Back

VIJAY PANJWANI

Learning is a key to... • 21d

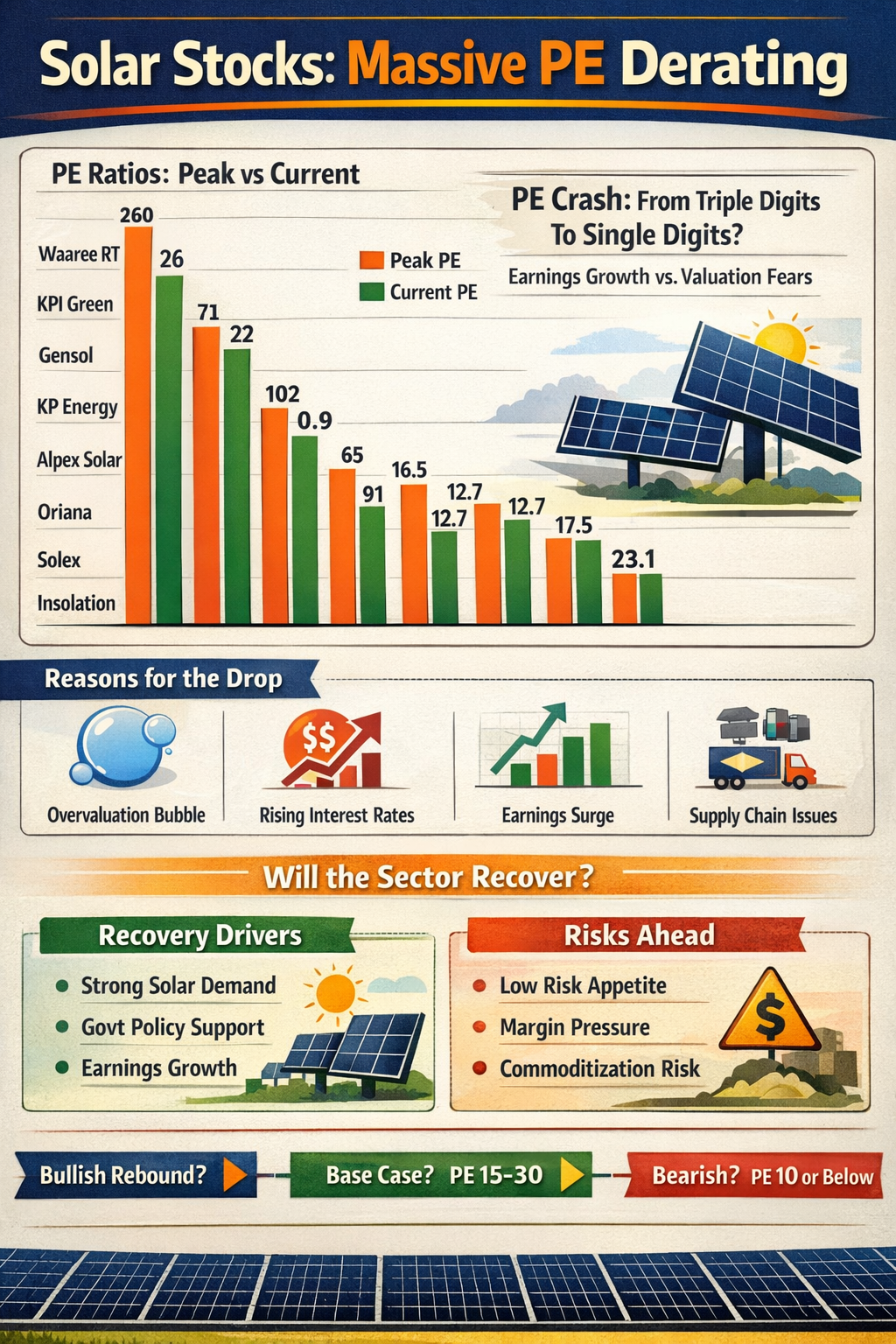

Solar Stocks: Massive PE Derating – What’s Really Happening? Many solar stocks have seen sharp PE contraction — from triple-digit valuations to much more reasonable levels. This doesn’t automatically mean the sector is weak. It reflects a reset from excessive optimism to realistic expectations. 📉 Why did PEs fall? • Over-valuation during the hype phase • Higher interest rates • Supply chain & margin pressure • Market preference shifting to profitability 📈 What can drive recovery? • Strong long-term solar demand • Government policy support • Earnings catching up with valuations ⚠️ Still watch out for: • Margin pressure • Commoditization risk • Overall risk appetite in the market 🔍 The key question now isn’t “How much has fallen?” It’s “Which companies can grow earnings from here?” 💬 What’s your view — recovery ahead or more consolidation? ⚠️ For educational purposes only. Not investment advice.

