Back

Saket Sambhav

•

ADJUVA LEGAL® • 8m

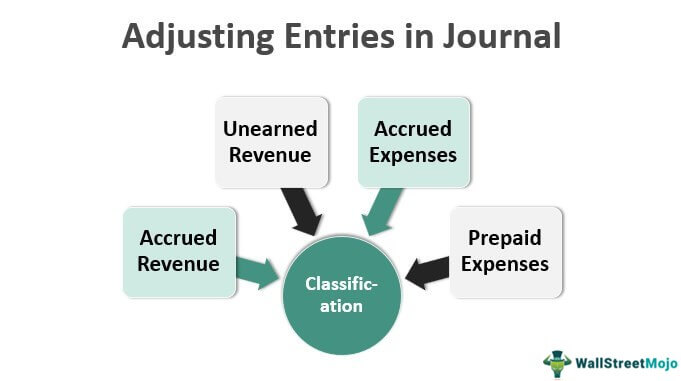

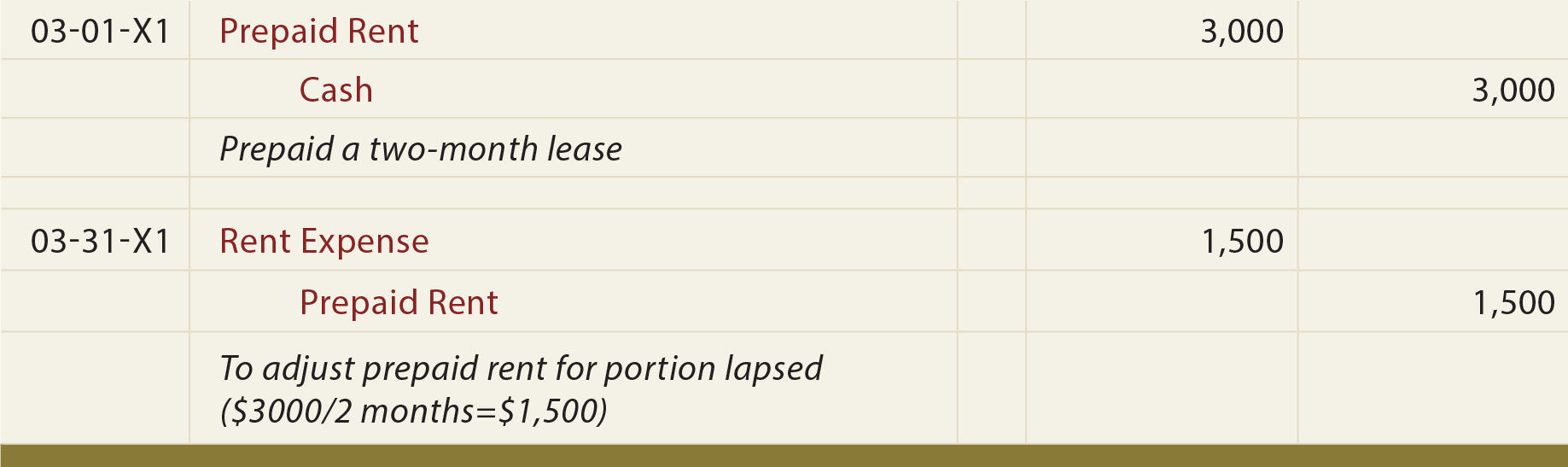

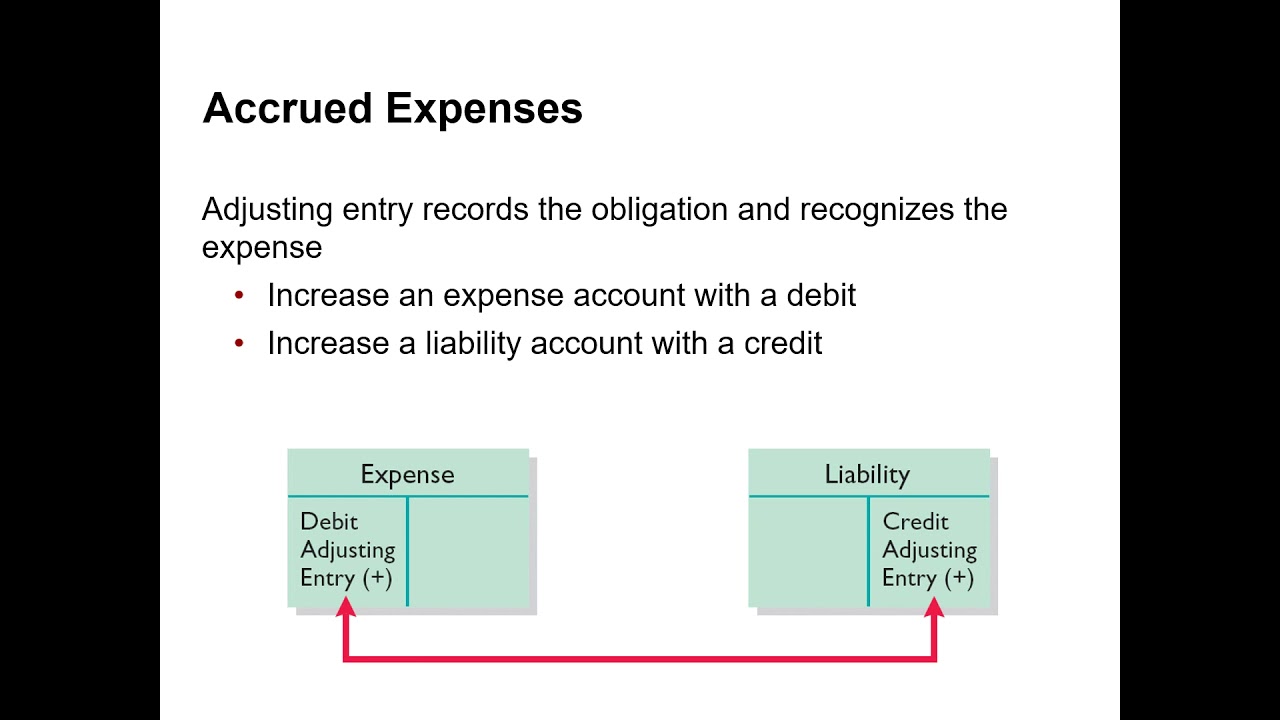

DBA Lessons for Founders - Hello party people - sharing some accounts related topics for now Let's NOT make Medial another news sharing app only... Topic 1: The Need for Adjusting Entries Why do we even NEED these "Adjustment Entries"? 🤔 Imagine you run a small local business, let's call it "Tech Solutions India," which provides IT support and software development. At the end of each month, you want to know exactly how much profit your business really made. 💰 Sometimes, in business, money doesn't move perfectly at the same time as services are provided or resources are used up. ⏳ Think about these common situations for "Tech Solutions India": 👉 Scenario A: Providing IT Support for a Big Client You provided extensive IT support to a big client throughout January. 💻 They promised to pay your invoice of ₹50,000 on February 10th. 🗓️ Even though the cash isn't in your bank account yet, you did the work and EARNED that ₹50,000 in January. ✨ 👉 Scenario B: Paying for Office Rent On January 1st, you paid ₹30,000 for three months of office rent upfront. 🏢 You spent the cash for all three months (January, February, March) right away. 💸 But in January, you only USED up one month's worth of that rent (₹10,000). ✅ If you just looked at when cash came in or went out of your bank account, your records for January might be confusing: 🤯 In Scenario A, your cash balance for January doesn't show the ₹50,000 you earned. 