Back

Account Deleted

Hey I am on Medial • 1y

Introducing Sahith Fintech SFI Pvt: Revolutionizing Merchant Finance Why We Started The Unorganized Sector In India, many merchants struggle with: Access to Credit: Traditional banking systems often have stringent requirements, making it difficult for merchants to secure loans. The Problem Merchants need a streamlined, integrated solution to manage their finances efficiently. The current system is fragmented, leading to operational inefficiencies, financial stress, and stunted business growth. Key Features: Zero Balance Current Accounts: Providing greater financial flexibility. Personalized Financial Products: Loans and credit cards tailored to individual business needs. Secure and Transparent: Ensuring all transactions are safe and clearly Real-Time Insights: Helping merchants make informed financial decisions. please do comment you opinion on my startup and give me your valuable suggestions on my startup idea we have already started building so we need you support and love

Replies (13)

More like this

Recommendations from Medial

Rohtash kumar

Hey I am on Medial • 1y

Looking for hassle-free loans and financial solutions? Andromeda, India's largest loan distributor, offers a wide range of services including home loans, personal loans, business loans, insurance, and more. Trusted by millions for all your financial

See More

aaquib mahfooz

Being innovative • 1y

i have idea of creating an online platform that connects lenders directly with borrowers is similar to peer-to-peer lending (P2P lending). P2P lending has become popular in recent years as an alternative to traditional banking and NBFC loans. To mak

See MoreTushar Aher Patil

Trying to do better • 1y

Day 9 About Basic Finance and Accounting Concepts Here's Some New Concepts 2. Non-Current (Long-Term) Liabilities Non-current liabilities are long-term debts that are due beyond one year. These are generally used to fund large purchases or investme

See More

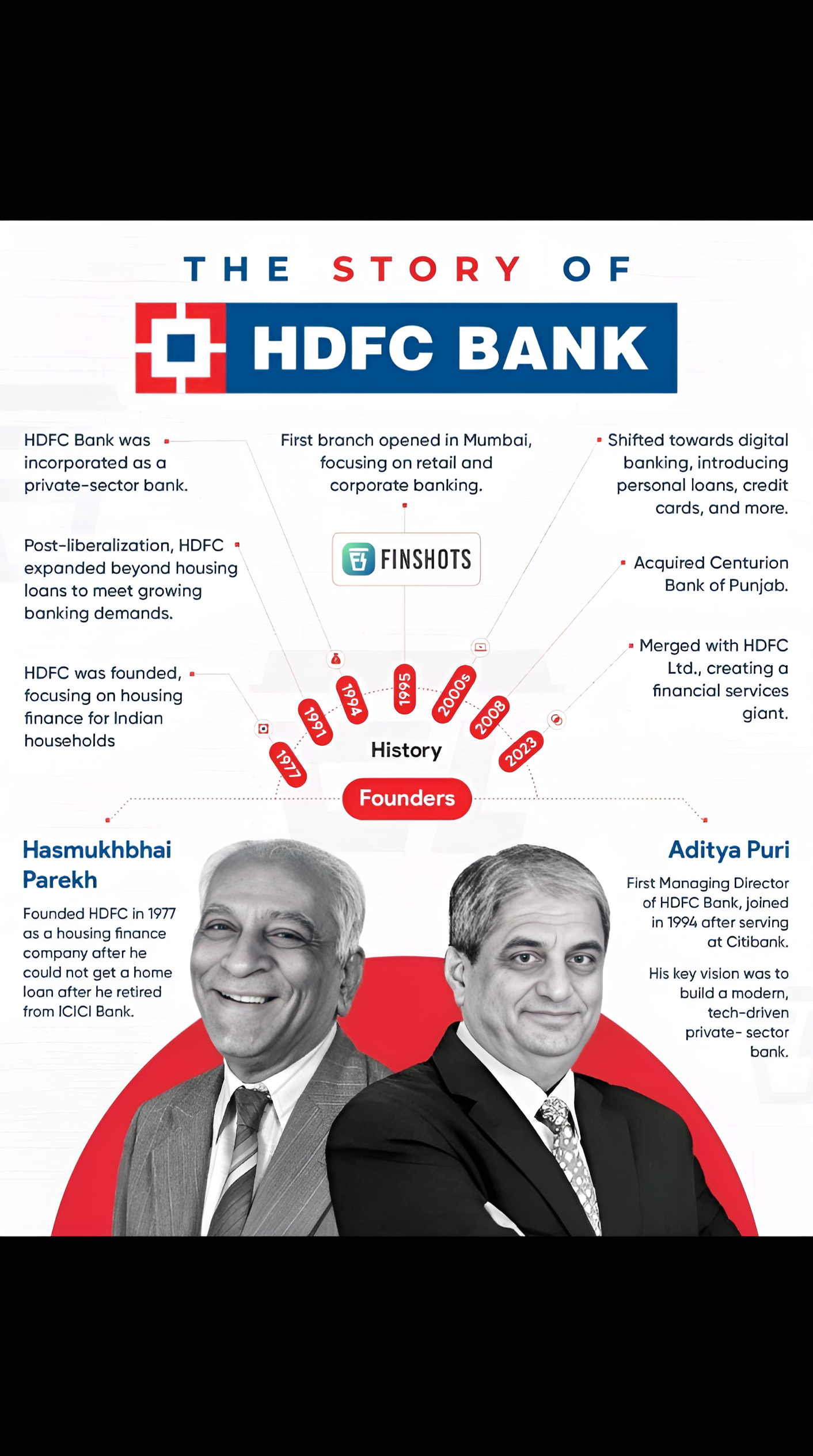

Yash Barnwal

Gareeb Investor • 1y

🏦 The Story of HDFC Bank 📈 Founded by Hasmukhbhai Parekh in 1977, HDFC Bank started as a housing finance company and grew into a leading private-sector bank. Under the leadership of Aditya Puri, who joined in 1994, the bank expanded into retail and

See More

advaidh prasad

CEO & Co-founder of ... • 1y

"Seeking Solutions: Addressing Credit Challenges in the HORECA Industry 🍽️ Facing sudden customer vanishings and navigating the unorganized sector has posed significant credit challenges for our HORECA business. How can we strategize and resolve cr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)