Back

Rohan Saha

Founder - Burn Inves... • 1y

The Indian stock market has declined rapidly, but the market's PE ratio hasn't dropped as quickly. The reason behind this is the earnings not being as good. There is still some downside risk in the market. If an FTA (Free Trade Agreement) happens between India and the USA, we might see a good rally in the market. However, without good earnings, the market won't sustain its gains in the long run.

Replies (6)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

From today's market behavior, it's clear that the Indian market is currently more focused on earnings rather than any global factors. A good rally or even a healthy sideways movement might occur, which could bring more confidence from a technical lev

See MoreRohan Saha

Founder - Burn Inves... • 1y

I think the RBI might consider another rate cut in the upcoming days to match growth. As for the stock market's fall, India needs three things: strong earnings, good GDP growth, and a strong rupee. Currently, market sentiment is shifting back towards

See MoreRohan Saha

Founder - Burn Inves... • 1y

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreRohan Saha

Founder - Burn Inves... • 7m

Zomato PE ratio has reached around 994 in the Indian market I mean can you even imagine? The company valuation still does not look worth buying yet people are investing in it what I keep thinking is how badly is this one stock affecting the Nifty? A

See MoreRohan Saha

Founder - Burn Inves... • 10m

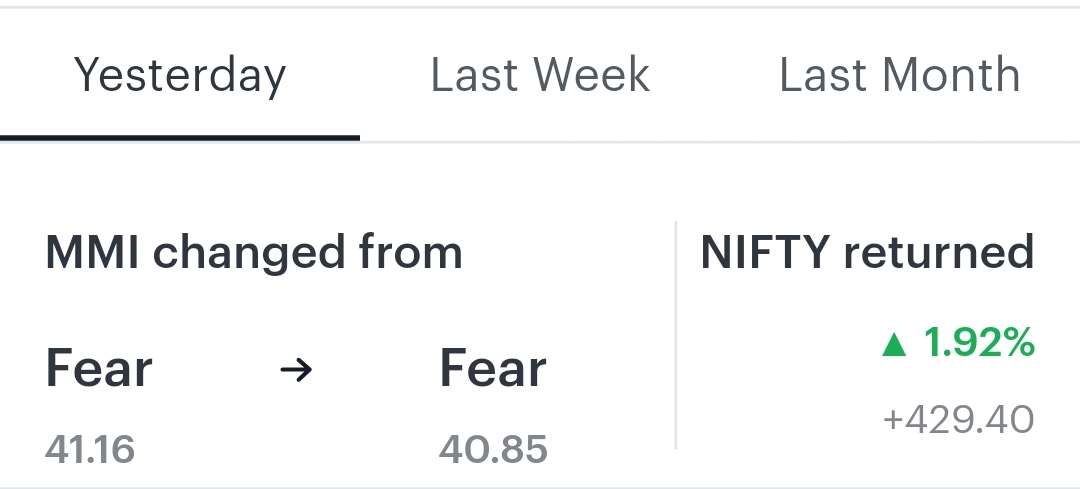

Nifty50 was up by 1.92% last Friday, but despite that, the MMI index has dropped from 41 to 40. This is still a positive sign. Currently, the market's complete focus will shift from tariffs to the earnings of Indian companies. TCS’s results haven’t b

See More

VIJAY PANJWANI

Learning is a key to... • 2m

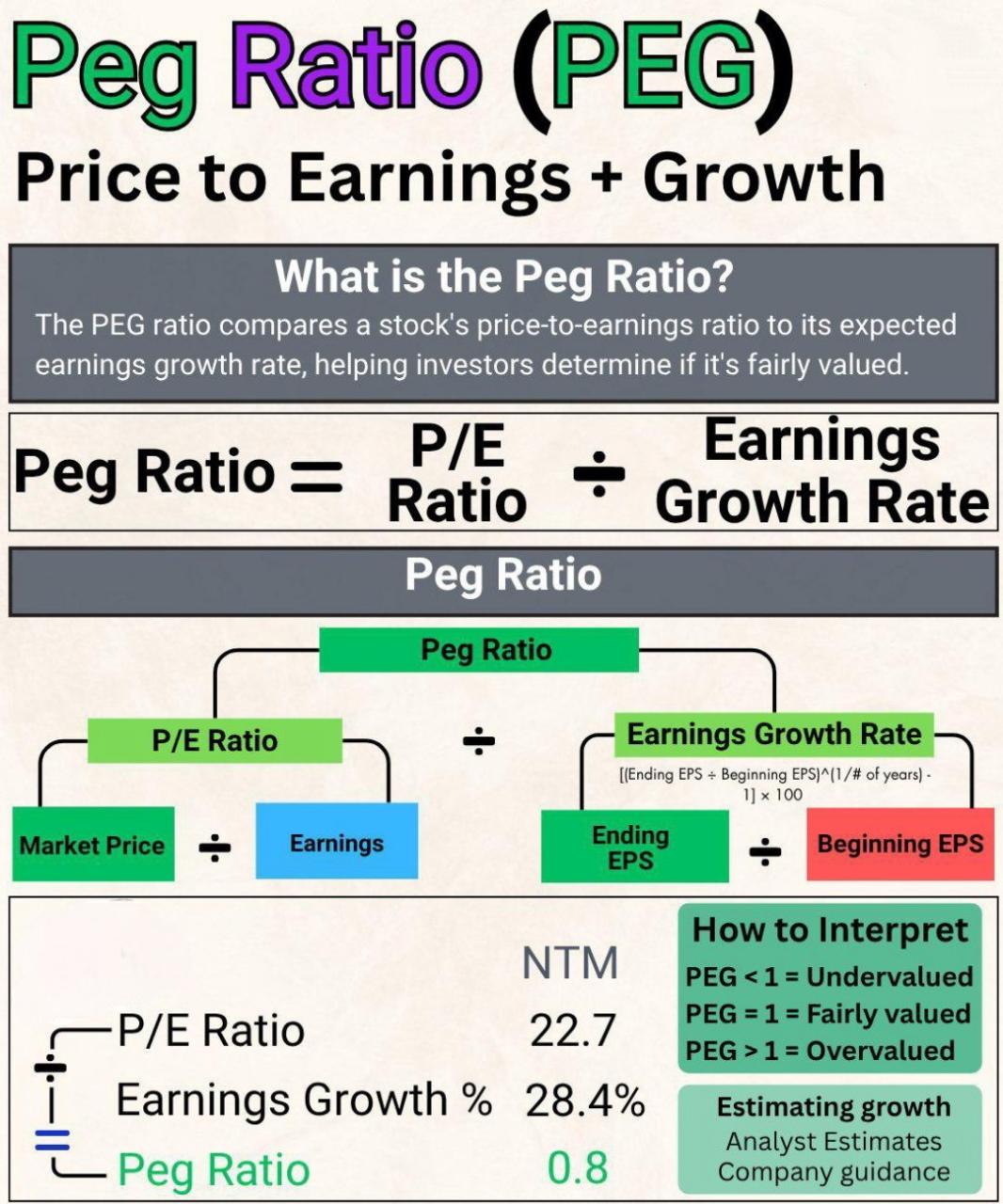

PEG Ratio Explained in 30 Seconds! Want to know if a stock is undervalued or overvalued? Use the PEG Ratio one of the smartest tools used by pro investors! 🧮 Formula: PEG = P/E Ratio ÷ Earnings Growth Rate ✅ PEG < 1 = Undervalued ⚖️ PEG = 1 = Fai

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)