Back

Somen Das

Senior developer | b... • 1y

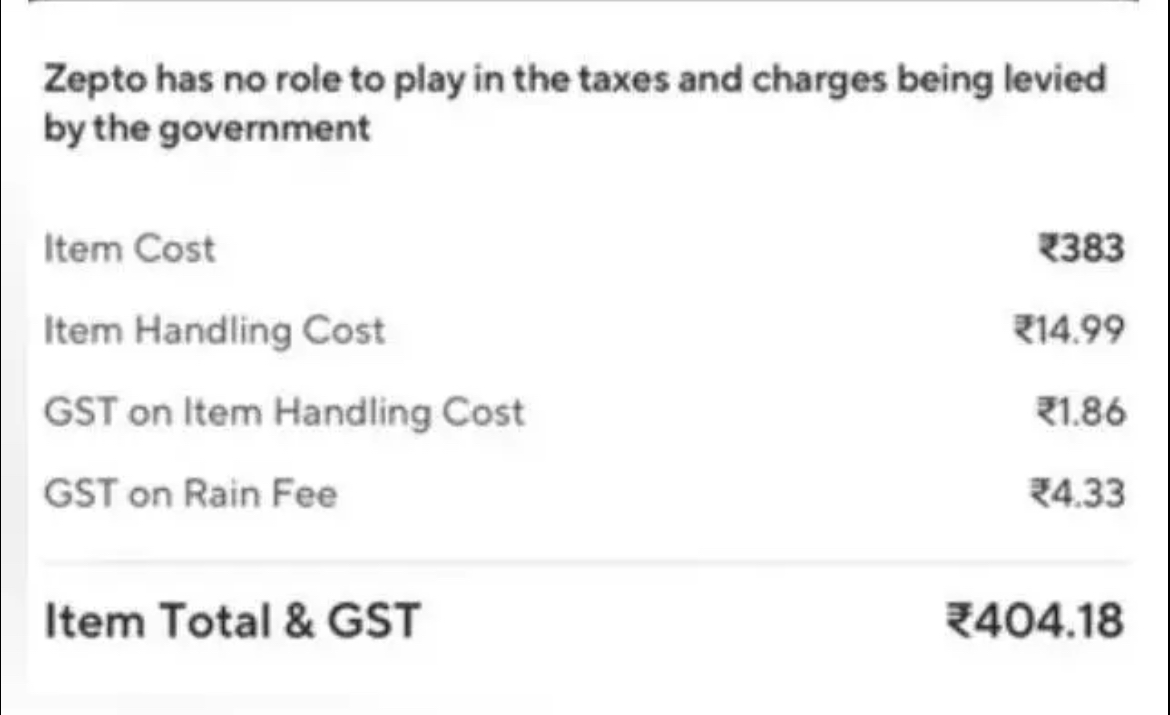

is GST required?

2 Replies

2

Replies (2)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See More4 Replies

1

10

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)