Back

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

Earnings Post Market - 13-05-2025 1) Tata Motors - Mix 2) Bharti Airtel - Above Estimate 3) GSK Pharma - Good 4) Manali Petro - Good 5) Syrma SGS - Good 6) Garden Reach - Good 7) Alembic - Flat 8) Suven Life - Weak 9) VIP Ind - Weak 10) AB Cap - Yo

See MoreRohan Saha

Founder - Burn Inves... • 6m

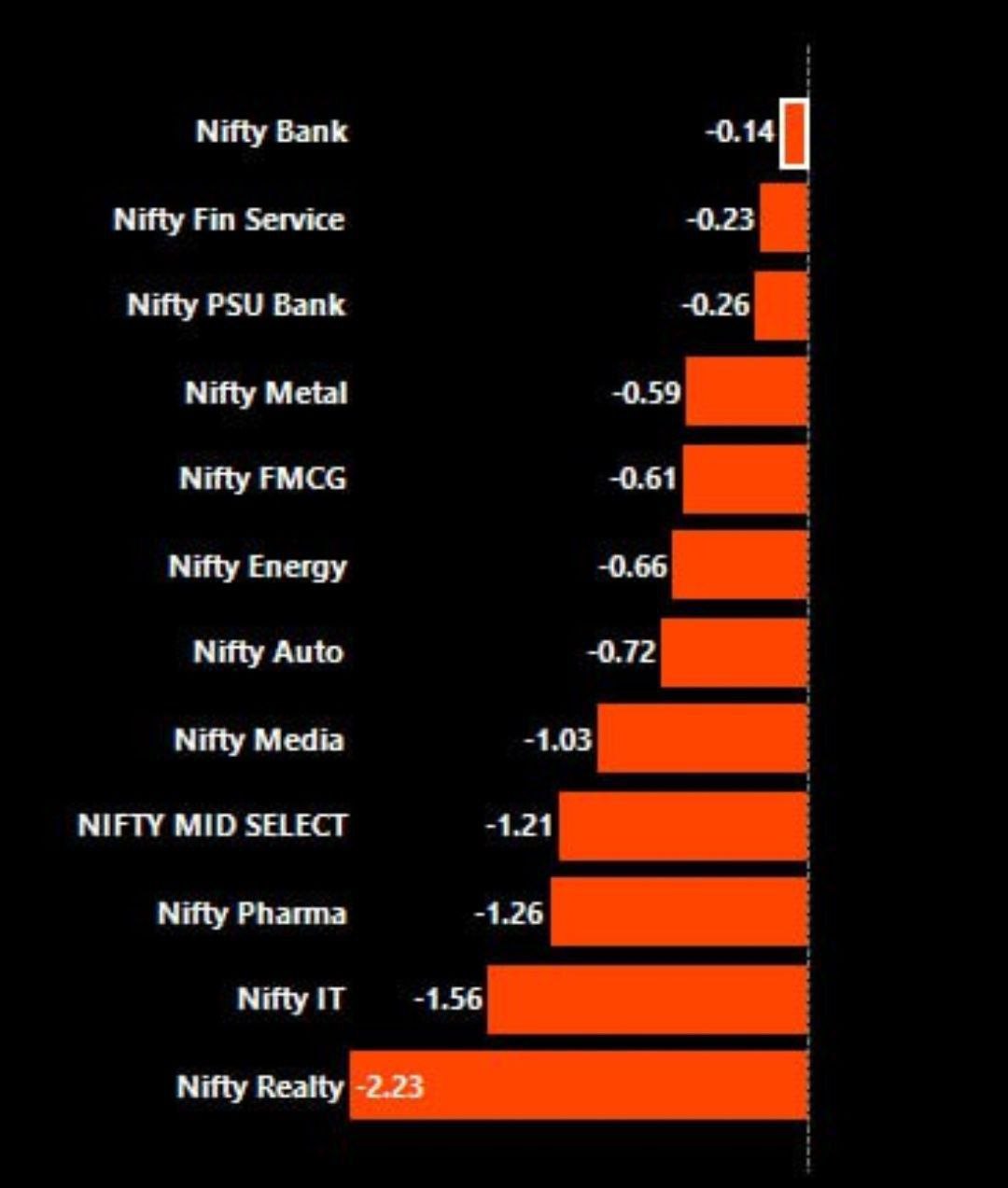

Right now these sudden ups and downs in the market are pretty normal since it’s still confused by tariffs and weak earnings If Indian companies had posted strong results there would have been some hope for the market to hold its ground but at this po

See Morefinancialnews

Founder And CEO Of F... • 1y

Stocks market today: Sensex, Nifty 50 crash 1% each; what is driving the market down? Explained with 5 factors 1. The Adani saga 2. Concerns over weak Q2 earnings 3. Escalating geopolitical tensions 4. Heavy foreign capital outflow 5. Technical

See MoreRohan Saha

Founder - Burn Inves... • 7m

Honestly this earnings season I think most companies except for some in tech and banking could actually post pretty decent results. Tech might take a slight hit because of weak demand but sectors like FMCG, infrastructure, defence etc seem well posit

See MorePrabhjot Singh

Final Year College S... • 9m

🚨 ₹21,000 Crore to Creators. And Counting. YouTube just revealed it paid over ₹21,000 Cr to Indian creators in 3 years — and it’s investing ₹850 Cr more. India is no longer just a consumer of content — we’re a Creator Nation. But I feel like some

See MoreDownload the medial app to read full posts, comements and news.