Back

vishakha Jangir

•

Set2Score • 7m

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗕𝗼𝗼𝘁𝘀𝘁𝗿𝗮𝗽𝗽𝗶𝗻𝗴 𝗶𝗻 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀? Bootstrapping refers to starting and growing a business using only personal savings, cash flow from initial sales, or minimal external help. It means building a startup without relying on external investors like venture capitalists or angel investors, at least in the early stages. Key Features of Bootstrapping : The business is funded by the founder's own money or revenue from customers. Founders retain full ownership and control. Emphasis is on generating income early to support operations. Operations are run with frugality and financial discipline. All business decisions are made by the founders without investor involvement. Advantages of Bootstrapping : Full ownership stays with the founders. Founders have complete control over business decisions. Promotes sustainable growth and early focus on profitability. Encourages financial discipline and strategic thinking. Disadvantages of Bootstrapping : Limited capital can slow down product development or scaling. Higher personal financial risk for the founders. Limited capacity to handle market fluctuations or failures. Competing with well-funded startups can be challenging. Common Bootstrapping Methods : Using personal savings. Borrowing from friends and family without giving equity. Reinvesting profits from early sales. Working part-time jobs to fund the business. Using low-cost tools, free software, and shared resources. Examples of Bootstrapped Startups : Zoho – A SaaS company from India, built without external funding. Mailchimp – Built using internal revenue, sold for billions. UClean – Started with ₹20 lakh from founders before raising funds later. GitHub – Operated without VC funding in its early years. Follow me vishakha Jangir for more such business and insights.

Replies (1)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

Exploring Bootstrapping: Self-Funding Your Startup Hey everyone, Today, let’s dive into a popular and often underrated funding method—bootstrapping. This is when you start and grow your business using your own savings or the revenue generated by the

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

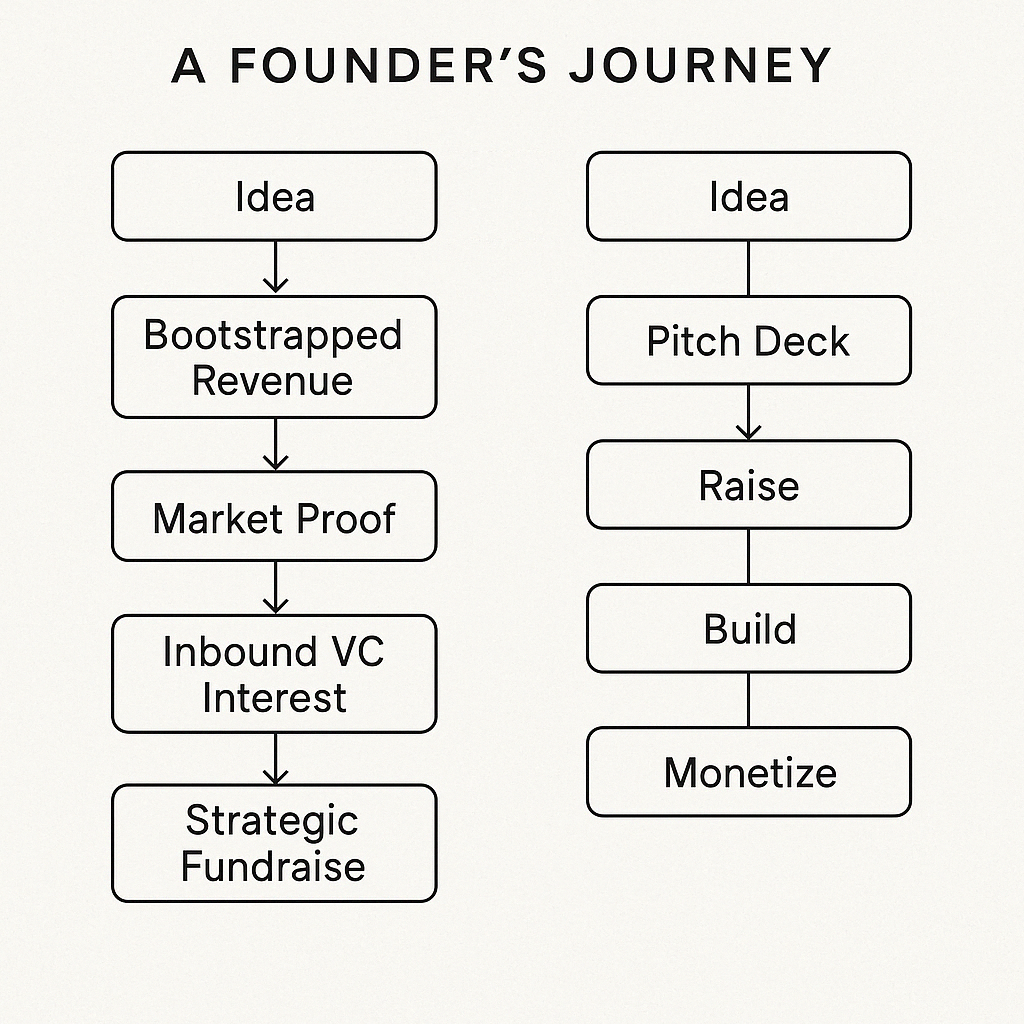

Should You Raise Fund or Bootstrap? Here’s a Reality Check Every founder faces this question: Should you raise external funding or bootstrap your startup? Both paths have pros and cons, and the right choice depends on your business goals, risk tol

See MoreSairaj Kadam

Student & Financial ... • 1y

Exploring the Easiest and Least Risky Funding Method for Startups When you're launching a startup, finding the right funding can be a daunting task. With so many options available, it’s crucial to choose a method that aligns with your business's nee

See MoreHemant Prajapati

•

Techsaga Corporations • 1y

Here are some of the most common sources of funds for early startup owners: 🏦 Personal Savings - Many founders invest their own money to get the business off the ground. 🏆 Bootstrapping - Generating revenue organically without external capital th

See More

Gangesh Rameshkumar

Figure it out • 8m

Term of the day: Bootstrapping Ever wondered if a company can scale big without external funding? That's exactly what a bootstrapped business tries to achieve! When an entrepreneur goes all in and tries to grow his company without any financial ass

See MoreVansh Khandelwal

Full Stack Web Devel... • 28d

Hexagonal Architecture (Ports and Adapters) isolates core business logic from external systems—UIs, databases, third‑party services—using ports (interfaces) and adapters (implementations). The framework‑agnostic domain improves maintainability, testa

See MoreVicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)