Back

Priyadarshi M

𝗦𝘁𝗮𝗿𝘁𝘂𝗽 𝗖𝗮�... • 4m

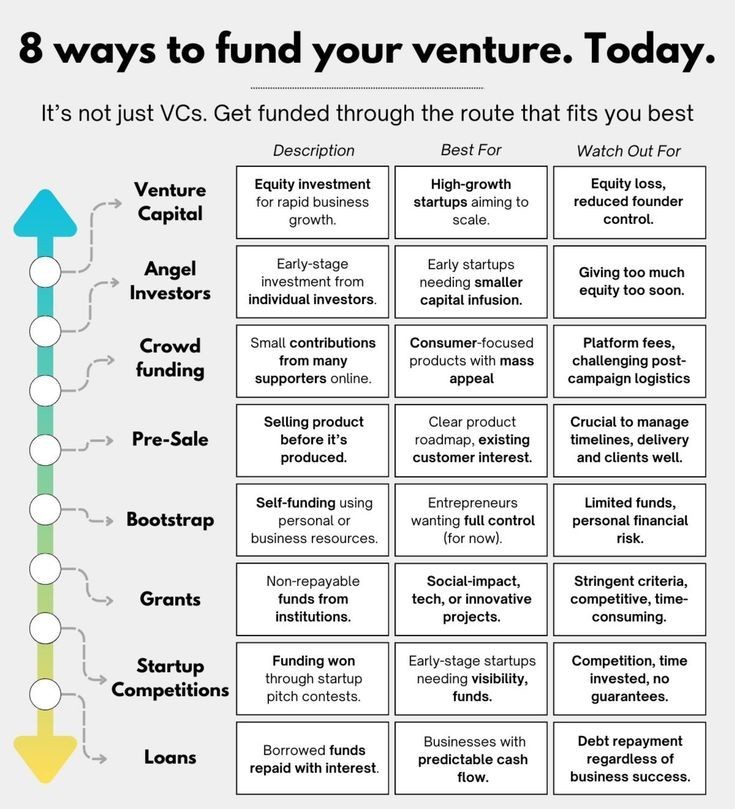

𝗟𝗼𝘀𝗶𝗻𝗴 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗕𝗲𝗳𝗼𝗿𝗲 𝗬𝗼𝘂 𝗚𝗿𝗼𝘄: 𝗧𝗵𝗲 𝗛𝗶𝗱𝗱𝗲𝗻 𝗙𝗼𝘂𝗻𝗱𝗲𝗿 𝗧𝗿𝗮𝗽 Many promising startups fail—not for lack of vision, but because founders surrender control too soon. In the scramble for funding, ownership is traded for survival, only for founders to lose their voice when it counts most. 𝗣𝗿𝗼𝗯𝗹𝗲𝗺: • Excessive seed-stage equity dilution. • Early investors wield outsized control, hampering future fundraising. • Limited financial foresight or mentorship in early negotiations. • Lowered team motivation and authority as founder shares dwindle. 𝗦𝗼𝗹𝘂𝘁𝗶𝗼𝗻𝘀: • Raise smaller, milestone-driven rounds. • Consider convertible notes or SAFE agreements early. • Maintain at least 60–70% founder equity through Series A. • Consult startup finance advisors before finalising deals. Protect your vision. Get expert guidance where founders grow without sacrificing control. DM for more clarity. #StartupStrategy #FounderEquity #JeetaaConsulting #SmartFunding #Entrepreneurship #InvestorRelations #StartupGrowth

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

We're actively seeking startups to established players, with flexible mandates designed for impact. * Early-Stage Catalyst: We provide the crucial first institutional check ($1-8 Crore for 8-18% equity) to visionary founders with early market tracti

See More

Aditya Malur

AI-Powered Product C... • 11m

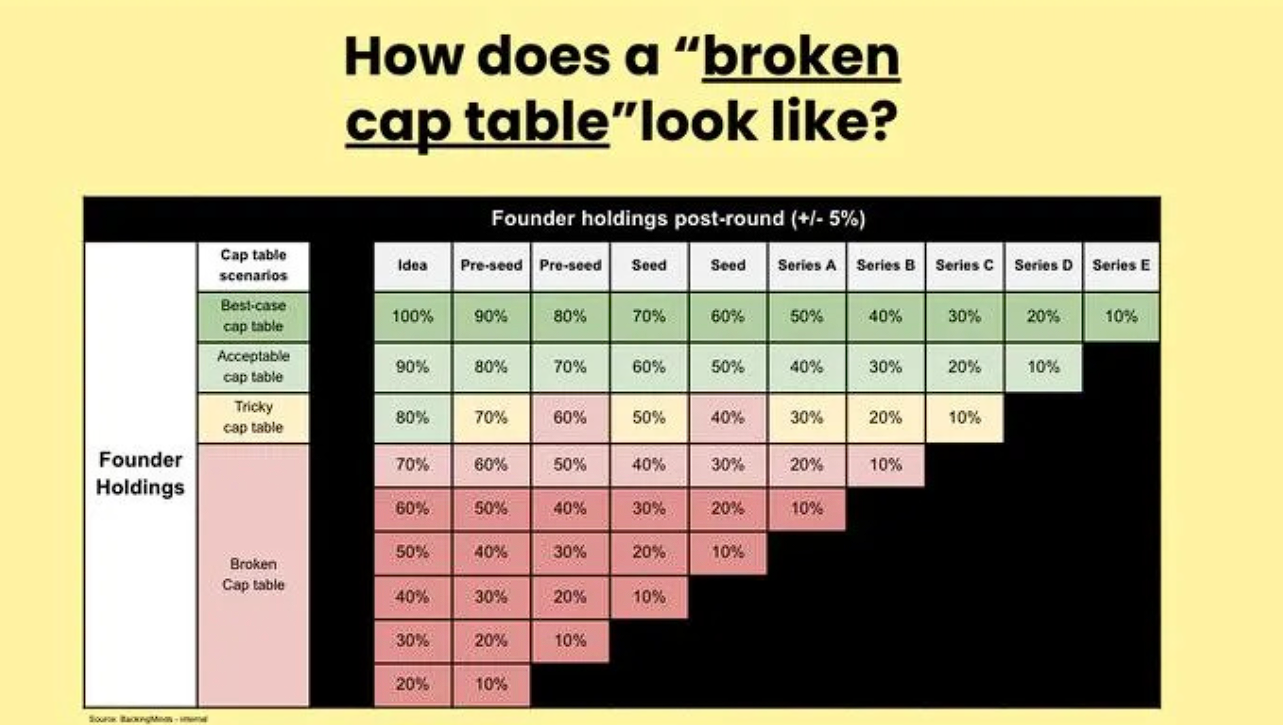

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob G

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)