Back

NomiPe

Next-Gen Money for t... • 7m

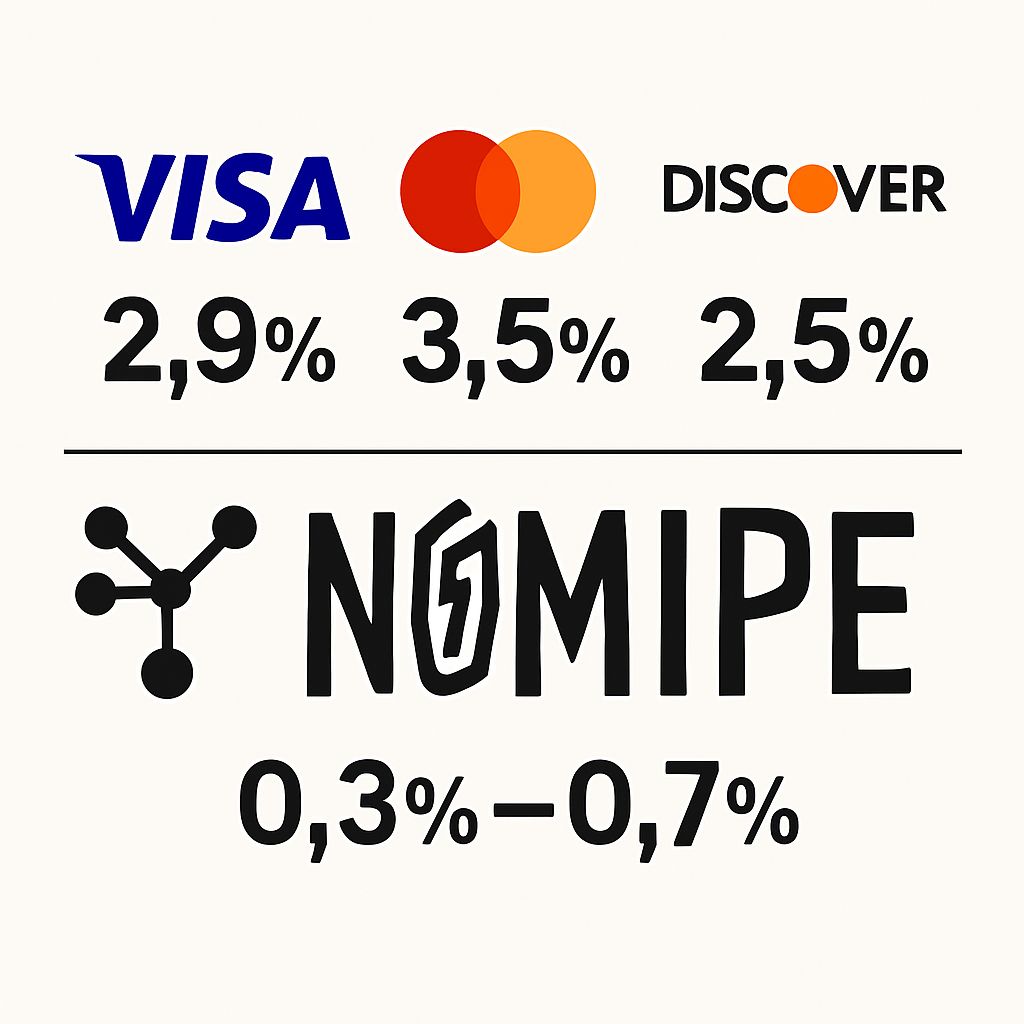

💸 Only 0.3% to 0.7% transaction fees! 🔐 Ultra-secure | UPI Vibes | No Cashout Needed 🌐 Use like digital cash – across apps, games, and global purchases 👉 Launching Soon!

More like this

Recommendations from Medial

Swamy Gadila

Founder of Friday AI • 6m

🚀 Should India Start Charging Fees for High-Value UPI Transactions? UPI is a world-class digital payments system — fast, free, and inclusive. But there's a hidden cost: 💸 Infra cost of ₹0.10–₹0.30 per transaction 🏦 Over ₹1,000 crore/month just t

See MoreAdarsh Shukla

Hey I am on Medial • 7m

Hey! I’m building a new-age esports & gaming platform focused on solving 3 core problems faced by players in games like Free Fire and ScarFall: 1. Slot Shortage in free tournaments 2. Lack of Exposure for talented players 3. Unaffordable Paid Tourna

See MoreShuvodip Ray

Never compromise wit... • 11m

⭐ The Domino Effect of a Single Breach 🔐 Imagine you use the same password for a social media account, email, and online banking. If hackers breach the social media platform (which happens daily), they’ll extract your credentials and test them on o

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)