Back

Mahendra Lochhab

Content creator • 1y

"GST to be charged on petrol but it can happen only if states agree to put them under GST" FM Nirmala Sitharama

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See MorePoosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MoreAccount Deleted

Hey I am on Medial • 9m

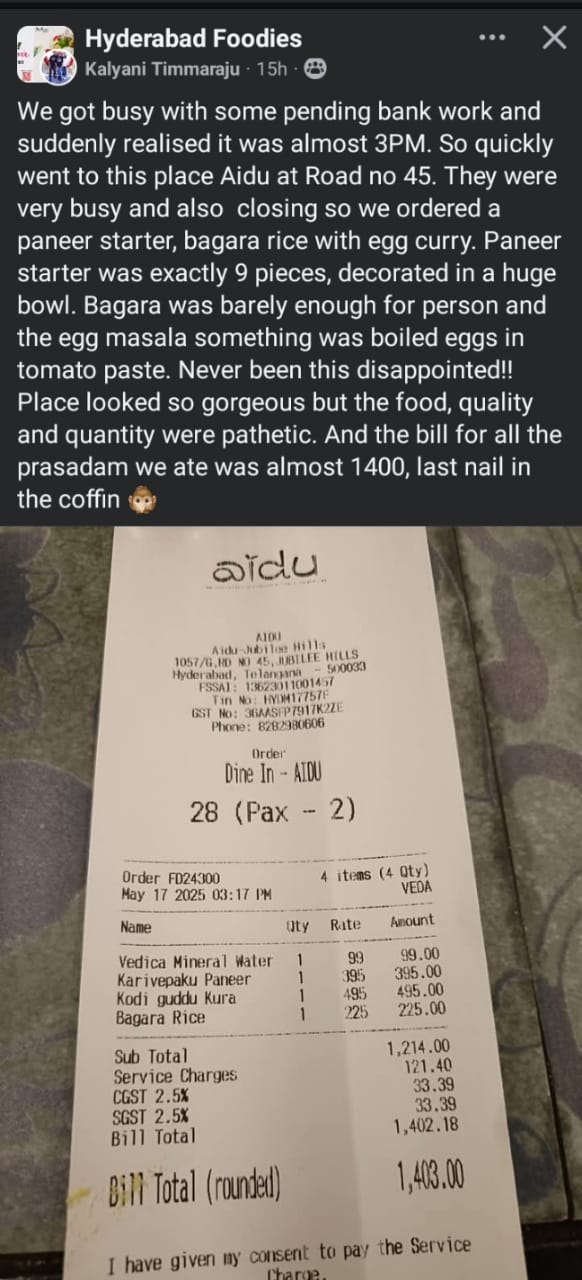

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

Account Deleted

Hey I am on Medial • 6m

People don’t stick to digital products just because they exist. They stick if the product keeps giving them two things on loop: 1. Rare knowledge — insights or perspectives that make them feel smarter than the average person. also the tools come und

See MoreRushikesh vetal

Building another goo... • 9m

🚨 Startup Founders, Small Business Owners – Beware of Tax Filing Frauds! I want to share a real incident that happened to me, not to gain sympathy, but to ensure it doesn't happen to others. A firm claiming to handle GST returns (AdvizeIndia) took

