Back

Applyly

Hey I am on Medial • 1y

Paytm has launched a UPI statement download Feature By Applyly November 7, 2024 Introduction Paytm has launched a UPI statement download feature to support users in managing expenses and tax filing. This tool is common in developed countries. But Paytm has launched this feature now in Indian market. This tool provides detailed transaction statements in a simple PDF format. Users can select specific date ranges, including entire financial years, to generate transaction records. With this new feature, Paytm aims to enhance financial transparency and simplify tax preparations. Users can easily monitor their transactions, set budgets, and maintain organised financial records. This addition aligns with Paytm’s ongoing effort to offer simple tools for better financial management. The feature empowers users to track their spending habits effectively. Quick and Convenient Access to Records Users can access the new UPI statement download option in the “Balance & History” section of Paytm. The feature enables users to choose custom date ranges and generate comprehensive UPI transaction statements. Each statement includes transaction amounts, recipient details, linked bank accounts, and timestamps. This in-depth financial breakdown helps users manage their expenses with ease and clarity. The feature supports day-to-day financial monitoring, making it easier for users to stay informed about their financial activities. Paytm has launched a UPI statement download Feature to ensure users can track their spending accurately. Simplifies the Tax Filing Process The UPI statement download feature is especially helpful for users preparing for tax filing. With organised transaction records, users can confidently share financial data with tax professionals or use them for self-filing. The detailed statements help users maintain transparency and avoid potential tax filing errors. Paytm has launched a UPI statement download Feature to offer users peace of mind by ensuring that their financial data is easy to access. Effective Budgeting Budget-conscious users will find Paytm’s UPI statement download tool very beneficial. The ability to review detailed transaction histories helps users identify spending patterns and plan their budgets better. This feature encourages users to adopt smarter financial habits by understanding where their money goes. Whether managing monthly expenses or planning for larger purchases, users gain valuable insights from their transaction records.

Replies (1)

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 11m

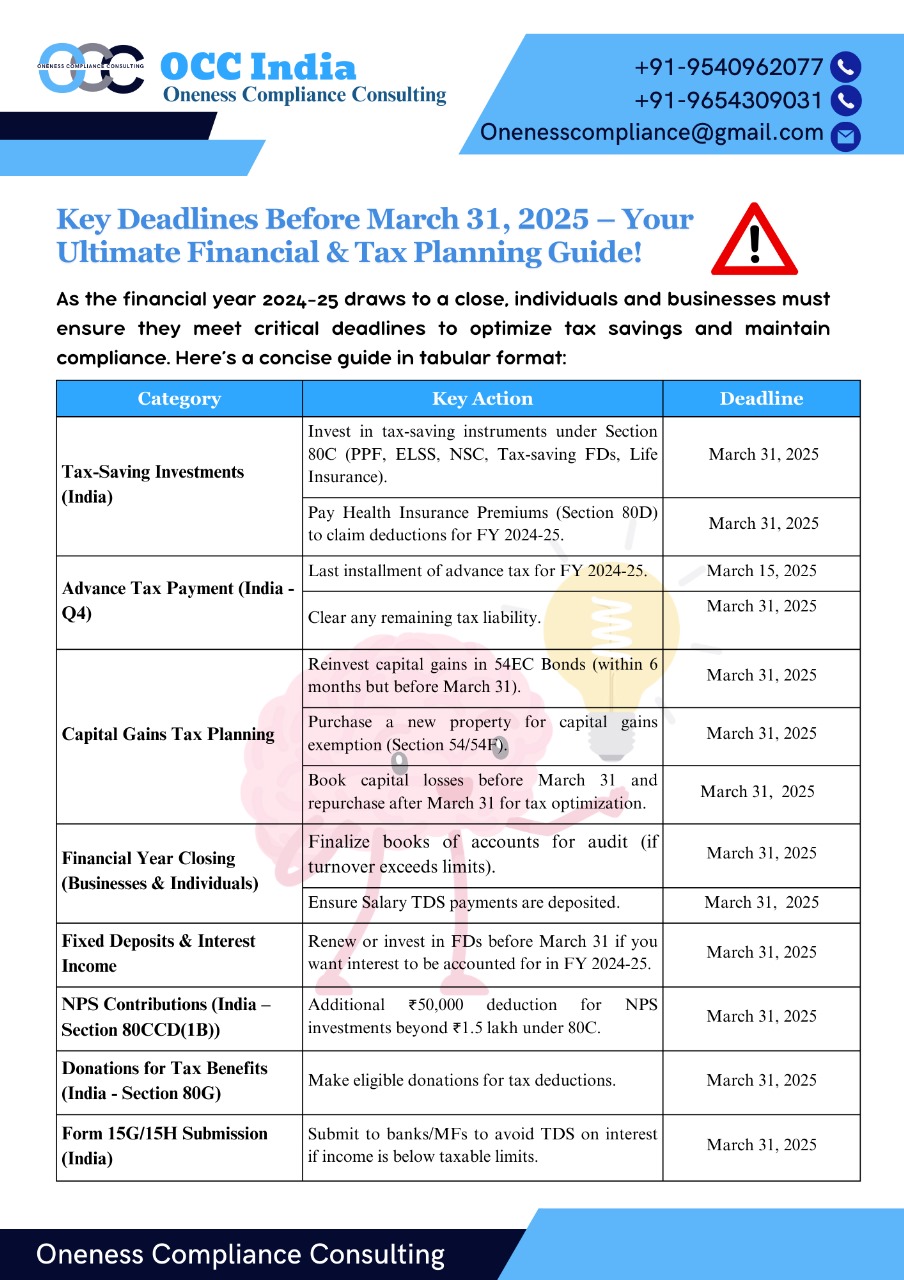

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Sameer Patel

Work and keep learni... • 1y

PAN Card The PAN (Permanent Account Number) card is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It's crucial for various financial transactions such as opening a bank account, filing income tax returns, and buyin

See Morecalculus

Your Bottom Line Our... • 8m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See Moregray man

I'm just a normal gu... • 10m

The Finance Ministry has dismissed reports suggesting that the government is considering imposing Goods and Services Tax (GST) on UPI transactions exceeding INR 2,000. In an official statement, the ministry clarified, “The claims that the government

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)