Back

Vaibhav Gupta

Lifelong Learner • 1y

UPI's Credit Revolution CIBIL is at the forefront of credit scoring in India, but the potential integration of UPI transaction data could dramatically transform how financial worthiness is evaluated. Imagine financial institutions using insights from declined transactions due to insufficient funds, types of merchants, and transaction locations to make more informed lending decisions. Similarly, insurance companies could analyze spending patterns—like frequent purchases of cigarettes through UPI—to adjust health-related premiums accordingly. This innovative approach could vastly improve the precision of credit and insurance assessments, but it's still in the early stages and not without its challenges. Chief among these is the issue of data privacy. As we move towards a system that can utilize such detailed personal spending data, the key question remains: Are consumers comfortable with their everyday purchases being closely monitored for financial profiling? What do you think🤔 🤔?

More like this

Recommendations from Medial

AjayEdupuganti

I like software and ... • 1y

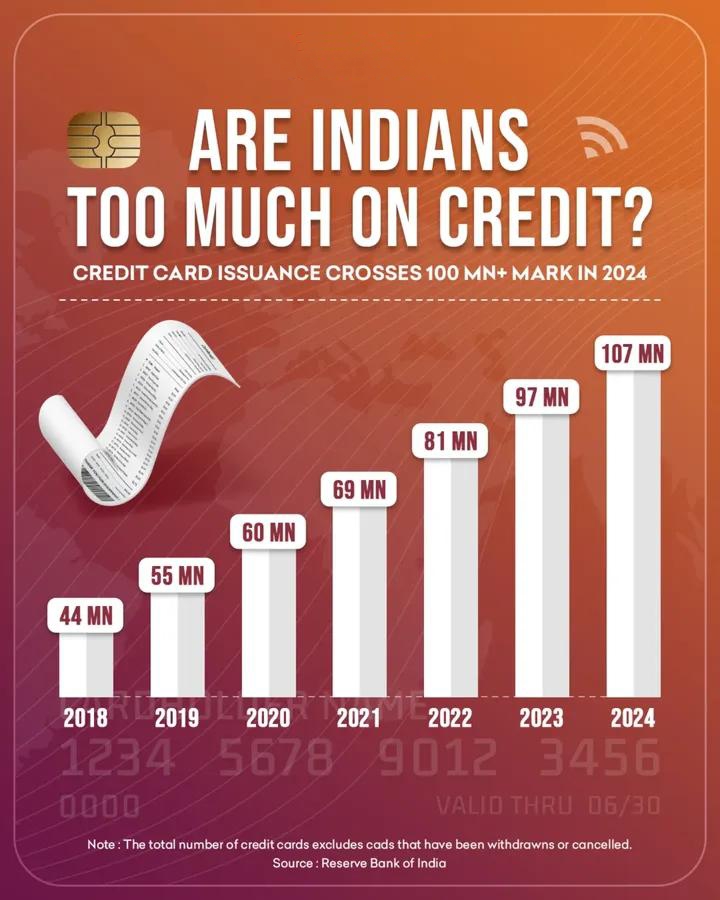

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)