Back

Adithyan Selvaraj

Building Staynix🏠 • 1y

What are all the mandatory things needs to be considered while registering a private limited company? ( RoC, GST, Current Bank Account) Please mention other than the above things that are mandatory for the newly forming company.

Replies (20)

More like this

Recommendations from Medial

Miten Solanki

Entrepreneur | Probl... • 5m

I am finally registering my startup as a company and wanted to know which kind of company registration should I do? so I have been building my AI product from last 3 months, solo. now the mvp is getting traction and we need a gst number to register

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

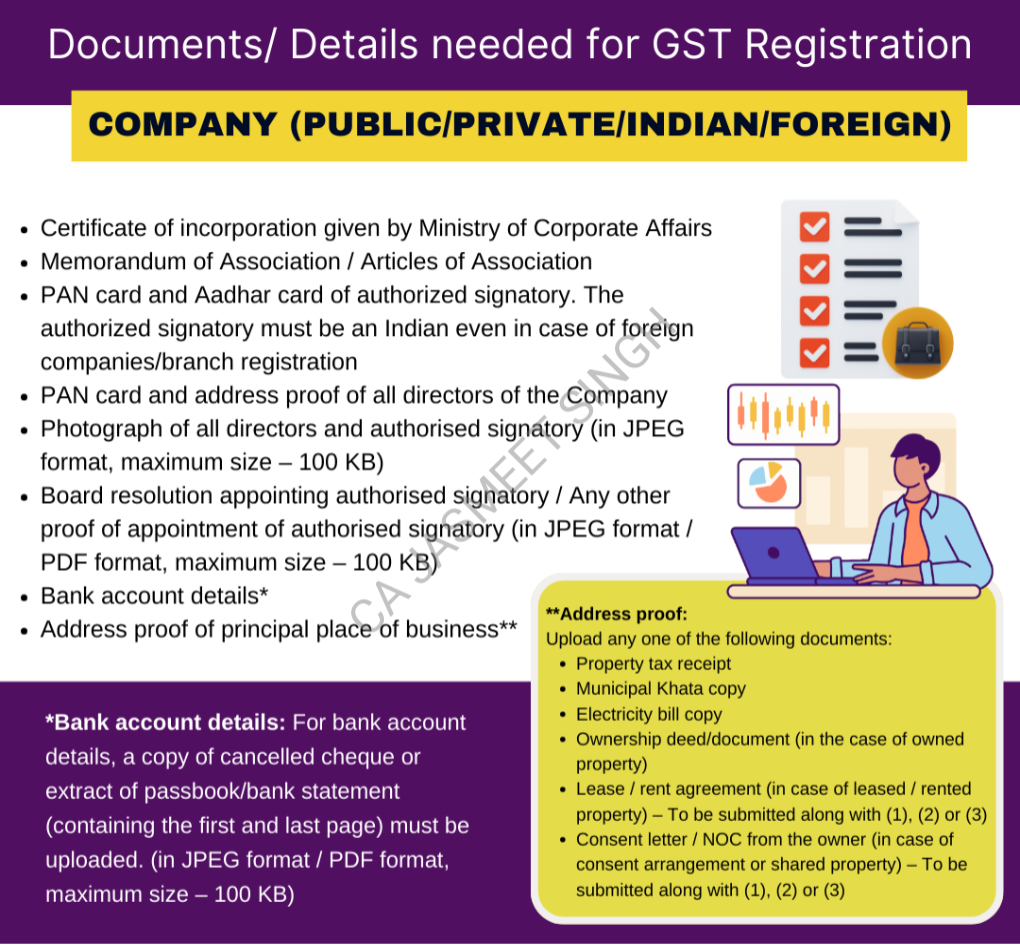

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

CA Jasmeet Singh

In God We Trust, The... • 9m

3 DIY Health Checks Every Founder Should Do Monthly 1. Cash Flow Pulse Check → Ask: Did I collect more than I spent this month? → If unsure, review bank statements & tally collections vs payments. Why it matters: Profitable on paper ≠ cash in bank.

