Back

Saket Sambhav

•

ADJUVA LEGAL® • 8m

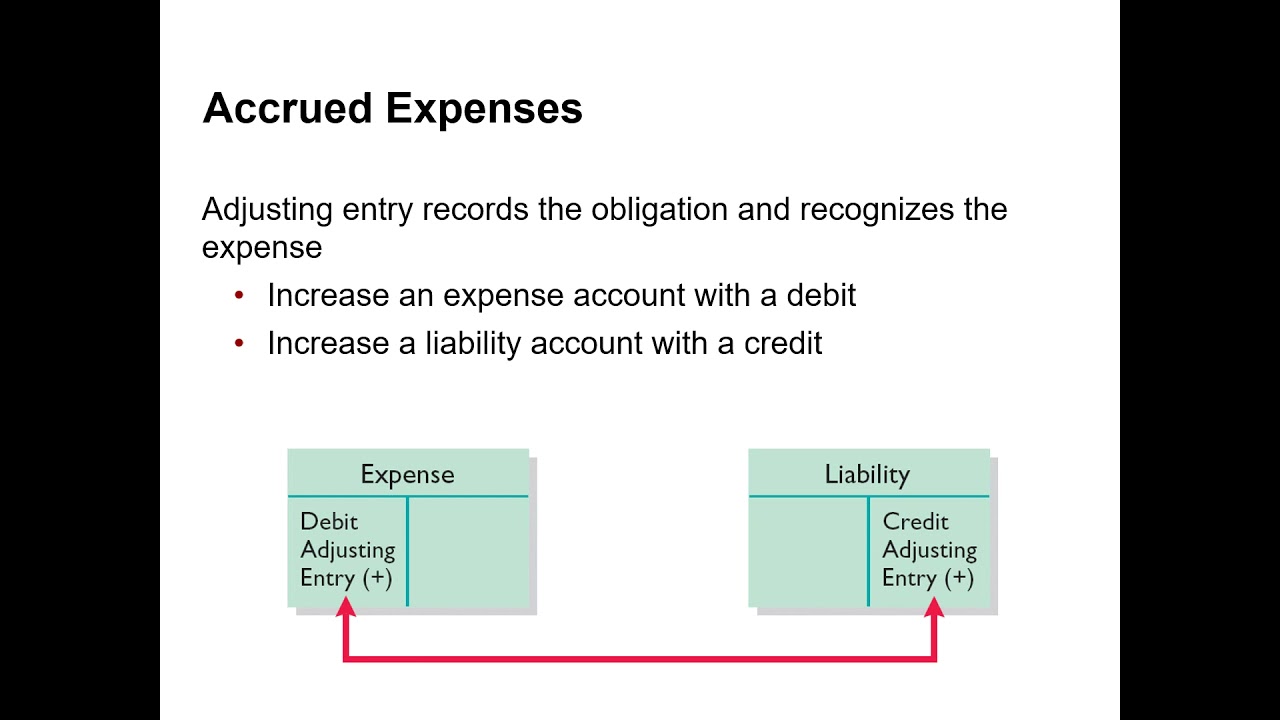

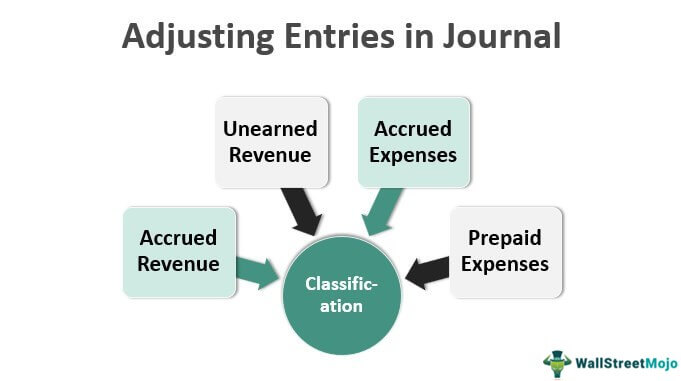

DBA Lessons for Founders - TOPIC 5 Types of Adjusting Entries - Accrued Revenues / Receivables You're still running Tech Solutions India. 🚀 What are Accrued Revenues? 🤔 Sometimes, your business provides a service or delivers a product to a client in one accounting period (like a month), but you don't actually receive cash for it until a later period. ⏳ Or perhaps you haven't even sent the bill (invoice) yet. Even though the cash hasn't come in, you have already done the work and earned that money. When you've earned money but haven't received cash yet, it means someone owes you that money. This "money owed to you" is an Asset called a "Receivable." So, "Accrued Revenues" are revenues that have been earned (work completed, service delivered) but for which cash has not yet been received (and perhaps not even billed) at the end of the accounting period. They result in an asset called an "Accrued Revenue" or "Accounts Receivable." 💰 Think of it simply: 💡 Imagine you're a freelance graphic designer. You finish designing a logo for a client on March 30th. You'll send them the invoice on April 1st, and they'll pay you in mid-April. Even though you get paid in April, you earned the money for the logo design in March, because that's when you finished the work. 🎨 Example for Tech Solutions India: Unbilled IT Support Services 💻 Service Performed (Over Time): Tech Solutions India provides ongoing IT support to a client, with billing done at the end of a long project phase. By March 31st, you have provided ₹75,000 worth of IT support services to a client. However, according to your contract, you won't send the bill (invoice) and receive payment until April 15th. 🗓️ The Revenue is Earned (Even if Uncollected): By March 31st, you have already completed the IT support services for ₹75,000. This means Tech Solutions India has earned this revenue in March, even though cash hasn't entered the bank and a formal bill hasn't been sent. Under accrual accounting, revenue must be recognized when earned. ✨ The Need for Adjustment (End of March): At the end of March 31st, you need an "adjusting entry." You must show that you earned ₹75,000 in Service Revenue in March, even though you won't receive the cash or send the bill until April. You also need to show that this client owes you this money. 📊 The Adjusting Entry (on Mar 31st): What happened? ₹75,000 of service revenue was earned in March. You also have a new asset (money owed to you) for these uncollected services. How you'd record it: Debit: Accounts Receivable (This is an Asset account. It represents money owed to your business. Debits increase assets.) - ₹75,000 Credit: Service Revenue (This is a Revenue account. It increases your profit. Credits increase revenues.) - ₹75,000 Why is this important? 🌟 It makes sure your Income Statement for March accurately shows the ₹75,000 Service Revenue that belongs to March. (This helps you calculate the true profit for March by including all income earned from work done in March.) ✔️ It makes sure your Balance Sheet at March 31st accurately shows a ₹75,000 Accounts Receivable asset. This tells anyone looking at your books that your company is owed this money, even though it hasn't been collected yet. ✔️ Accrued Revenues are the opposite of Accrued Expenses: With Accrued Revenues, you earn the revenue first, then receive cash later. With Accrued Expenses, you incur the expense first, then pay cash later. Both types of adjustments are crucial to follow the matching principle and show the correct financial picture! 👍

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 11m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreTushar Aher Patil

Trying to do better • 1y

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)