Back

Saket Sambhav

•

ADJUVA LEGAL® • 8m

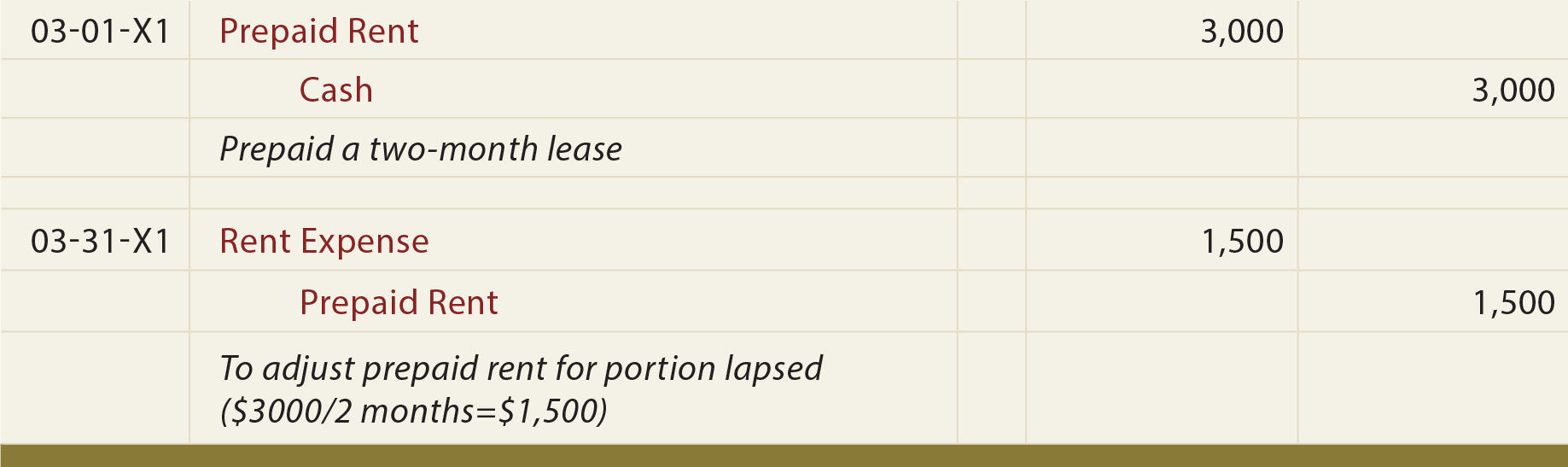

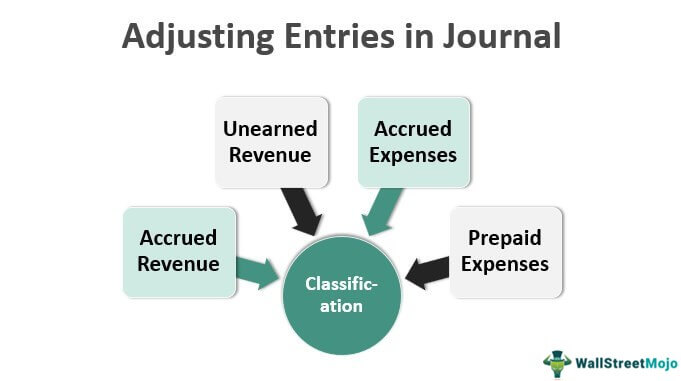

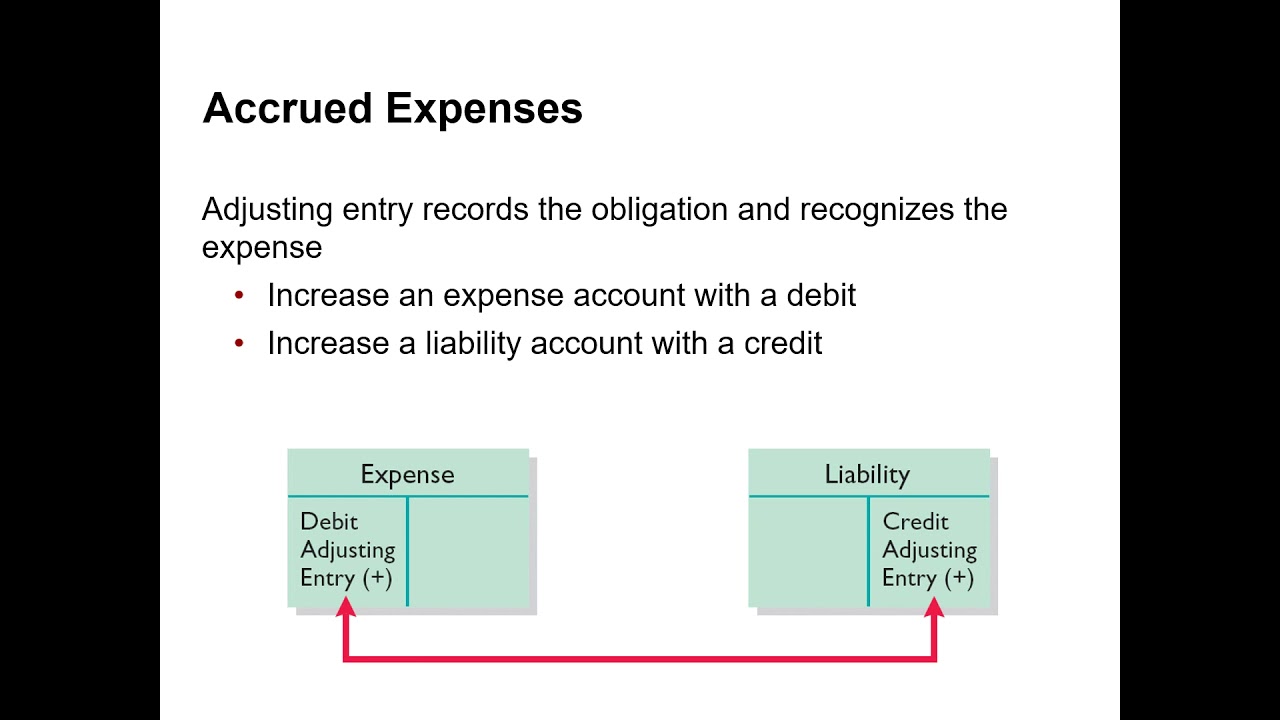

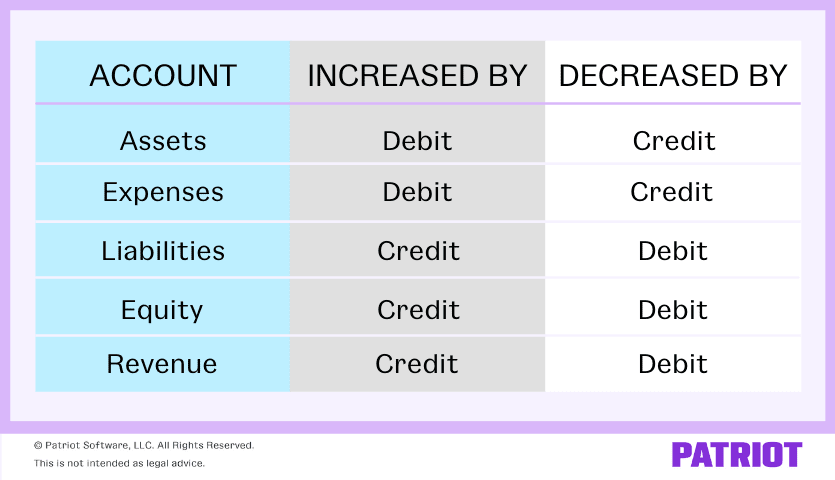

DBA Lessons for Founders - Topic 2: Types of Adjusting Entries - Prepaid Expenses (Converting Assets to Expenses) You're still running Tech Solutions India. 🚀 What are Prepaid Expenses? 🤔 Sometimes, your business pays for things in advance 💰 that it will use up over time. ⏳ When you pay upfront, you haven't actually used the service or item yet. So, it's not an "expense" right away. 🚫 Instead, when you pay, you get a "future benefit" or a "right to use" something for a period. In accounting, anything that gives you a future economic benefit is an Asset. ✨ So, a "Prepaid Expense" is essentially an asset that you've paid for upfront. ✅ Think of it like this: 💡 Imagine your company buys an annual subscription to a popular video conferencing software. You pay the entire ₹12,000 annual fee upfront. When you pay, you own the right to use that software for the whole year. That "right to use" is an asset until you actually consume the software's service month by month. 💻 Example for Tech Solutions India: Prepaid Office Rent 🏢 Initial Payment (The Cash Transaction): On January 1st, Tech Solutions India pays ₹30,000 from its bank for three months of office rent. This covers January, February, and March. 🗓️ What happened? Your bank balance (Cash/Bank Asset) went down by ₹30,000. But in return, you gained the right to use the office space for three months. 