Back

Jayant Mundhra

•

Dexter Capital Advisors • 1m

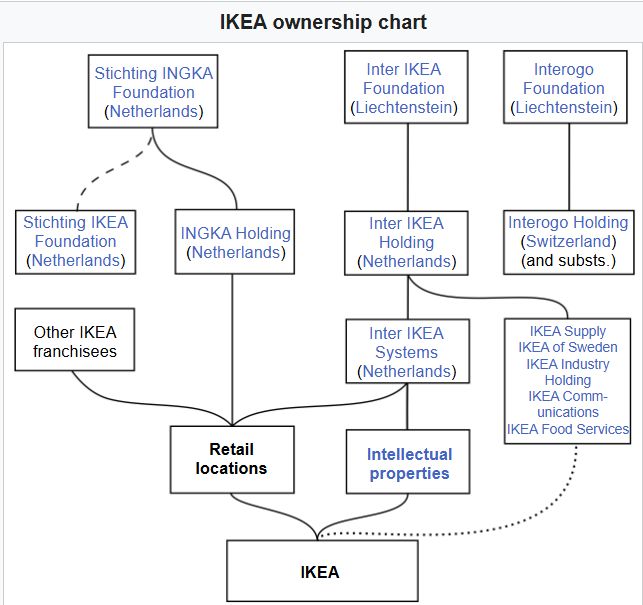

Spent massive time digging into IKEA’s global structure over last few days. And I am seriously mind-blown. The WILD truth? The world’s largest furniture retailer is technically owned by a charity. Sharing below all my findings. .. The founder - Ingvar Kamprad - was a genius. He didn't just build IKEA. He build it as a tax fortress. The goal was simple: Eternal life for the company. Zero inheritance tax for the family. Minimal tax for the Govt. Thus, he sliced the company into two distinct groups. - Ingka Group: The retailer. They run ~392 stores. Owned by a Dutch foundation (Stichting INGKA) - Inter IKEA: The true boss. They own the IP, the brand, and the 'concept.' Owned by a secretive Liechtenstein foundation (Interogo) .. Here is how the game is played. Every time you buy a bookcase in high-tax country like India, Germany or France, the store (Ingka) pays a massive 'franchise fee' on that sale to Inter IKEA. - And this way, Ingka strips profits out of high-tax countries (tax-deductible expense) and shifts them to the Netherlands - Once in the Netherlands, that cash hits the nation’s special “Innovation Box” tax regime under which the tax varies between 5-9%. Not the standard 25% From there? It flows to Liechtenstein. Tax rate? Effectively 0%. .. And, this is where it gets deeper. You see, in 2012, the Liechtenstein foundation 'sold' the trademark to the Netherlands subsidiary for €9bn. They didn't pay cash. They used a loan. This created massive interest payments flowing from the Dutch entity back to Netherlands. Massive tax deductions on one end, tax-free income on the other. .. And this gets better. You see, the founder himself died in 2018. And, the family still holds the keys, but not the shares. Shares are owned by certain foundations. - This means NO inheritance tax (which hits 40% in Sweden) - But they sit on the boards of the foundations. They run the show This is all a masterpiece of legal engineering. It protects the brand from takeovers. It shields the family from taxes. And it keeps the empire intact forever. Crazy, no? Did you know this?

More like this

Recommendations from Medial

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

“IKEA’s Royal Sleepover” WEIRD Marketing Strategy #13 It all started on Facebook, a group was created ‘I Wanna Have a Sleepover in IKEA’ and the number of members joined were 10K,IKEA Selected 100 lucky people to spend the night in their showrooms.

