Back

Anonymous 2

Hey I am on Medial • 8m

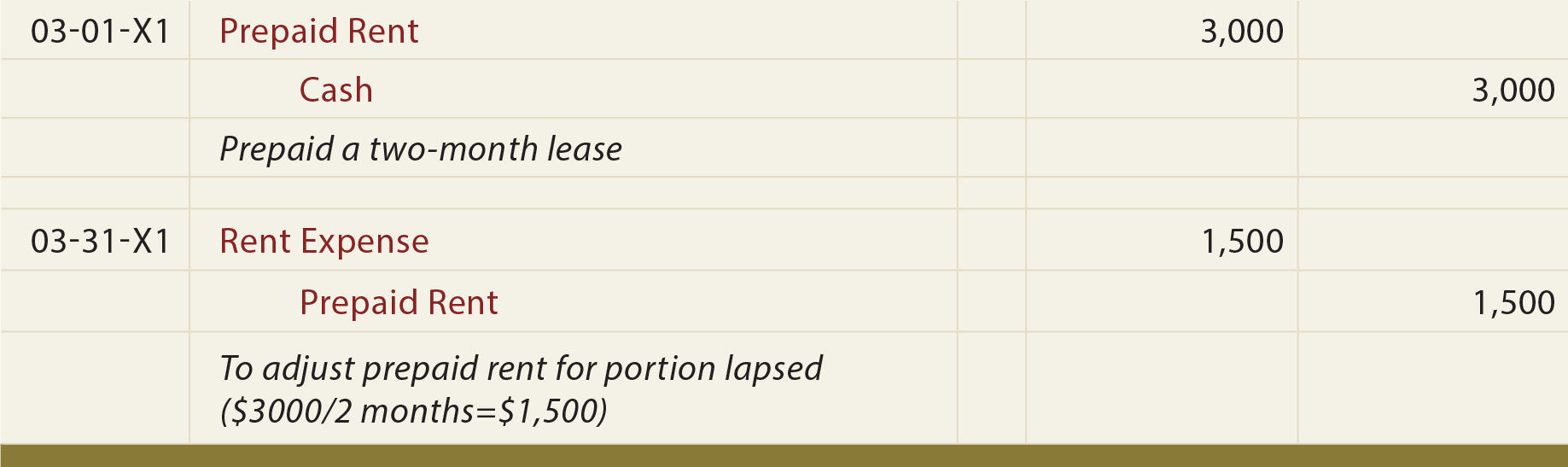

Great example, but how does this work with Indian GST? Do you record the GST component separately, or does it all go into the prepaid rent account? The tax implications seem important for Indian startups

Replies (1)

More like this

Recommendations from Medial

Reyansh Rathod

Entrepreneur • 11m

Friends, have you ever thought that paying tax is our responsibility, but why does it seem like a deep trap? India's tax system is so complicated that the common man gets confused! On one hand, the changing rules of GST, on the other hand, the high r

See MoreRecouptax Consultancy Services

Onestop solution for... • 10m

Hi Guys, Does anyone need help with book keeping, accounting, Gst filing/TDS filing services. We are offering affordable and reliable services for Individual Tax Filings, Book keeping, Accounting, GST & TDS filings and all other registrations.

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreAshutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreSantanu Bej

🚀Innovative Softwar... • 8m

I'm seeking advice from the professional community. My 50:50 partner and I have a registered private limited IT services company with a company account. We're having a disagreement on where to store our revenue. My partner suggests storing revenue i

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)