🔑 How you'd record it initially (on Jan 1st): Debit: Prepaid Rent (This is an Asset account. It's a future benefit. You have a "claim" on using the office for future months.) - ₹30,000 Credit: Cash/Bank (Your bank balance decreased.) - ₹30,000 At this moment, you haven't used the office for even one day of January yet. So, no rent "expense" has occurred. It's fully an asset on your books. 👍 Using it Up (Over Time): As January goes by, you are actively using up one month of that office space. 🏢 Even though you won't pay rent again until the three months are over, you benefited from having and using the office during January. ✨ The Need for Adjustment (End of January): At the end of January 31st, you need to make a special "adjusting entry." This entry will show that one month's worth of the office rent has been "used up" and is now an actual expense for January. 📊 How much is one month's worth? ₹30,000 (total prepaid) / 3 months = ₹10,000 per month. The Adjusting Entry (on Jan 31st): What happened? ₹10,000 of your "Prepaid Rent" asset is now gone (because you used the office space for January). This ₹10,000 has become a "Rent Expense" for January. ✅ How you'd record it: Debit: Rent Expense (This is an Expense account. Expenses reduce your profit. Debits increase expenses.) - ₹10,000 Credit: Prepaid Rent (This is an Asset account. You used up part of this asset, so its balance needs to go down. Credits decrease assets.) - ₹10,000 Why is this important? 