See MoreSaket Sambhav

•

ADJUVA LEGAL® • 8m

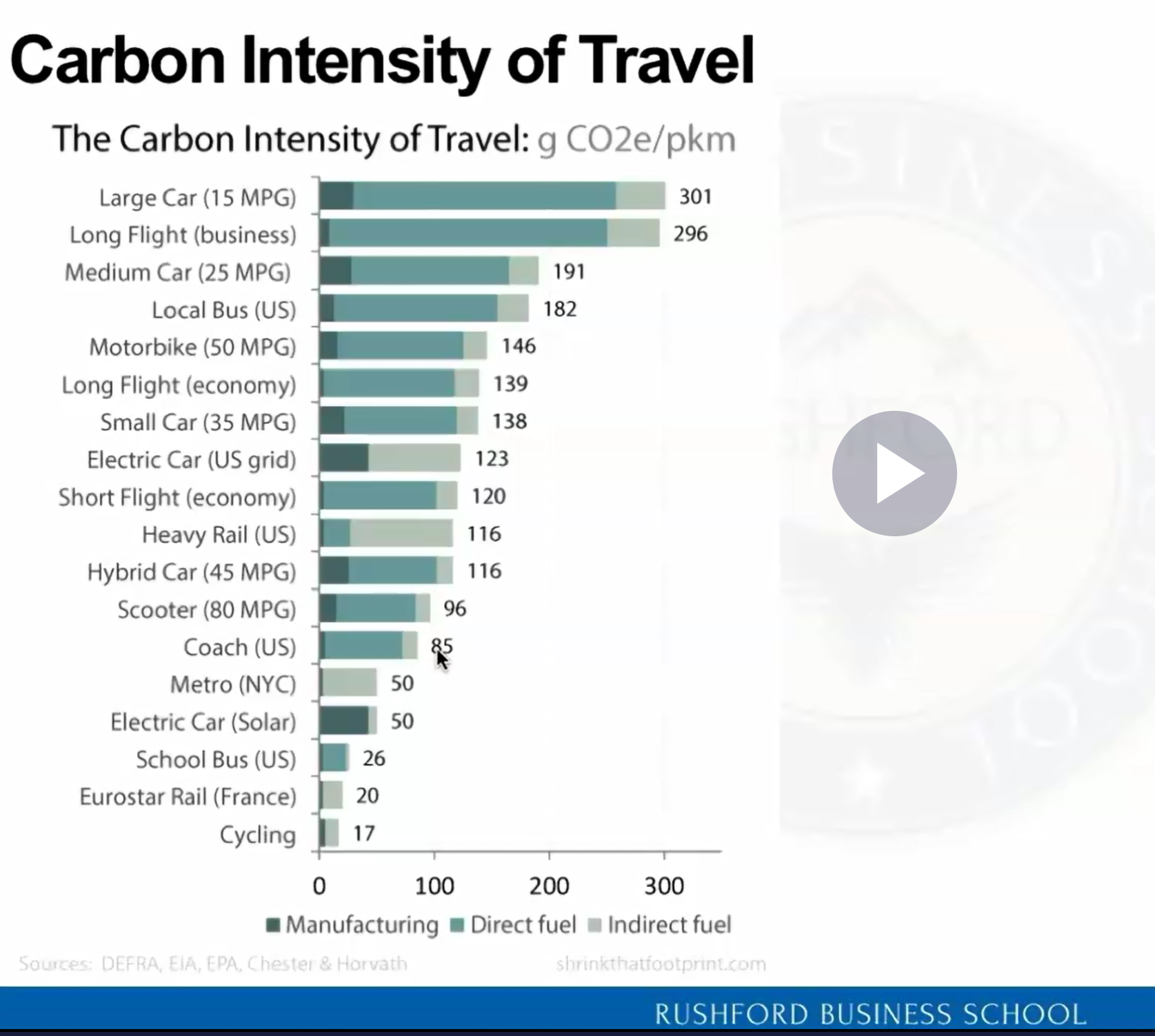

Do EVs Really Reduce Carbon? A Surprising Look at Manufacturing vs. Lifetime Emissions. 🚗⚡ Attended an interesting lecture during my DBA studies, and a fascinating point came up that I had to share. We often hear that Electric Vehicles (EVs) have a

See More

Dr Sarun George Sunny

The Way I See It • 5m

📌Starting 22nd September 2025, India’s GST structure has been simplified into three key slabs: 💸 GST Slabs Simplified👉 🟢 0% GST (Exempted) • Food & Beverages: Ultra-High Temperature (UHT) milk, chena/paneer (pre-packaged and labelled), pizza

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)