Back

SamCtrlPlusAltMan

•

OpenAI • 6m

Meaning that you must have a higher than usual risk appetite. Leverage it, I think 20s should be heavily experience enriched and risk filled too.

Replies (1)

More like this

Recommendations from Medial

Suman solopreneur

Exploring peace of m... • 1y

naval ravikant Earn with your mind, not your time – focus on skills that provide leverage rather than just working for hourly wages. Higher leverage comes with more accountability – moving from labor to management, investment, and entrepreneurship

See Morefinancialnews

Founder And CEO Of F... • 1y

"How to Build ₹5 Crore in 20 Years: Top Mutual Fund Schemes to Consider" How to Build ₹5 Crore in 15-20 Years: Best Mutual Fund Investment Strategy If you aim to accumulate ₹5 crore in 15-20 years, it’s crucial to choose the right mutual fund schem

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

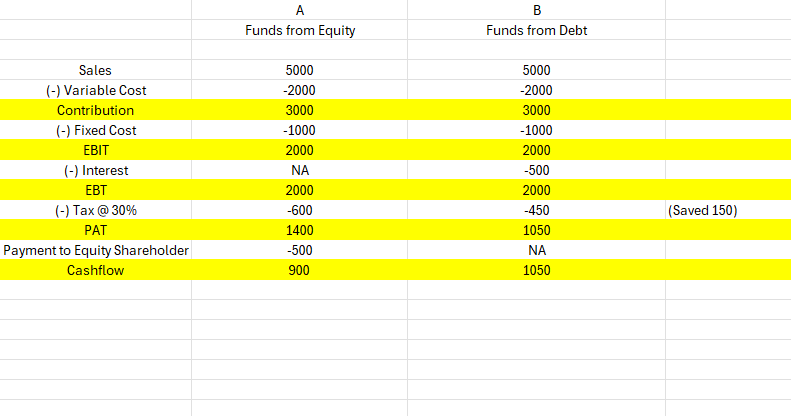

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Shreeya

GTM, Strategy & BizO... • 1y

For anyone in their early 20s, still navigating career choices, this article is a must-read. Having spent a decade building companies—I’ve seen firsthand how the nature of opportunity is shifting. The traditional path of steady corporate growth is n

See MoreAashna Agrawal

Specialist in Talent... • 1y

These days I’ve been wondering quite a bit about how entrepreneurial studies in universities have taken a flight. Not sure how useful they are - of course this comes with very little knowledge wrt their courses, but isn’t entrepreneurship a mindset

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Anugrah

Exceptional 1 : Foun... • 10m

Brain Breaking Thoughts DAY-6! What’s the biggest risk you can take in your 20s? 🌱 Is it betting on yourself with a big leap, or playing it safe and sticking to what you know? Some say taking big risks early is the only way to grow fast, while othe

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Why Private Funding is a Tougher Nut to Crack Than a Bank Loan Often, private funding proves harder to get than a traditional bank loan. Banks are risk-averse and highly regulated, relying on excellent credit, established history, and collateral. Thi

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)