Back

PRATHAM

Experimenting On lea... • 1y

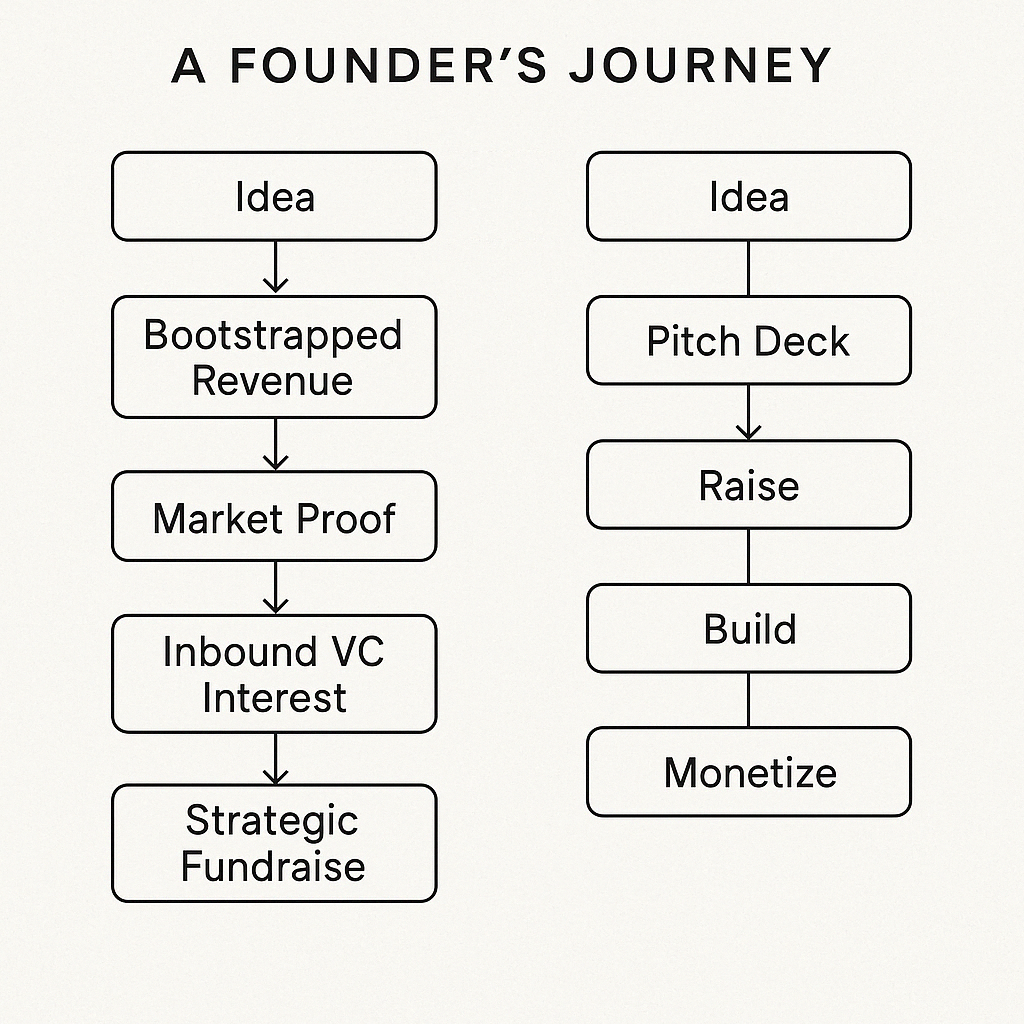

BOOTSTRAPPING BOOTSTRAPPING🤑💥 People are obsessed with BOOTSTRAPPING!, many think BOOTSTRAPPING is better because you get majority equity and no investors pressure. 👀 According to current situation of startup ecosystem, funding is better because when you get good funds you can compete with competitions or create market and do scaling better. You get investors pressure which in somewhat is good and bad. It's up to you what you think about. Main problem with bootstrapping is that you would have less funds unless you are rich enough, in funding you will have decent amount of funds ( depends on business and sector ). I am not saying bootstrapping is bad, if you can bootstrap confidently then do it.🤌 OpenAi had one of the best product ( ChatGPT ) they still took funding because they knew the competition and the money needed for RnD, tech and product building. So if such business with such amazing product needs funding then think yourself, is bootstrapping even possible now ❓

Replies (22)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

Don't you think that bootstrapping is much better than taking a fund? But, still why is everyone leaning towards funding rather than bootstrapping? From my understanding, people have fear, lack of resources, and validation. What is your opinion? P

See MoreVicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Mayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreAdithya Pappala

250Tn Global Impact Ventures • 3m

Most founders can't raise funds not because.... -bad product -bad sales -bad team but because they go to wrong dates. Yes! they meet wrong VCs. If you are a pre-revenue startup,Read this! "Pitching 25 seed-VCs is much more better than pitching t

See MoreMehul Fanawala

•

The Clueless Company • 1y

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreAanya Vashishtha

Drafting Airtight Ag... • 11m

"Should You Raise Funds or Bootstrap? Here’s a Reality Check." Raising funds sounds glamorous—big checks, investor clout, fast growth. But it’s a trade-off. You get cash but lose equity and often control; investors expect results, not excuses.

See MoreSairaj Kadam

Student & Financial ... • 1y

Exploring Bootstrapping: Self-Funding Your Startup Hey everyone, Today, let’s dive into a popular and often underrated funding method—bootstrapping. This is when you start and grow your business using your own savings or the revenue generated by the

See MoreVikas Acharya

Building Reviv | Ent... • 1y

Do You Really Need Investors? Maybe Not! Fundraising vs. Bootstrapping – What’s Right for You? Bootstrapping (Pros & Cons) ✅ Full control ✅ No pressure from investors ❌ Slower growth Example: Mailchimp, Zoho, Basecamp – all built without investors

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)