Back

Saket Sambhav

•

ADJUVA LEGAL® • 8m

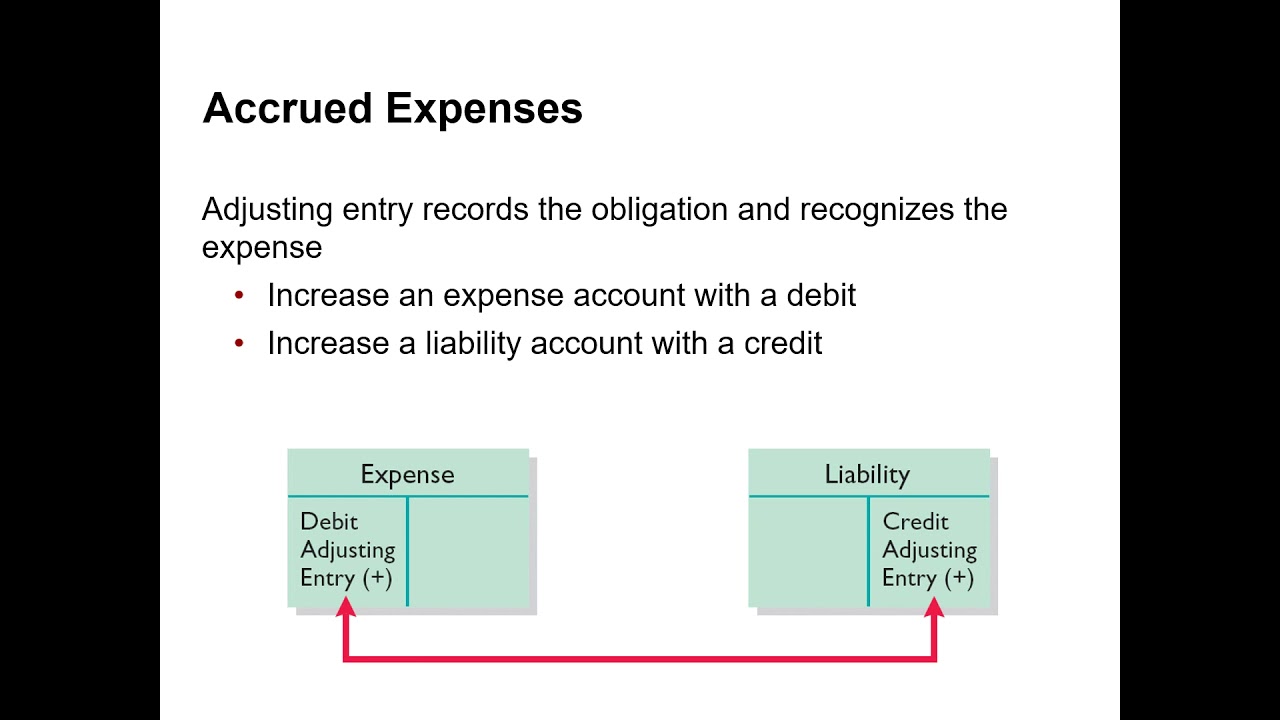

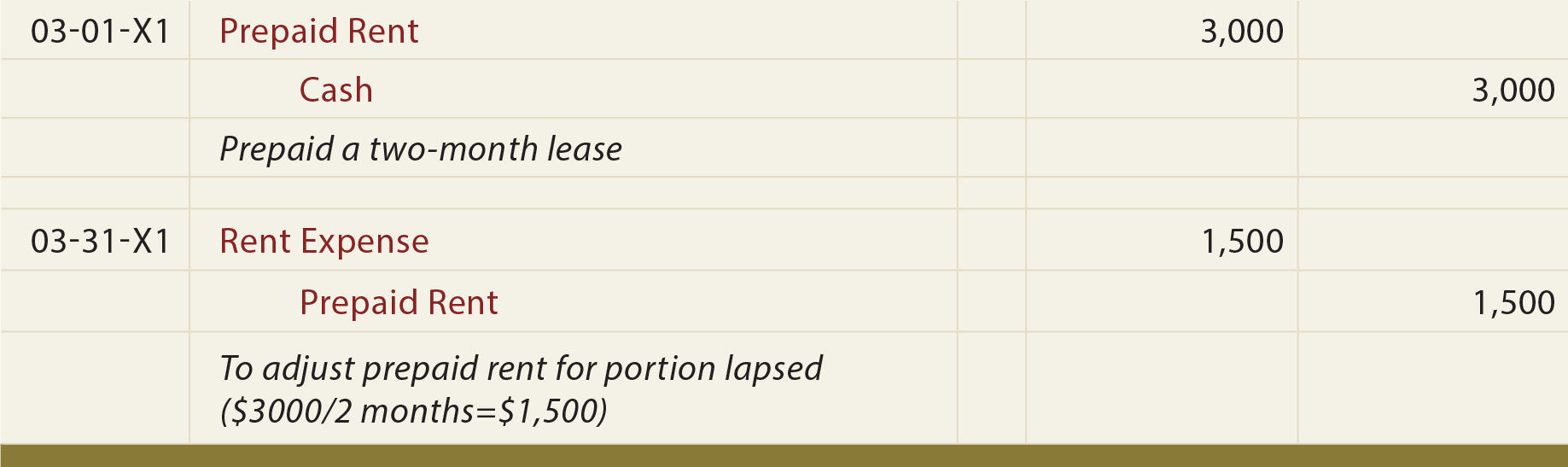

DBA Lessons for Founders - Topic 4: Types of Adjusting Entries - Accrued Expenses / Payables You're still running Tech Solutions India. 🚀 What are Accrued Expenses? 🤔 Sometimes, your business uses a service or receives a benefit in one accounting period (like a month), but you don't actually pay for it until a later period. ⏳ Even though you haven't paid cash yet, the expense has already happened because you've used the service or benefit. When an expense has occurred but you haven't paid for it yet, it means you owe that money. This "money owed" is a Liability. So, "Accrued Expenses" are expenses that have been incurred (used up) but are unpaid at the end of the accounting period. They result in a liability called a "Payable." 💸 Think of it simply: 💡 Imagine you hire a cleaning service for your office. They come and clean your office every week. At the end of the month, they might send you one bill for all the cleanings done that month, and you'll pay it next month. Even though you pay next month, the cleaning service was provided in the current month, so the expense belongs to the current month. 🧹 Example for Tech Solutions India: Accrued Salaries 👩💻👨💻 Work Performed (Over Time): Tech Solutions India pays its employees their salaries every Friday for the work done during that week. Let's say the total salary for all employees for a 5-day work week (Monday to Friday) is ₹25,000. So, each day costs ₹5,000 (₹25,000 / 5 days). The month of March ends on a Wednesday. The last payday was Friday, March 28th. This means employees worked on Monday, Tuesday, and Wednesday (March 31st) but haven't been paid for these 3 days yet because payday isn't until Friday, April 4th. 