Back

Samanth Shetty

Be yourself • 8m

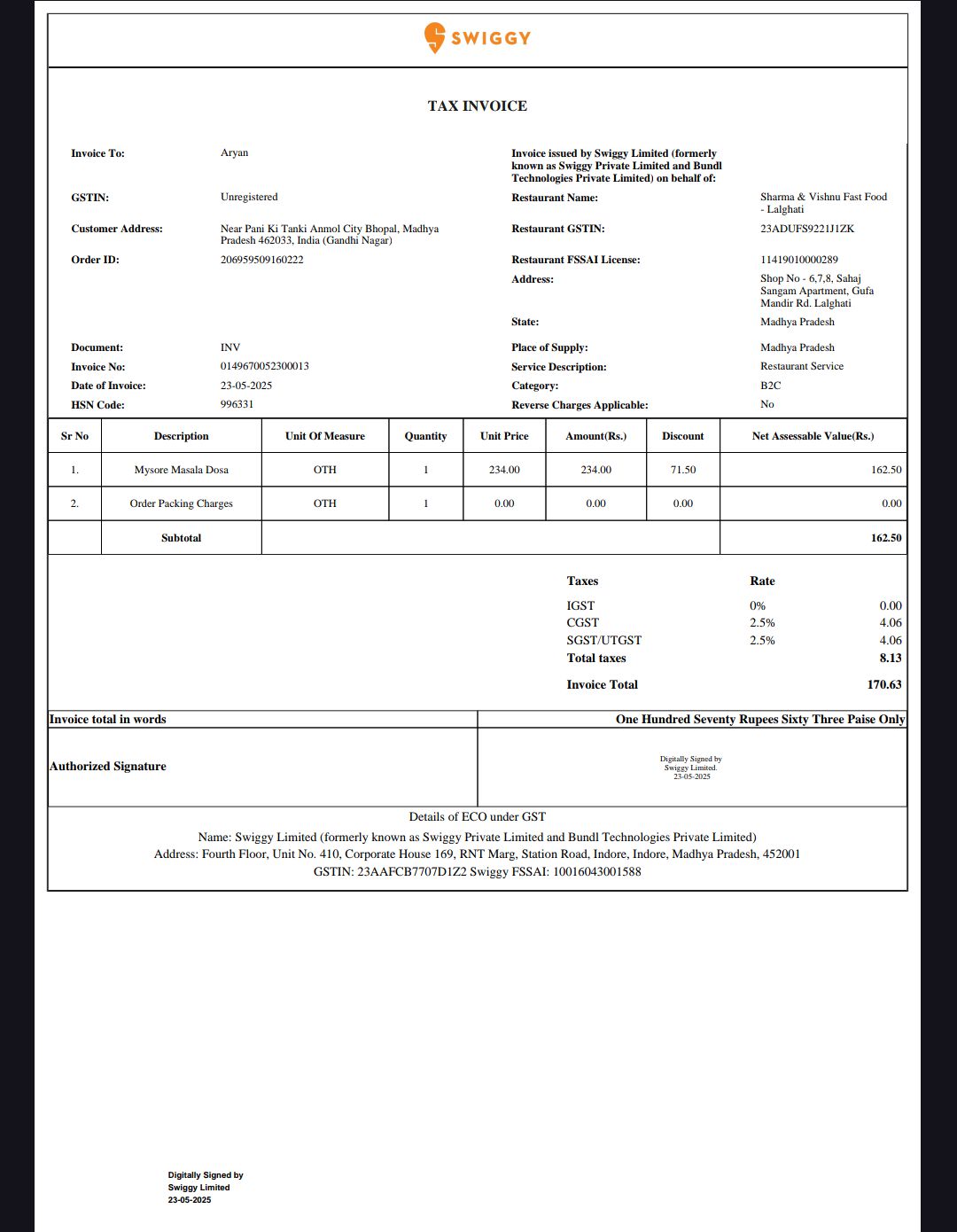

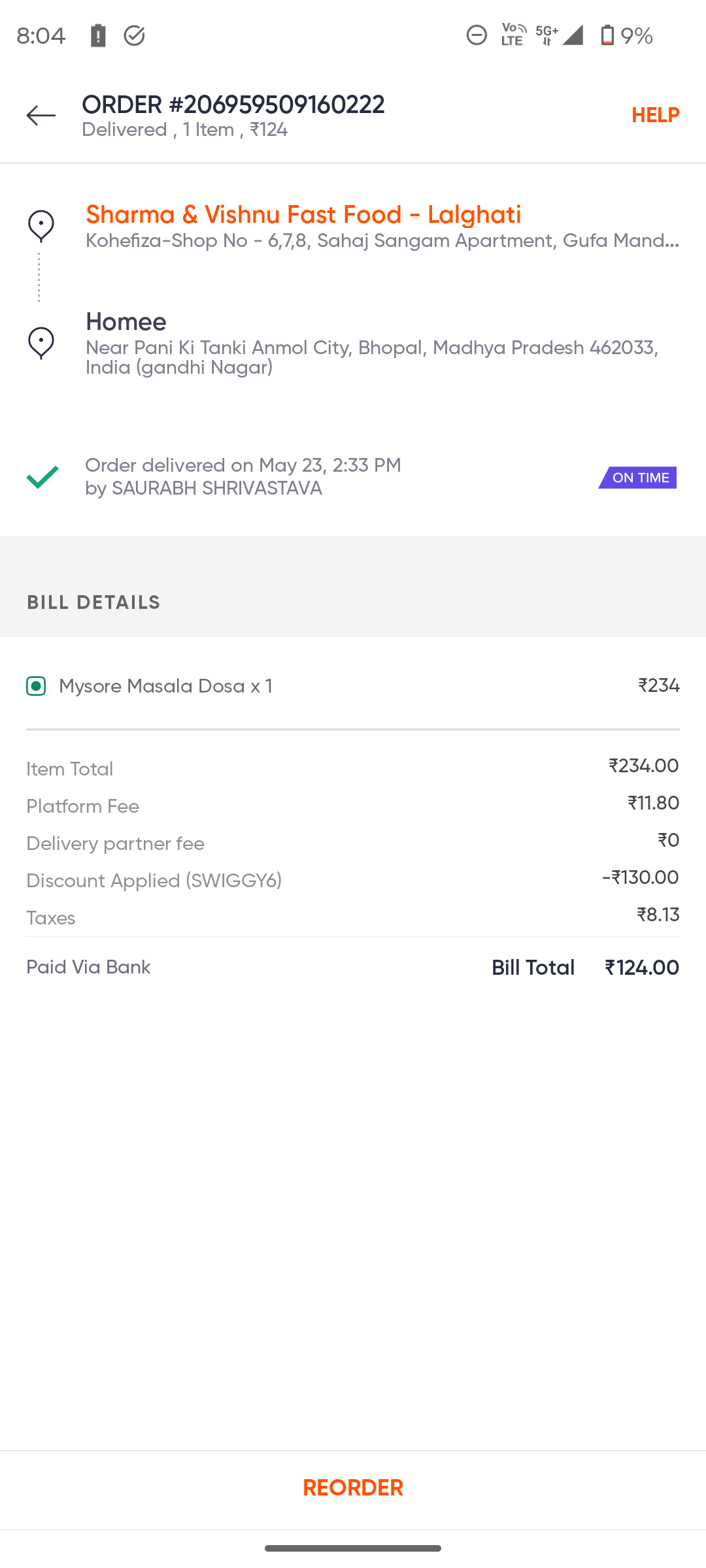

1. GST is charged on the amount before Swiggy’s discount. Lemme say you for example Swiggy gave you 130 discount, as a discount it doesn't reduce the taxable value for GST, because that discount is from Swiggy and not from resturant bro. If the resturant had offer or discount that would be liable of reducing GST but Swiggy is offering discount. Second thing is that discount shown on the invoice is 71rs which is resturant discount or they will charge resturant that discount, so that is legally deducted before tax if you see properly in invoice, MRP IS 234rs - 71rs equals to 162rs. So the tax is collected on 162rs. Hence yu have paid the correct tax and you have no gain or loss in this. Remaining 58rs was from Swiggy as a promotion and it oesn't affect your GST cost. Simple conclusion:- You paid ₹124, but GST is not on ₹124, it’s on ₹162.50, which is correct under Indian GST law. The Swiggy promo code is like a gift by them and it will not be liable to reduce the tax liability for the restaurant. I'm ending here, if you have any doubt contact your lawyer / Audit CA they will let you know the each and every detail.

Replies (1)

More like this

Recommendations from Medial

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreCA Kakul Gupta

Chartered Accountant... • 5m

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)