Back

Havish Gupta

Figuring Out • 6m

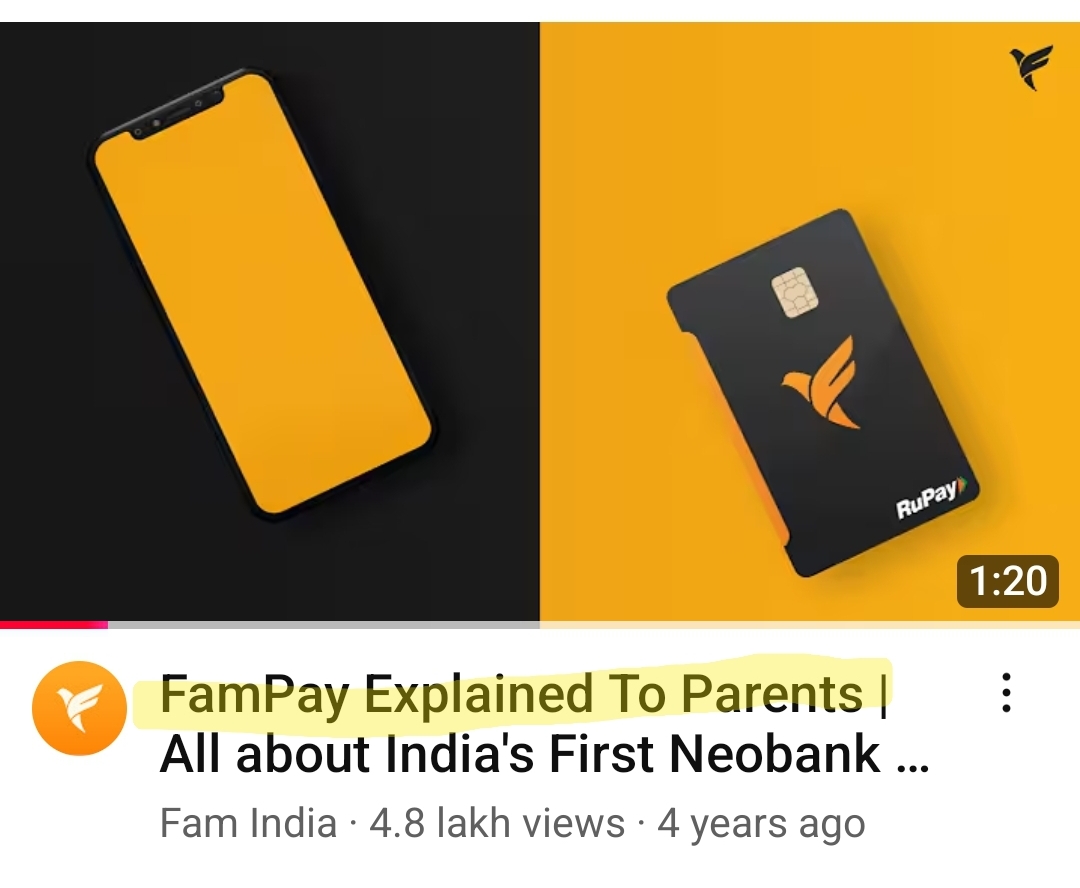

Remember Fampay? That struggling fintech startup made for teens. That startup has finally turned profitable, reporting a profit before tax of ₹10-12 crore with about ₹100 crore revenue (Entrackr reported). And it's really a big deal considering the fact that they couldn't raise a single funding round since 2021 while the company itself was bleeding money. Just look at their financials (Revenue/Profit): FY21: 0.35 Cr / -13.2 Cr FY22: 3.06 Cr / -43.36 Cr FY23: 3.8 Cr / -120 Cr FY24: 25.16 Cr / -13.51 Cr FY25: 90-100 Cr / +10-12 Cr And here's how they pulled this off: 1) Making it for everyone: They made it universal, which means along with teens, anyone with a bank account can use it just like a regular UPI app like GPay or PhonePe. 2) High charges: While the app is free to use, there are charges for everything from adding a custom UPI handle to money loading, from a custom PUBG theme QR page to subscription fees. 3) Offering gold and gift card purchases: Unlike other UPI apps, Fam doesn't have any fee payment systems, so they let you invest in gold and purchase gift cards, and that's where they make some flat commission fees. And 4th and most Importantly, they launched NAMASPAY last year, an app that allows foreigners to make UPI payments in India. For that, they charge a flat registration fee of ₹1,650 along with 4% and 1% fees for adding and withdrawing money respectively, while the UPI payments are free. International users just have to register with their mobile number and after a KYC, one can go ahead with making UPI payments by adding money with their credit cards. Because of all these reasons, FamApp (formerly FamPay) is now the 8th most used UPI app in India, standing just behind Cred and Axis Bank, processing over 112 million transactions monthly. Now, it's finally raising another funding round by Elevation Capital of $15 million. Also, I'm personally using FamPay for a very long time and they have improved their service a lot. Not even a single transaction has failed since I started using it, while in the beginning, every 3rd - 4th transactions used to just randomly fail. However, everything isn't working well for them. Taneja, one of the original co founder is leaving the company while investors are demanding exits. Still, they're performing way better than anyone expected, and they'll surely keep growing while tackling these issues. What do you think?

Replies (2)

More like this

Recommendations from Medial

Satyam Anand

BUILDING @something • 1y

🔥🔥🚀 FAMPAY IT IS !!! Meet Sambhav Jain and Kush Taneja , IIT Roorkee grads who co-founded FamPay, the neobank for teens. Dedicated to reshaping how teens engage with money , FamPay offers a secure and intuitive digital banking platform tailore

See More

Account Deleted

Hey I am on Medial • 12m

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Dr Sarun George Sunny

The Way I See It • 6m

The National Payments Corporation of India (NPCI) is developing UPI 3.0, an upgrade to its UPI that will enable payments through smart devices. The new system will be Internet of Things (loT) -enabled, allowing automated transactions via devices such

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)