Back

Manoj S

Hey I am on Medial • 1y

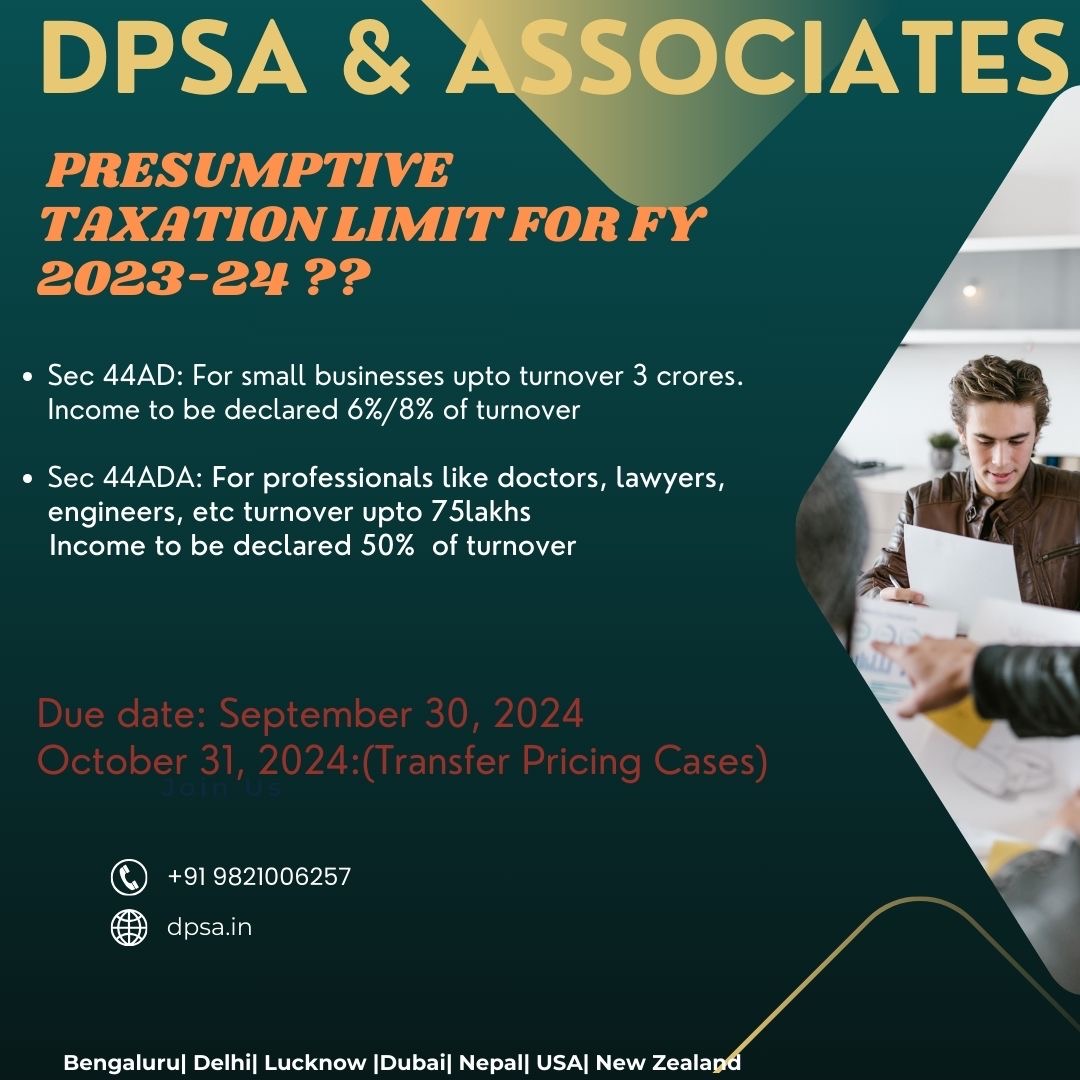

10 Things that you need to consider as a startup or Business before end of Fincancial Year 31st March 2024 Accounting & Taxes: ✅ Finalize books (FY23-24). ❓ Check TDS deadlines. ❓ Review TDS/TCS for high-value transactions (if applicable). ❓ Review HSN/SAC code requirements. New Rules (April 1st): E-invoicing mandatory for > Rs. 4 crore turnover. Decide on QMP filing for GST (opt-in by April 30th, < Rs. 5 crore). Exporters: ✈️ Apply for LUT (FY 24-25, if applicable). Other: 🆕 Start fresh billing series (April 1st). Optional Review composition scheme (up to Rs. 1.5 crore). Remember: This is a general list. Consult me for specific guidance! #FYEnd #Accounting #Taxes #Business #Startups

More like this

Recommendations from Medial

Shreyas Ramdasi

Mechanical Engineer • 1y

Billionaire businessman Gautam Adani has increased his stake by 1.32% in Adani Enterprises from the open market in April to June quarter, a statement to stock exchanges stated on June 14.Adani Enterprises had reported a consolidated net profit of Rs

See More

Shreyas Ramdasi

Mechanical Engineer • 1y

FMCG major Marico shares zoom nearly 10% after Q4 earnings The company’s stock jumped 9.73 per cent to Rs 582.75 on the BSE and zoomed 9.83 per cent to Rs 582.45 apiece on the NSE. Shares of FMCG major Marico Ltd advanced nearly 10 per cent on Tuesda

See MoreAKSHAT VARAHAGIRI

Entrepreneur | ui&ux... • 1y

Food delivery platform Zomato has increased its platform fee for customers by 25% to Rs 5 per order, effective April 20. The fee increase, applicable in key markets including Delhi, Bengaluru, Mumbai, and Hyderabad, is expected to boost the company's

See MoreCA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreVikas Acharya

Building Reviv | Ent... • 11m

Oyo estimates Rs 1,100 crore PAT for FY26: Founder Ritesh Agarwal Travel tech unicorn OYO estimates its profit after tax to touch Rs 1,100 crore in the next financial year 2025-26, according to projections shared by Founder Ritesh Agarwal with the c

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)