Back

Poosarla Sai Karthik

Tech guy with a busi... • 6m

90% of Indians earn less than ₹25,000 a month, according to the World Inequality Database. A ₹50,000 minimum balance means the average person must keep almost two months of income locked in their account or pay a fee. For those with tight budgets, this is not just inconvenient, it excludes them from fair access to banking. It leaves millions underbanked or dependent on informal options. While serving low-balance accounts may cost more physically, digital banking can cut costs and make zero or low-balance accounts viable. If banks do not adapt, fintechs will-and they will gain both market share and trust. Banking should work for everyone, not just the highest earners.

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 7m

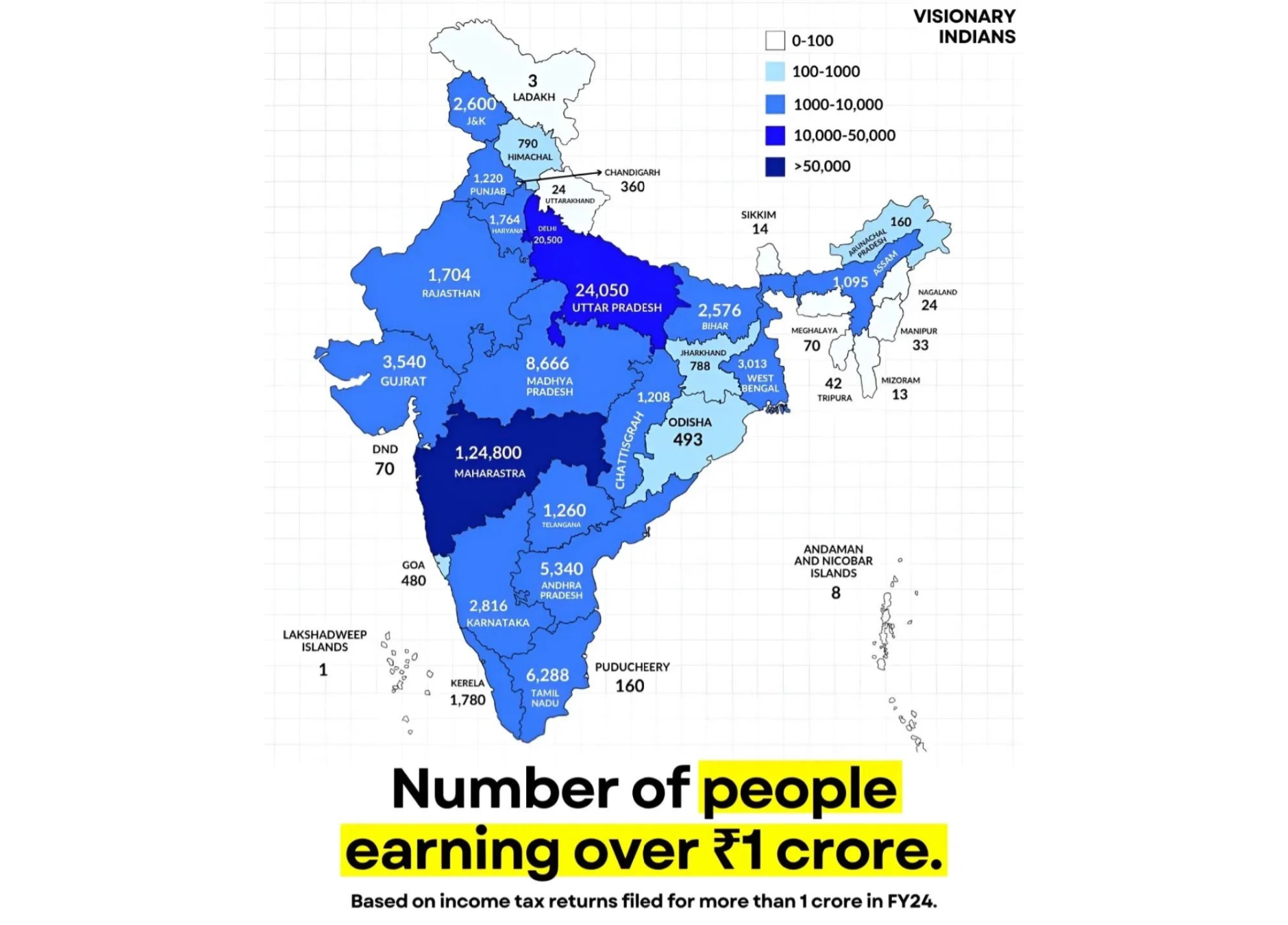

How Many Indians Actually Earn Over ₹1 Crore a Year? The Number Might Shock You. 💬 With a population of over 140 crore, you'd expect lakhs of crore plus earners in India. But the real number is surprisingly low. What does this say about income ineq

See More

Gituparna Sarma

Co-founding Entrepre... • 1y

SBI BANKING is a Mess 😮💨 What you think about SBI current accounts man, those are some really unprofessional staff ? they only care about their targets and not a thing for Their customers. what's funny that SBI so-called crf complaint Portal

See MoreRohan Saha

Founder - Burn Inves... • 1y

In the last few years, the returns from the Indian banking sector have not been very impressive. The PE ratio and PB ratio are all below their averages. Currently, the results of HDFC Bank and Kotak Mahindra Bank will decide whether banking stocks or

See MoreSubhadeep Choudhuri

Full Stack Developer... • 10m

Rethinking 2FA: Is There a Better Way? Tried logging into Axis Bank’s Internet Banking lately? Here’s the flow: 1. Go to their website – you need an OTP. 2. But the OTP isn’t sent via SMS. 3. You have to log into their mobile app (via MPIN) to g

See MoreVikas Acharya

Building Reviv | Ent... • 1y

Modern banking tech company" ZETA" announced it has secured a $50 million investment from a strategic investor valuing it at $2 billion. However, the SaaS company did not reveal the investor’s name. Zeta became a unicorn in May 2021 after a $250 m

See More

Account Deleted

Hey I am on Medial • 1y

Introducing Sahith Fintech SFI Pvt: Revolutionizing Merchant Finance Why We Started The Unorganized Sector In India, many merchants struggle with: Access to Credit: Traditional banking systems often have stringent requirements, making it difficult

See More

Suprodip Bhattacharya

Entrepreneur || Star... • 1y

I don’t know how is it I want suggestions and constructive criticism..Give me solution not the negative criticism .Idea: We know about neo banking like 24*7 banking online.They provide it by partnering with bank like jupiter,fi money parnered With FE

See MoreRahul Das

Product and analytic... • 1y

Many coffee shops with great coffee didn't succeed like Starbucks. The reason? "It was never about coffee." Howard Schultz transformed Starbucks into a multi-billion dollar empire, inspired by Italian coffee shops' customer experience. After buying

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)