Back

Saket Sambhav

•

ADJUVA LEGAL® • 8m

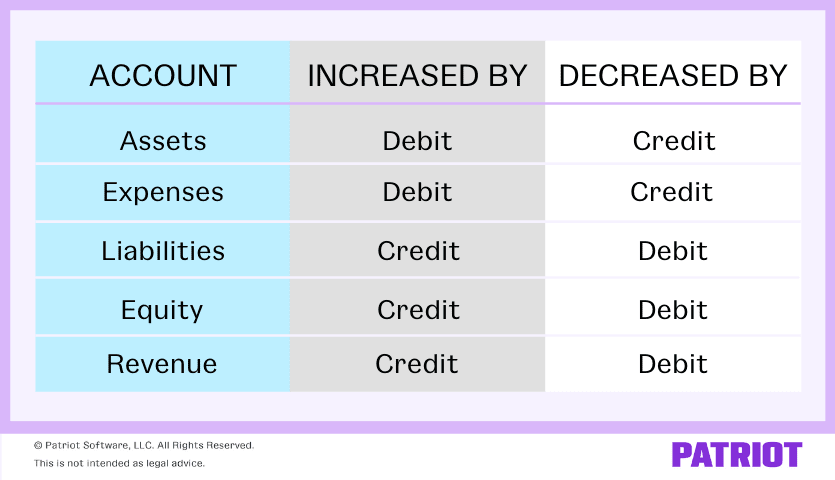

DBA Lessons for Founders - TOPIC 3 Types of Adjusting Entries - Depreciation (A Special Way of Converting Assets to Expenses) You're still running Tech Solutions India. 🚀 What is Depreciation? 🤔 Think about your big-ticket items that last for years - servers, office furniture, or vehicles. These are your "Fixed Assets." 🖥️ They don't last forever; they slowly wear out or become obsolete. Depreciation is the accounting process of spreading the cost of an asset over all the years it helps your business make money. It's NOT about an asset's resale value in the market. 🚫 It's about matching the asset's cost to the revenue it helps generate each period. This is a core concept called the "Matching Principle." Example: Server Equipment 🖥️ You buy new servers for ₹6,00,000 with an expected useful life of 5 years (60 months). Using the simple "straight-line" method: Monthly Depreciation = ₹6,00,000 / 60 months = ₹10,000 per month. At the end of each month, you make this adjusting entry: Debit: Depreciation Expense - ₹10,000 (This is this month's "used up" cost. It goes on your Income Statement.) Credit: Accumulated Depreciation - ₹10,000 (This is a special "contra-asset" account. It's a running total of the asset's wear and tear.) How it Looks on Your Balance Sheet: The "Accumulated Depreciation" account sits right under the asset, reducing its value on your books. After one month, it looks like this: Server Equipment (Original Cost) : ₹6,00,000 Less: Accumulated Depreciation : (₹10,000) Book Value of Server Equipment: ₹5,90,000 📉 This "Book Value" is the asset's remaining value for accounting purposes. Important Exception: Land is never depreciated! It doesn't get 'used up'. 🏞️ Why does this matter? Depreciation ensures your monthly Income Statement is accurate by including the cost of using your long-term assets. It also gives a true picture of your assets' book value on the Balance Sheet. It's crucial for understanding your real profitability! ✨ Pic credit - Patriot Software

Replies (4)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 6 About Basic Finance and Accounting Concepts Here's Some New Concepts 3. Tangible Assets Physical assets that have a physical form and can be touched. Examples: machinery, real estate, vehicles, inventory, and office supplies. 4. Intangibl

See More

PRATHAM

Experimenting On lea... • 1y

📢 WTF is EBITDA ❓🤔 EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization ( Amortization in simple words is like repayment of installment/loans). It’s like looking at how much money a company makes from its core busine

See MoreSanskar

Keen Learner and Exp... • 11m

Complicated Business Terms Simplified PART: 1 ROI (Return on Investment): How much profit or value an investment generates compared to its cost. TAM (Total Addressable Market): The total demand for a product/service globally, assuming no competiti

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Continue-Tax and Accounting Compliance within the Online Gaming Sphere!! Value of supply of online gaming including online money gaming Value =Total paid or payable to or deposited with the supplier by way of money or money's worth, including virtu

See More

Vasvi Seth

Cyber Security Stude... • 1y

Protecting assets is paramount for any organization. Whether digital or physical, assets hold immense value. 📊 Digital assets, such as sensitive employee or client data like SSNs, dates of birth, and bank account details, demand robust safeguarding.

See MoreTushar Aher Patil

Trying to do better • 1y

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)