See More

Aryan Sukhdewe

Looking to work in ... • 1y

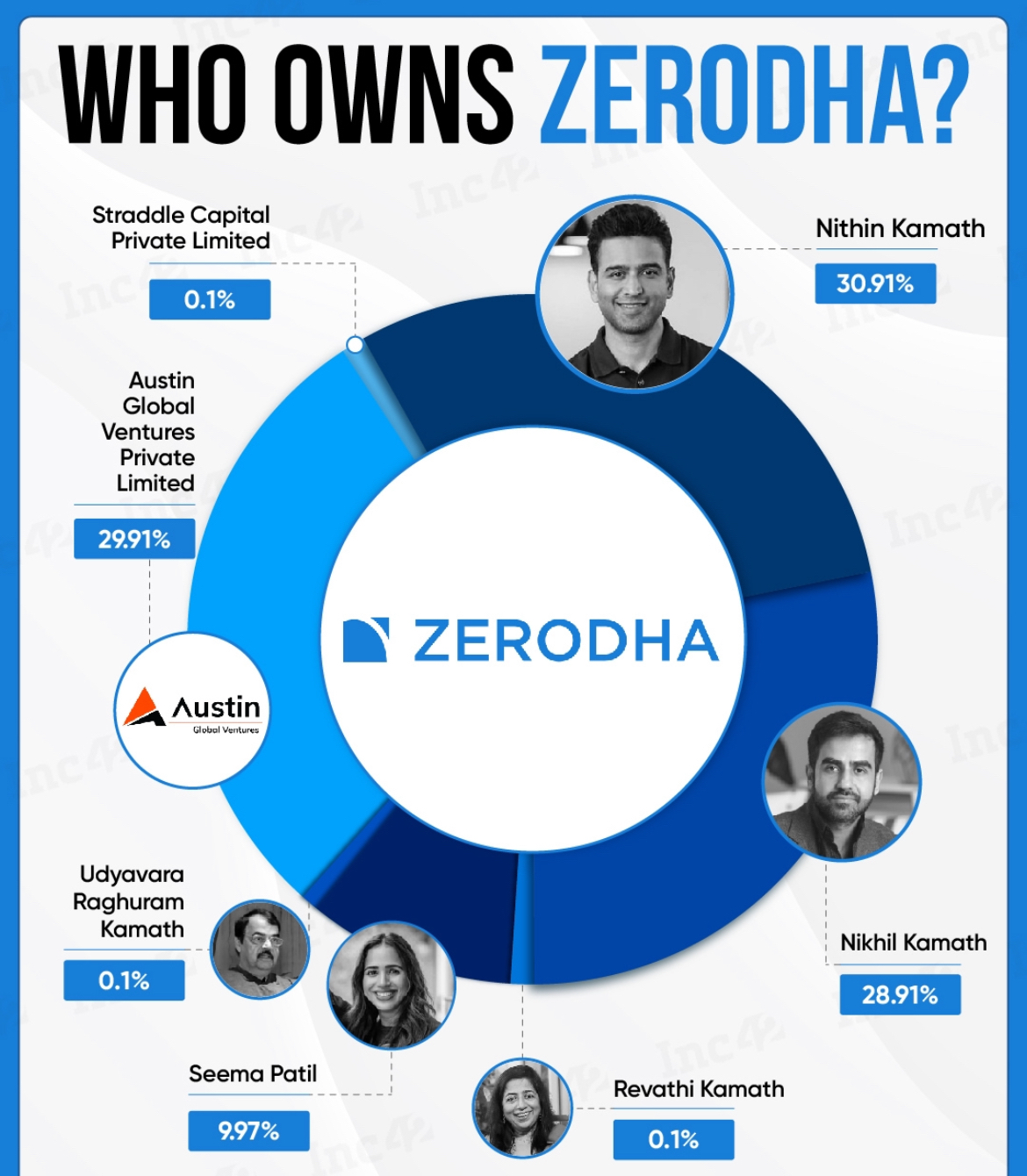

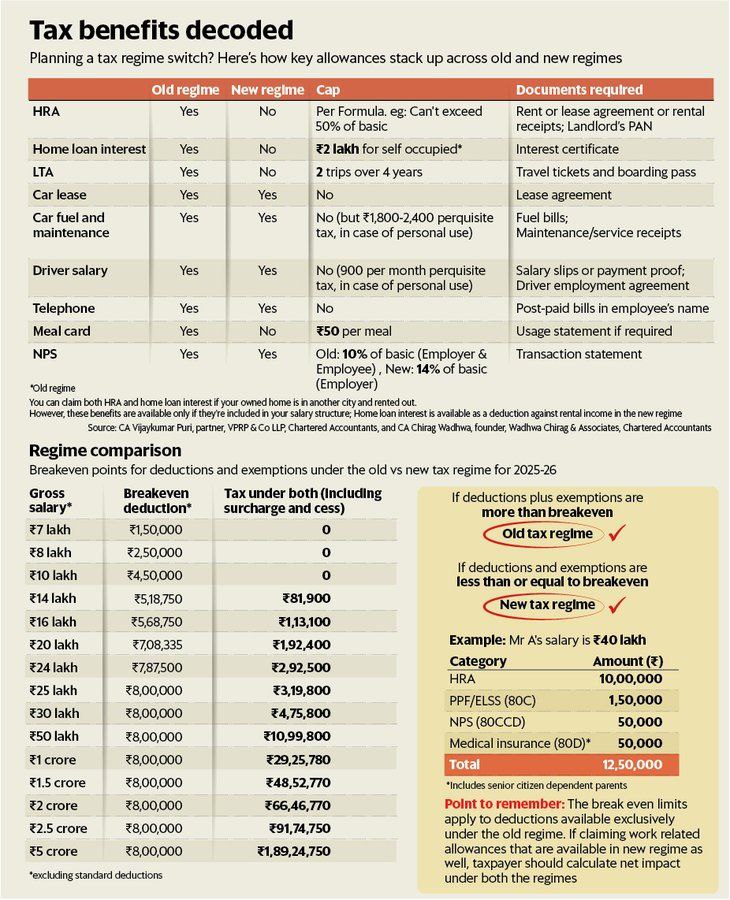

We are slowly moving towards a system of 30% taxation on capital gains. [1] A lot of retail folks used to enjoy the indexation benefits on Debt mutual Funds. This was taken away in 2023. Rational? Well, Equities have no indexation-- why should

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 10m

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8.

See MoreAditi

Will become a inspir... • 9m

“The IKEA Effect: Why We Value What We Build” The IKEA Effect is a psychological phenomenon where people place higher value on products they partially create themselves. The name comes from IKEA, where customers assemble furniture — and end up lovin

See MoreSanskar

Keen Learner and Exp... • 1y

Rolex, we all have heard of this premium watch brand based in Geneva, Switzerland. But do you know that despite earning $11.4 billions in revenue and a profit of $1.1 billion it pays absolutely no taxes and is not actually a private company. Well Ro

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)