📉 In Scenario B, your cash balance for January shows you spent ₹30,000 on rent, but you only used ₹10,000 worth of rent in January. 📈 The Big Idea: Getting the "Right Picture" for the "Right Time" 📸 Accountants want to show the fairest and most accurate picture of how your "Tech Solutions India" business did for a specific time period (like January). They want to answer: ❓ How much revenue (money earned) did you really earn in January? (Even if some cash hasn't arrived yet, or some cash arrived early for future services). ❓ How many office resources, utilities, or other things did you really use up in January to provide those services? (Even if you paid for them last month, or will pay for them next month). This way of doing things is called "ACCRUAL Accounting." 📊 It's a fundamental principle where we record business events (like earning revenue or incurring expenses) when they actually happen, not just when cash changes hands. ➡️💵⬅️ So, "Adjusting Entries" are like special clean-up tasks that accountants perform at the very end of an accounting period (like January 31st) to: ✅ Update the books: Ensure all the services you provided are counted as revenue for the right month, and all the resources you used are counted as expenses for the right month. ✅ Show the true story: Help you see your actual profit for that specific time period, not just how much cash you received or paid. ✅ Match things up: Make sure the "costs you used to make money" (expenses) are matched against the "money you made" (revenue) in the same time period. This is a core accounting concept known as the "Matching Principle." 🤝 Why are they "adjusting"? 🤔 Because they adjust accounts that might be a little out of sync at the end of the period. They are needed for things that happen continuously over time (like equipment slowly wearing out ⏳) or for events where the cash part doesn't happen at the exact same time as the earning/using part. 🔄 That's the fundamental reason why adjusting entries are so important in accounting – to give you a clear, correct, and fair view of your business's performance for any given period. 👍 pic credit - WallStreetMojo Niket Raj Dwivedi

Replies (9)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

I started my accounting firm one year ago, I am not an CA but MBA with good experience in accounting but still struggling to get clients even struggling to pay rent and expenses, anyone who already faced the same situation or knows how to handle this

See MoreKimiko

Startups | AI | info... • 9m

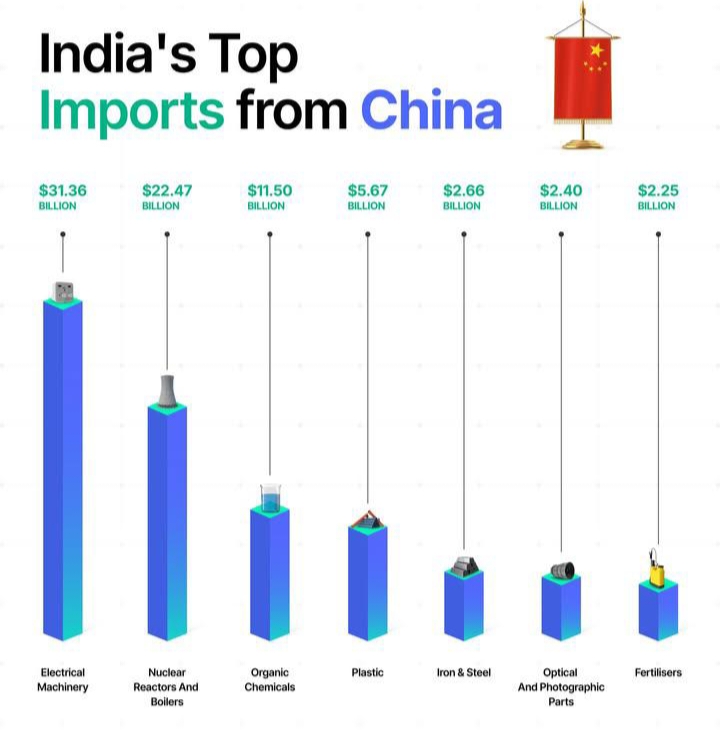

In 2024–25, India’s total imports stood at $915.19 billion, with China accounting for the largest share at $126.96 billion. During the same period, India recorded a trade deficit of $94.26 billion, widening from $78.39 billion in the previous year. I

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)