🌟 It makes sure your Income Statement for January accurately shows the ₹10,000 Rent Expense that belongs to January. (This helps you calculate the true profit for January, as only the rent used in January is counted.) ✔️ It makes sure your Balance Sheet at January 31st accurately shows that you only have ₹20,000 (₹30,000 - ₹10,000) of Prepaid Rent left (as an asset) for the future months (February and March). This reflects what you still own for future use. ✔️ So, Prepaid Expenses start as assets when you pay cash, and then through an adjusting entry, they slowly "convert" into expenses as you use them up over time. It's all about making your financial reports true and fair for each period! 👍 pc - principlesofaccounting

Replies (6)

More like this

Recommendations from Medial

SAHA Realtors

Rediscovering lifest... • 7m

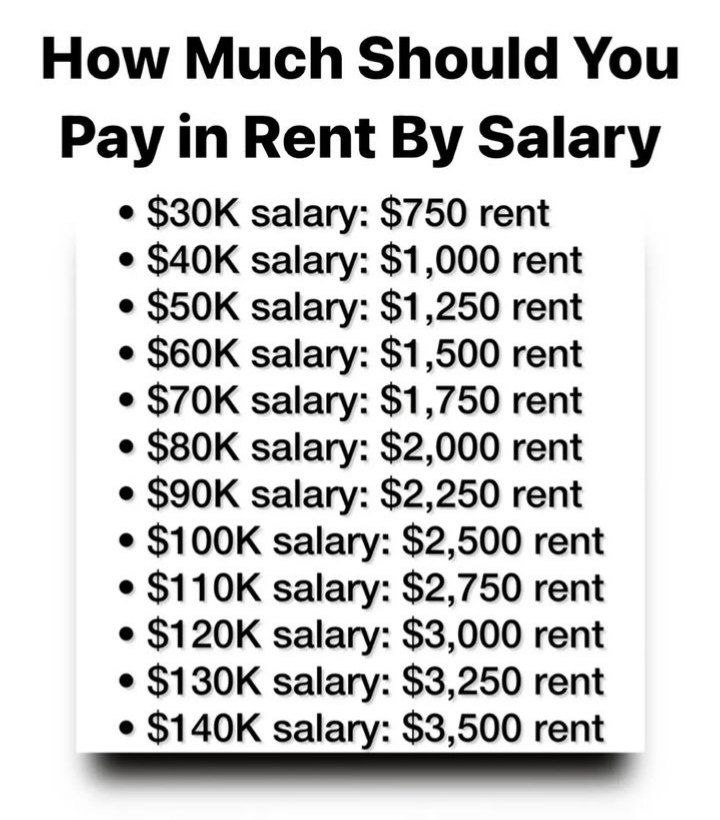

Real Estate Lease Agreements A lease is a written legal agreement between landlord and the tenant that helps to establish the following : *How much the tenant will pay in rent. *How long the tenant is legally committed to stay. *Any additional payme

See More

VENTURE NAVIGATOR

INVESTOR | Start up ... • 1y

Why One Startup Got Funded & The Other Didn’t? 🚀💰 Recently, I validated two pitch decks. One secured funding, while the other is still seeking investors. The difference? Smart financial planning vs. unnecessary burn. ✅ Funded Startup: 🔹 Allocat

See MoreAbhinav Pentani

Building @Vectr | Op... • 1y

Are you a founder who's tried keeping track of office expenses and felt like you were auditioning for a reality show called ‘Receipts Gone Wild’? (Sounds like a subreddit, but it’s not. ;) ) Or maybe you’re that small business owner drowning in invoi

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)