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 4m

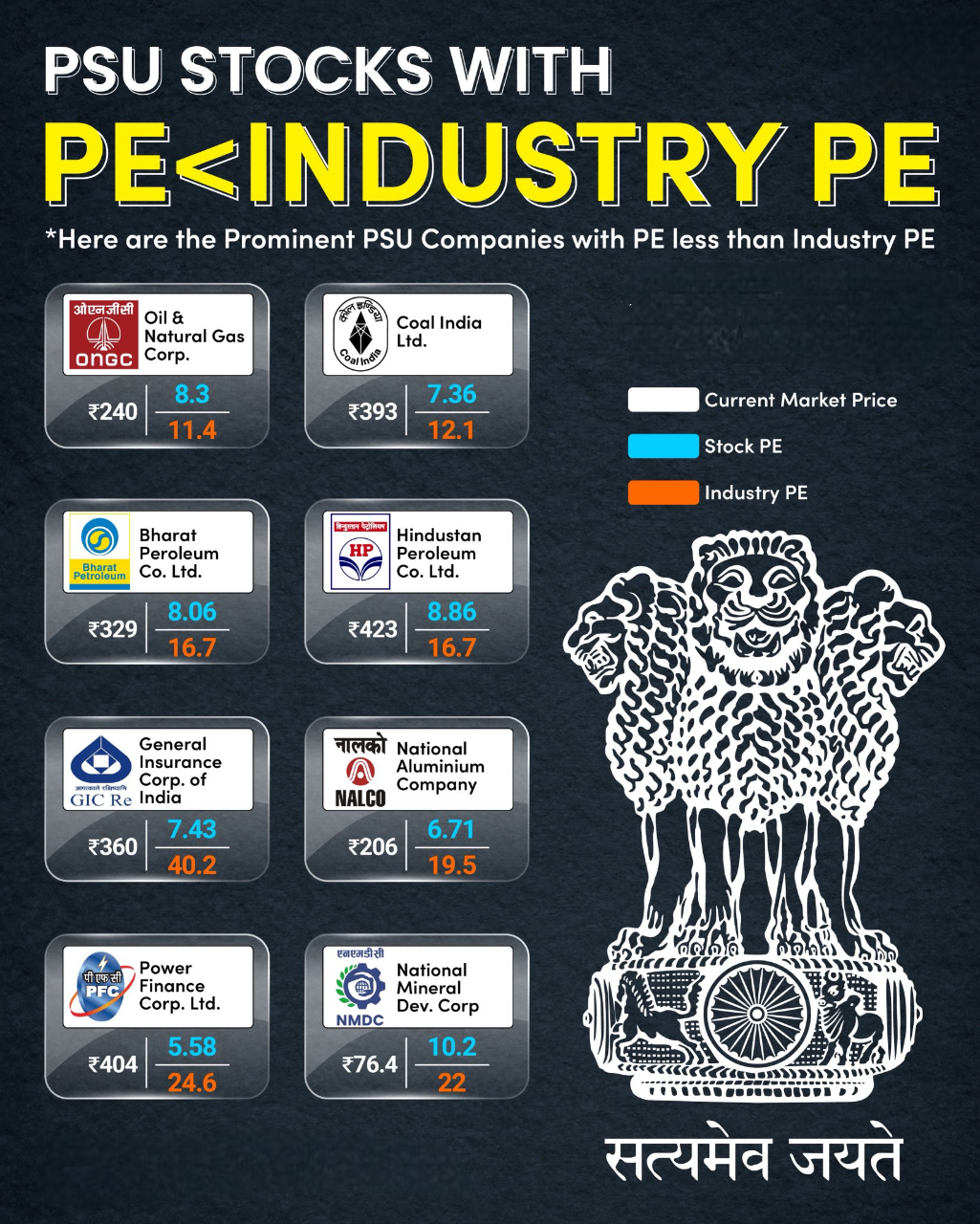

PSU Stocks with PE < Industry PE In the current market, valuation matters more than ever. One strong indicator is the Price-to-Earnings (PE) ratio. When a company’s PE is below the industry average, it can signal undervaluation and opportunity for i

See More

financialnews

Founder And CEO Of F... • 1y

“Nifty Smallcap Stocks: 50% Trading 20-42% Below 52-Week Highs – Investor Strategies” “Dalal Street Small-Cap Stocks: Investor Interest Wanes Amid Weak Earnings, Geopolitical Tensions, and Profit-Taking” Investor interest in small-cap stocks on Dala

See More

financialnews

Founder And CEO Of F... • 1y

"Nifty Smallcap 100 Drops 3.5%: 17 Stocks Plunge Over 5%" The Nifty SmallCap 100 index saw a sharp decline of 3.5% in today’s intraday trade, dropping below the 18,200 mark to 18,149. This is the lowest level for the index since mid-August, reflecti

See MoreRohan Saha

Founder - Burn Inves... • 1y

The Indian stock market has declined rapidly, but the market's PE ratio hasn't dropped as quickly. The reason behind this is the earnings not being as good. There is still some downside risk in the market. If an FTA (Free Trade Agreement) happens bet

See MoreAryan patil

Intern at YourStory ... • 1y

SEBI warned ⚠️ investors about Stock market bubble is about to burst anytime soon 📉 because The price-to-book (P/B) ratio of the Nifty Midcap 150 index is 4.26, and the Nifty Midcap 50 index has a P/B ratio of 3.64 This Means valuations of the Mid/s

See MoreRohan Saha

Founder - Burn Inves... • 6m

The market seems to be facing strong selling pressure going into next week Interestingly it is mostly retail investors who are selling possibly even more aggressively than FIIs based on the latest FII and DII data the market usually does not drop thi

See More

Download the medial app to read full posts, comements and news.