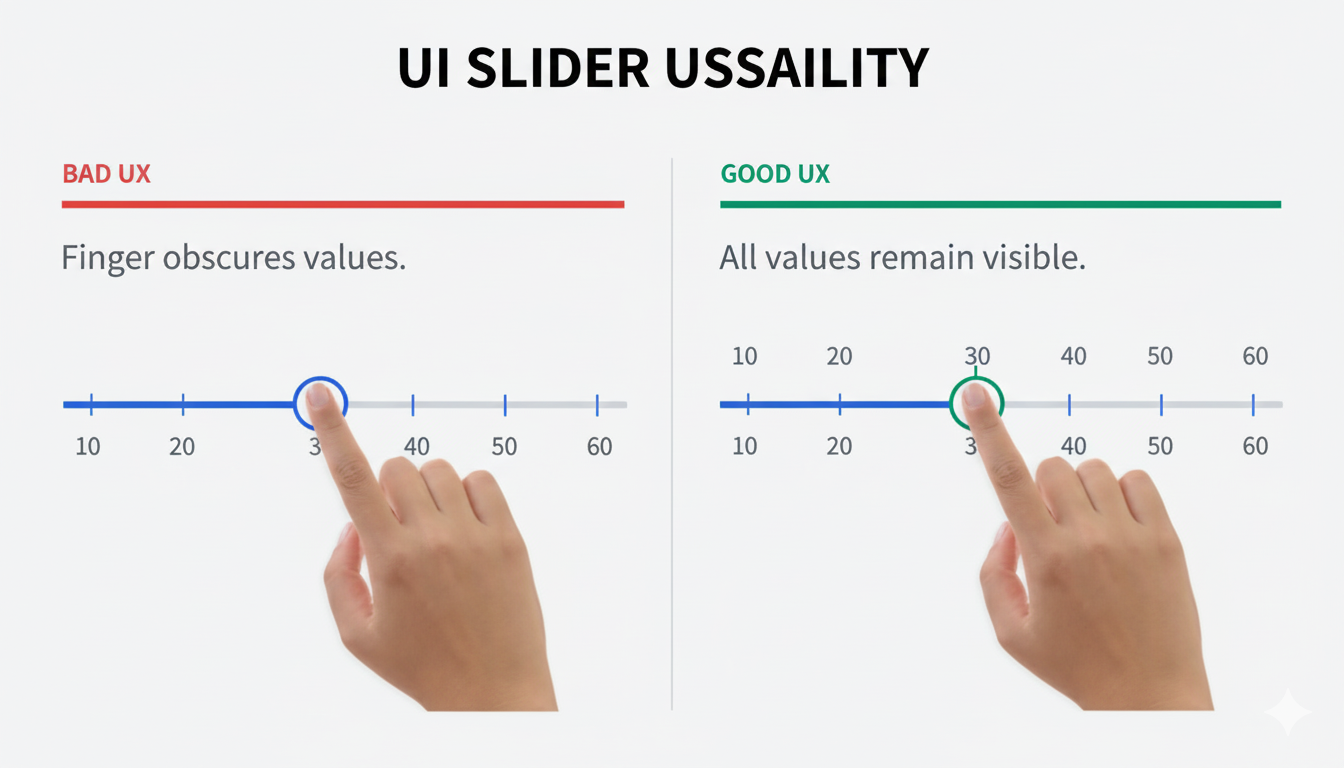

In mobile UI, put the slider values above the slider, not below. Because when users touch it, their index finger covers part of the values, so they won't be sure which value is currently Selected in mobile UI, put the slider values above the slider,

See More

Dr Bappa Dittya Saha

We're gonna extinct ... • 1y

OI trends! ⚠️ In the money put removed! Nifty strong above 22000. Deep In the money Call removed. 22500 still a strong resistance! Above it is strong support! 23k - 23.5k this is max nifty can go It's a sell on rise! And building position in under

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)