Back

Sairaj Kadam

Student & Financial ... • 1y

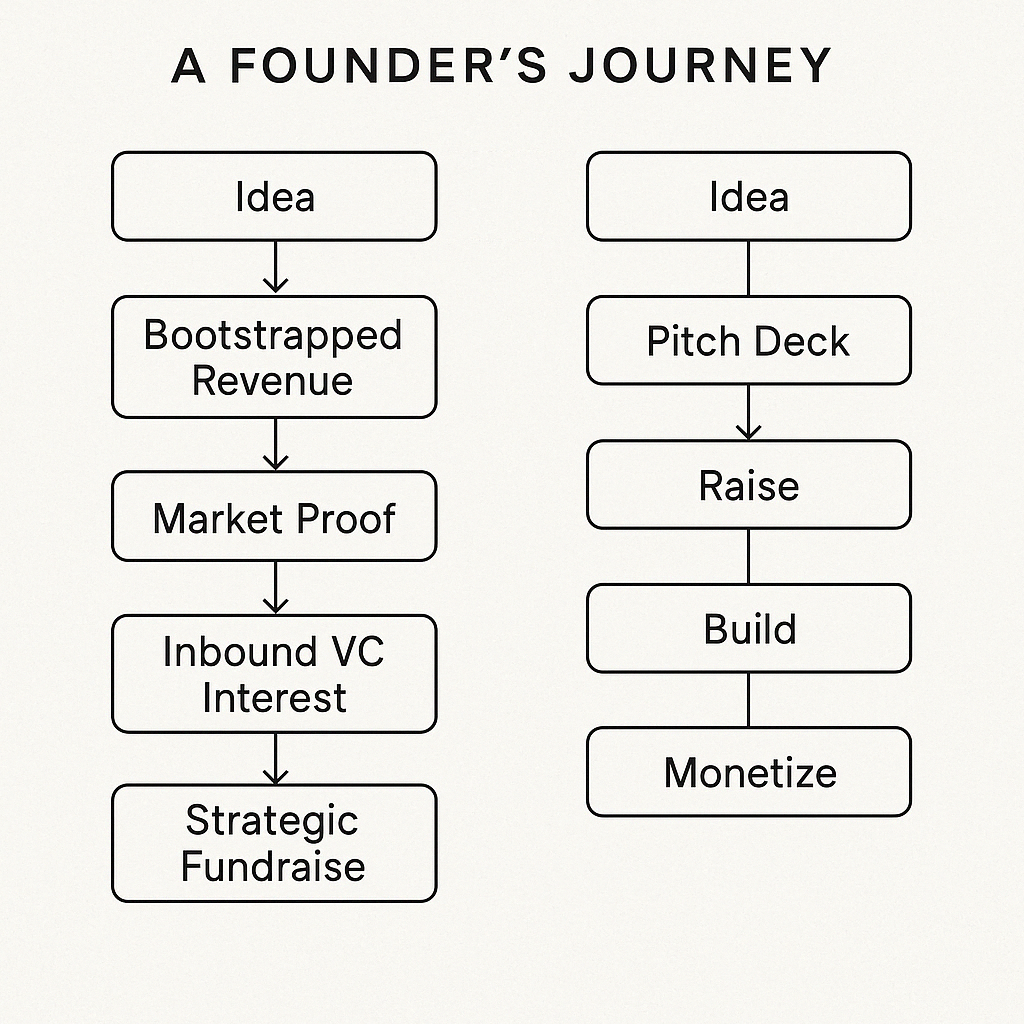

Exploring the Easiest and Least Risky Funding Method for Startups When you're launching a startup, finding the right funding can be a daunting task. With so many options available, it’s crucial to choose a method that aligns with your business's needs while minimizing risk. While every funding method comes with its own set of challenges, there is one that stands out as being relatively easier to obtain and less risky: Bootstrapping Why Bootstrapping? Bootstrapping involves using your own savings or revenue generated from your business to fund its growth. While this might not sound as glamorous as securing venture capital or landing a big loan, it offers several key advantages that make it an attractive option: 1. Full Control: Since you’re not relying on external investors or lenders, you maintain complete control over your business decisions. You don’t have to answer to anyone else or dilute your ownership. 2. No Debt: Bootstrapping allows you to grow your business without taking on debt. This means you don’t have to worry about repayments or interest rates, reducing financial stress. 3. Learning Opportunity: Because you’re working with limited resources, bootstrapping forces you to be resourceful and efficient. This experience can be invaluable as your business grows. The Downsides Of course, bootstrapping isn’t without its challenges. The main downside is that growth may be slower compared to startups that secure external funding. Without a large influx of cash, you might have to make sacrifices or delay expansion plans until your revenue can support it. Comparing to Other Funding Methods - Venture Capital (VC): While VC can provide large sums of money, it comes with high expectations for rapid growth and often requires giving up a significant portion of your company. - Angel Investors: Similar to VCs, but typically involve smaller amounts and more personal relationships. However, they still often demand equity and a say in business decisions. - Bank Loans: These require repayment with interest, which can be a burden if your business doesn’t generate sufficient revenue quickly enough. Final Thoughts While bootstrapping might not be the fastest way to scale, it’s a solid choice for founders who want to retain control and minimize financial risk. It allows you to grow at a pace that suits your business, without the pressure of external obligations. If you’re confident in your ability to generate revenue and manage costs, bootstrapping could be the easiest and least risky path to take. So, today we talked about the easiest and least risky funding method for startups, and that’s bootstrapping. No doubts about that—it gives you full control and avoids the pitfalls of debt or giving up equity. But what if you’re thinking about taking someone else’s money? If you're leaning towards external funding but still want to keep the risk relatively low, the best option would be Angel Investors. ~ Kadam

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreSairaj Kadam

Student & Financial ... • 1y

Exploring Bootstrapping: Self-Funding Your Startup Hey everyone, Today, let’s dive into a popular and often underrated funding method—bootstrapping. This is when you start and grow your business using your own savings or the revenue generated by the

See MoreAanya Vashishtha

Drafting Airtight Ag... • 11m

Should You Raise Fund or Bootstrap? Here’s a Reality Check Every founder faces this question: Should you raise external funding or bootstrap your startup? Both paths have pros and cons, and the right choice depends on your business goals, risk tol

See MoreVicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

PRATHAM

Experimenting On lea... • 1y

BOOTSTRAPPING BOOTSTRAPPING🤑💥 People are obsessed with BOOTSTRAPPING!, many think BOOTSTRAPPING is better because you get majority equity and no investors pressure. 👀 According to current situation of startup ecosystem, funding is better because

See MoreSairaj Kadam

Student & Financial ... • 1y

Don't you think that bootstrapping is much better than taking a fund? But, still why is everyone leaning towards funding rather than bootstrapping? From my understanding, people have fear, lack of resources, and validation. What is your opinion? P

See MoreMehul Fanawala

•

The Clueless Company • 1y

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

Scaling a business is a balancing act — especially between bootstrapping and fundraising. Bootstrapping fosters discipline, control, and a lean mindset, while fundraising can inject the capital needed to accelerate growth. The smartest path? One that

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)