Back

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 11m

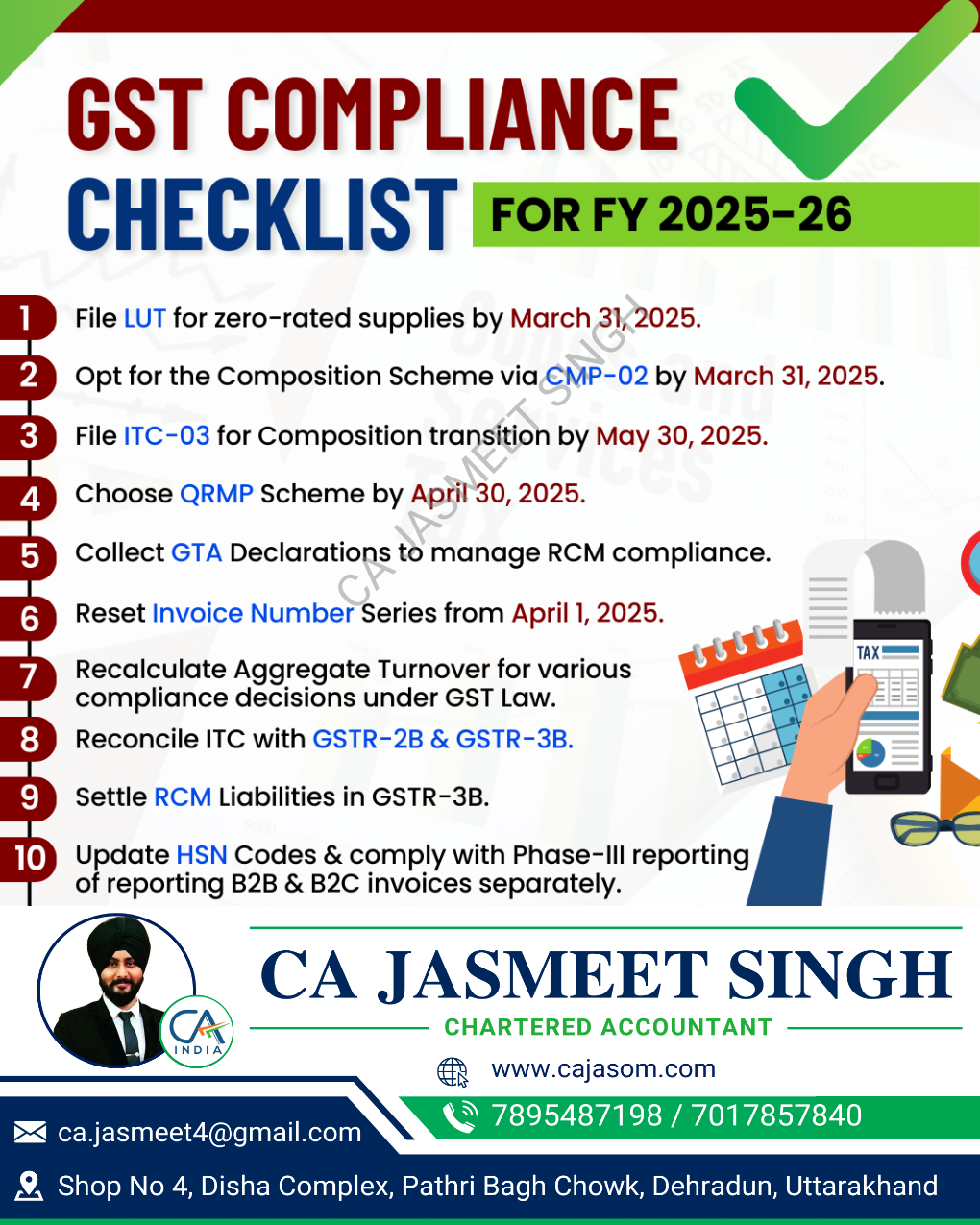

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Rohan Kute

Business | infograph... • 10m

If you ever wonder to start a company, you should have to know this. There are three types of companies: 1) Private Limited Company Eligibility: Minimum 2 directors and 2 shareholders (at least 1 Indian resident). Pros: Limited liability protecti

See More

Shubham Jain

Partner @ Finshark A... • 11m

Mandatory TReDS Onboarding for Companies with Turnover Above ₹250 Crores As per Gazette Notification S.O.-4845E dated 7th November 2024, all companies with a turnover exceeding ₹250 crores are required to onboard the Trade Receivables Discounting Sy

See MorePRATHAM

Experimenting On lea... • 4m

When ChatGPT 3.5 was launched, AI was termed as future and I that time thought it's a gold mine and what's the pickaxe? I was dumb and wasn't aware that much. Why I thought it? coz I always believe in Sell Pickaxe in Gold rush. Now If I think about

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)