🗓️ The Expense is Incurred (Even if Unpaid): By March 31st, the employees have already worked for 3 days in March. This means Tech Solutions India has incurred a salary expense for these 3 days, even though cash hasn't left the bank. Accrued Salary for these 3 days = 3 days * ₹5,000/day = ₹15,000. The Need for Adjustment (End of March): At the end of March 31st, you need an "adjusting entry." You must show that you had ₹15,000 of Salary Expense in March, even though you won't pay the cash until April. You also need to show that you owe this money. 📊 The Adjusting Entry (on Mar 31st): What happened? ₹15,000 of salary expense was incurred in March. You also have a new debt (liability) for these unpaid wages. How you'd record it: Debit: Salary Expense (This is an Expense account. Expenses reduce your profit. Debits increase expenses.) - ₹15,000 Credit: Salaries Payable (This is a Liability account. It represents money you owe for salaries incurred but not yet paid. Credits increase liabilities.) - ₹15,000 Why is this important? 🌟 It makes sure your Income Statement for March accurately shows the ₹15,000 Salary Expense that belongs to March. (This helps you calculate the true profit for March by including all costs for work done in March.) ✔️ It makes sure your Balance Sheet at March 31st accurately shows a ₹15,000 Salaries Payable liability. This tells anyone looking at your books that your company owes this money to employees, even though it hasn't been paid yet. ✔️ Accrued Expenses are the opposite of Prepaid Expenses in a way: With Prepaid, you pay cash first, then incur the expense. With Accrued, you incur the expense first, then pay cash later. Both require adjustments to match revenues and expenses to the correct time period! 👍 Pic credit - Professor Bossard

Replies (7)

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

Dear Companies, This is a reminder that the due date for filing the Tax Deducted at Source (TDS) return for Quarter 4 (January to March) is 31st May 2024. Please ensure proper submission of your TDS return. Dear Individuals, Ensure that your TDS d

