Back

Sairaj Kadam

Student & Financial ... • 1y

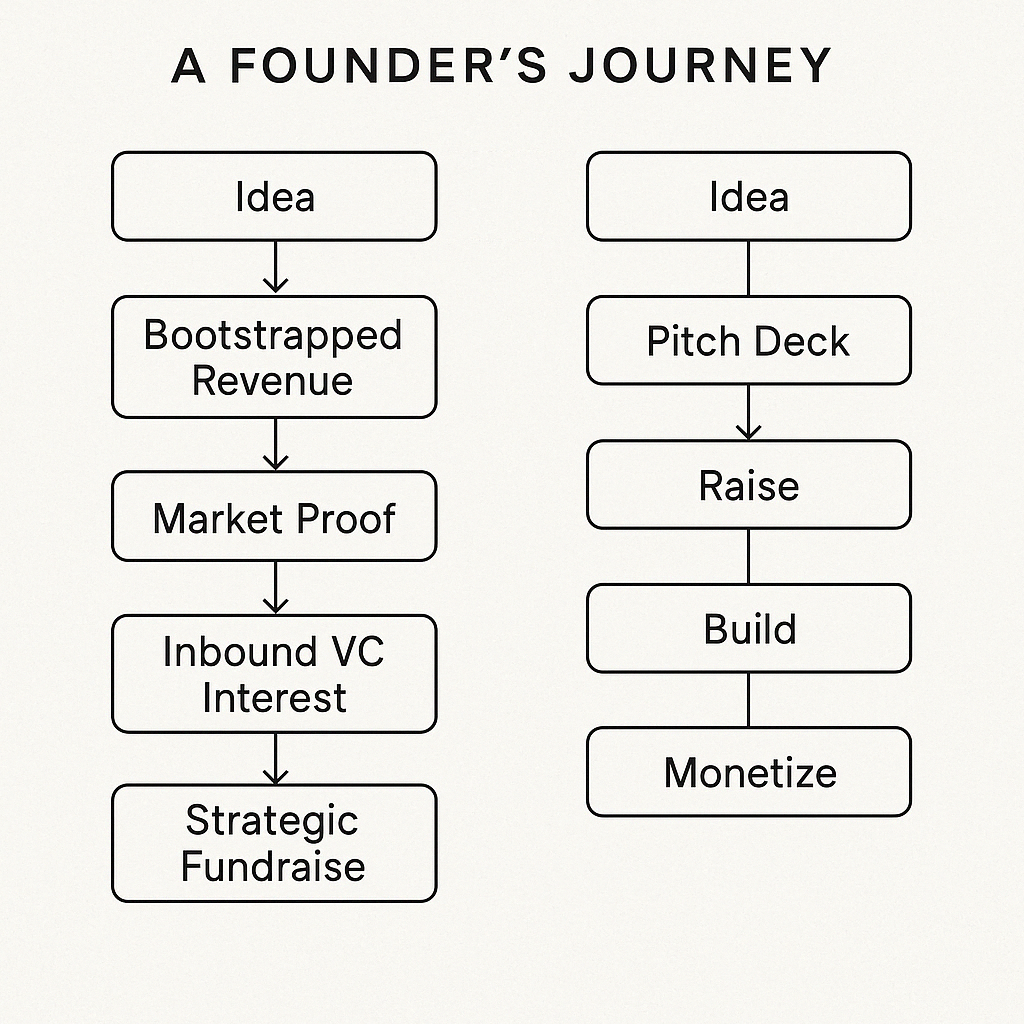

Exploring Bootstrapping: Self-Funding Your Startup Hey everyone, Today, let’s dive into a popular and often underrated funding method—bootstrapping. This is when you start and grow your business using your own savings or the revenue generated by the business itself, without relying on external funding sources like venture capital or loans. Why Consider Bootstrapping? Full Control: You maintain 100% ownership, making all decisions without investor influence, allowing you to stay true to your vision. No Debt: You don’t owe anyone money, which means less financial stress and no interest payments eating into your profits.Lean Operations: Limited funds push you to be resourceful, prioritize effectively, and build a stronger, more sustainable business model. Real-Life Example: Mailchimp, the email marketing powerhouse, was entirely bootstrapped. The founders started with just their own savings, carefully reinvesting profits to grow the company. Over time, Mailchimp became a multi-million dollar business, all without taking a single dime from investors. Is Bootstrapping Right for You? Bootstrapping isn’t easy and requires a lot of discipline, but if you value control, are comfortable with steady growth, and want to avoid debt, it could be a solid path forward. However, it’s crucial to evaluate your business goals, financial situation, and how much risk you’re willing to take on.Take some time today to consider whether bootstrapping aligns with your startup’s needs. If you’re unsure, think about your current resources and long-term goals. Could you make it work without external funding? Bootstrapping can be a daunting path for many entrepreneurs. One of the primary challenges is limited access to capital, which forces founders to be extremely resourceful and frugal. This often means juggling multiple roles, from marketing and sales to product development, with minimal external help. The lack of significant funding can also lead to slower growth, as the company may not have the necessary resources to scale quickly. Additionally, bootstrapped startups face high personal risk, as founders typically rely on their own savings or small revenue streams to keep the business afloat. This can create immense pressure to succeed and may limit the ability to take big, bold risks that could potentially lead to rapid expansion. Bootstrapping can be highly effective in certain situations. It is particularly well-suited for startups targeting niche markets, where the demand is strong but the need for rapid scaling is less critical. The ability to stay lean and focused can give a bootstrapped startup an edge over larger, less nimble competitors. Additionally, bootstrapping is often a perfect fit for service-based businesses like consulting or freelancing, In these scenarios, founders can maintain full control over their business while growing at a pace that aligns with their resources and market demand. That’s it for today! Kadam

Replies (1)

More like this

Recommendations from Medial

Vicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Sairaj Kadam

Student & Financial ... • 1y

Exploring the Easiest and Least Risky Funding Method for Startups When you're launching a startup, finding the right funding can be a daunting task. With so many options available, it’s crucial to choose a method that aligns with your business's nee

See MoreMehul Fanawala

•

The Clueless Company • 1y

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreMayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreGangesh Rameshkumar

Figure it out • 8m

Term of the day: Bootstrapping Ever wondered if a company can scale big without external funding? That's exactly what a bootstrapped business tries to achieve! When an entrepreneur goes all in and tries to grow his company without any financial ass

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)