See MoreAswanath CK

app developer • 11m

Hi all, I am trying to build a startup and I won't be able to build alone as I need someone from the backend, AI/ML etc.. But the question is how I will be able to talk to them like what will be their benefits? Giving them a share or profit percenta

See Moreshubham kaushal

Building EveOut • 1y

Preparing My Tech Startup for Production Release – Need Guidance I'm gearing up for the production release of my tech startup and need some guidance on a few key areas: Company Registration: How did you get your company registered? What steps did y

See MoreCA Jasmeet Singh

In God We Trust, The... • 9m

Startups Need More Than Just Hustle – They Need Health Checks." Running a startup? Don’t miss these 3 critical early-stage checks: 1. Startup Compliance Check Are you missing ROC or GST deadlines? A ₹500 late fee every day can silently kill your

See MoreGituparna Sarma

Co-founding Entrepre... • 10m

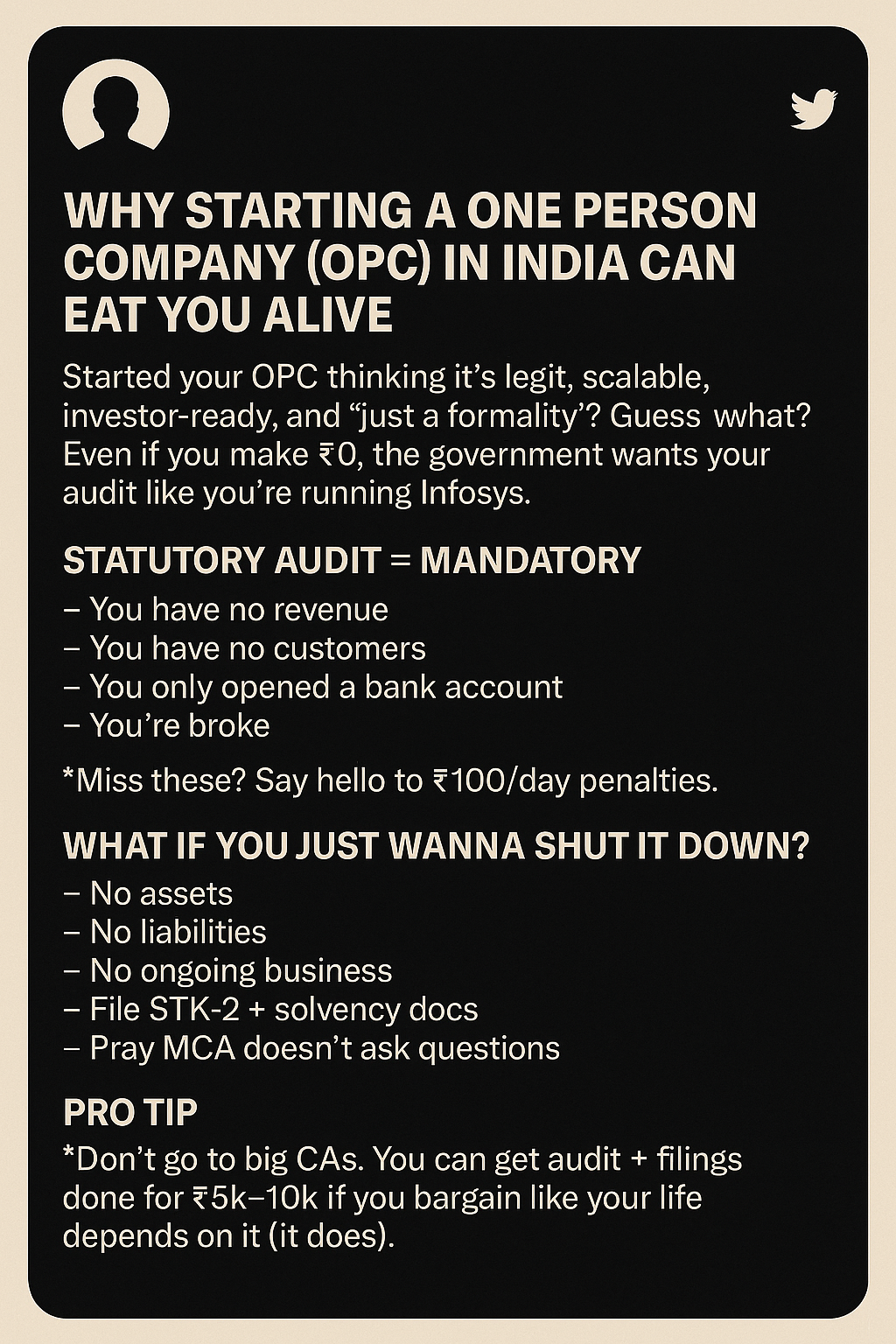

Starting a Company in India Can Eat You Alive — Even if You’re Broke Tag your CA friends, they’ll cry too. Started an OPC thinking it's "just a formality"? Even if you made ₹0, the govt wants an audit like you're Infosys. Statutory Audit = Manda

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)