See More

Sanjay Kadali

•

Health Catalyst • 5m

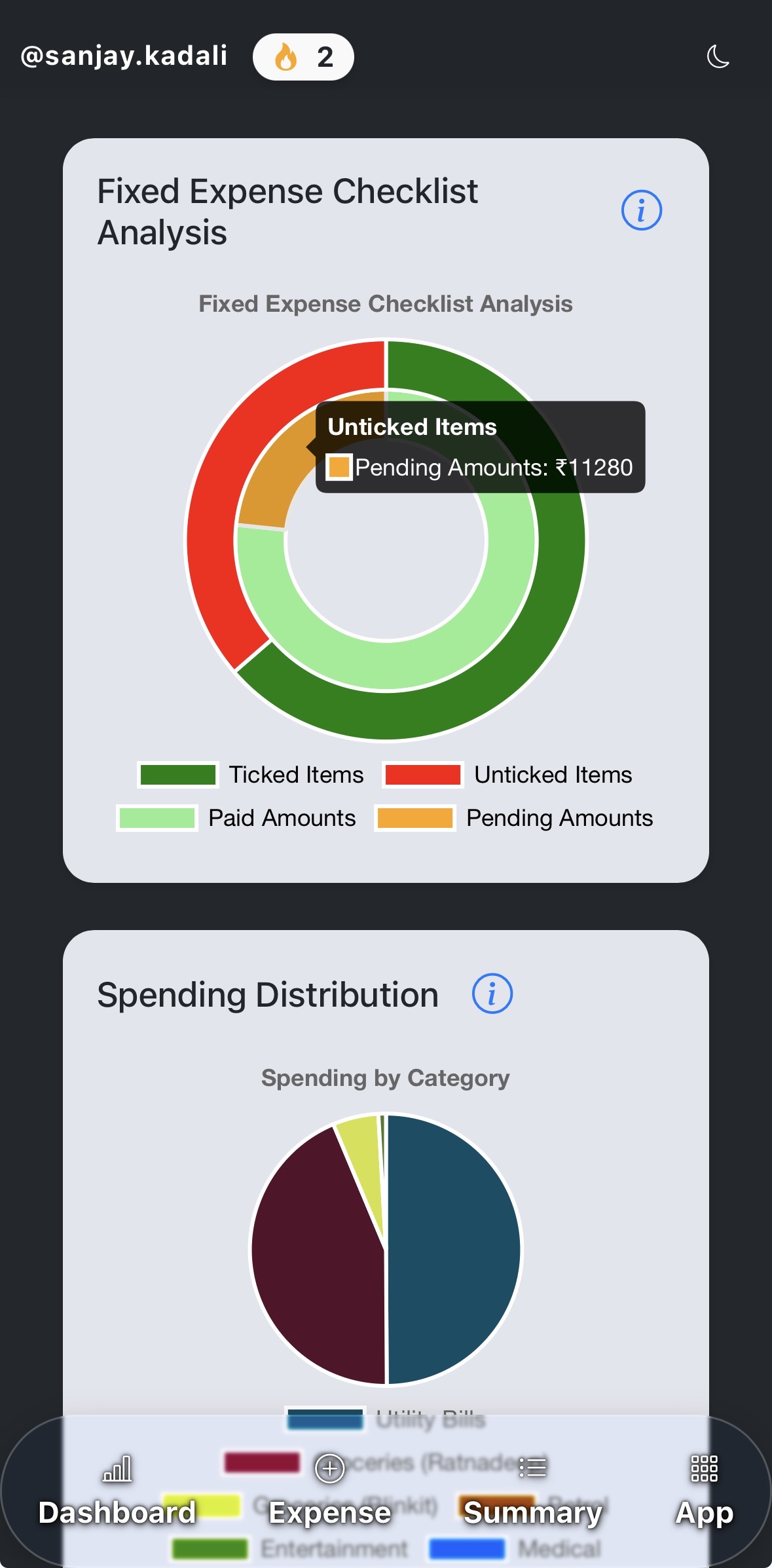

Fixed Expense Checklist: Pennywise lets users maintain a list of fixed expenses on a monthly basis... This visual representation helps users to be aware of pending and paid items for the month Adding a snip of it to this post. Please comment down i

See More

Sanjay Kadali

•

Health Catalyst • 5m

Ever asked yourself- "I need to sit and check my statements, why do I always end up with no cash at the end of the month!?" Well, skip this traditional approach and explore this new app in the talks: Pennywise, your new PET (Perosnal Expense Tracker

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)