Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 8m

Let me summarise this 😊 Depreciation refers to the wear and tear of tangible fixed assets, such as machinery and buildings (excluding land). Each year, you can deduct a fixed amount or a percentage of these assets until their value reaches zero at the end of their useful life. ( You can choose any of the SLM or WDV methods to record Depreciation) Similarly, amortisation applies to intangible assets, like software and servers. Depreciation is important for providing an accurate financial position of the company in any given financial year. If we were to deduct all depreciation in one year, it would lead to misleading profits or losses in the financial statements, so its divided into useful life age of an asset.

Replies (1)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 6 About Basic Finance and Accounting Concepts Here's Some New Concepts 3. Tangible Assets Physical assets that have a physical form and can be touched. Examples: machinery, real estate, vehicles, inventory, and office supplies. 4. Intangibl

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

Decline in India's Household Savings Net household savings in India declined to a 47-year low of 5.1% of gross domestic product in FY23, compared to 7.2% in the previous year. The finance ministry attributes this to changing consumer preferences for

See More

Tushar Aher Patil

Trying to do better • 1y

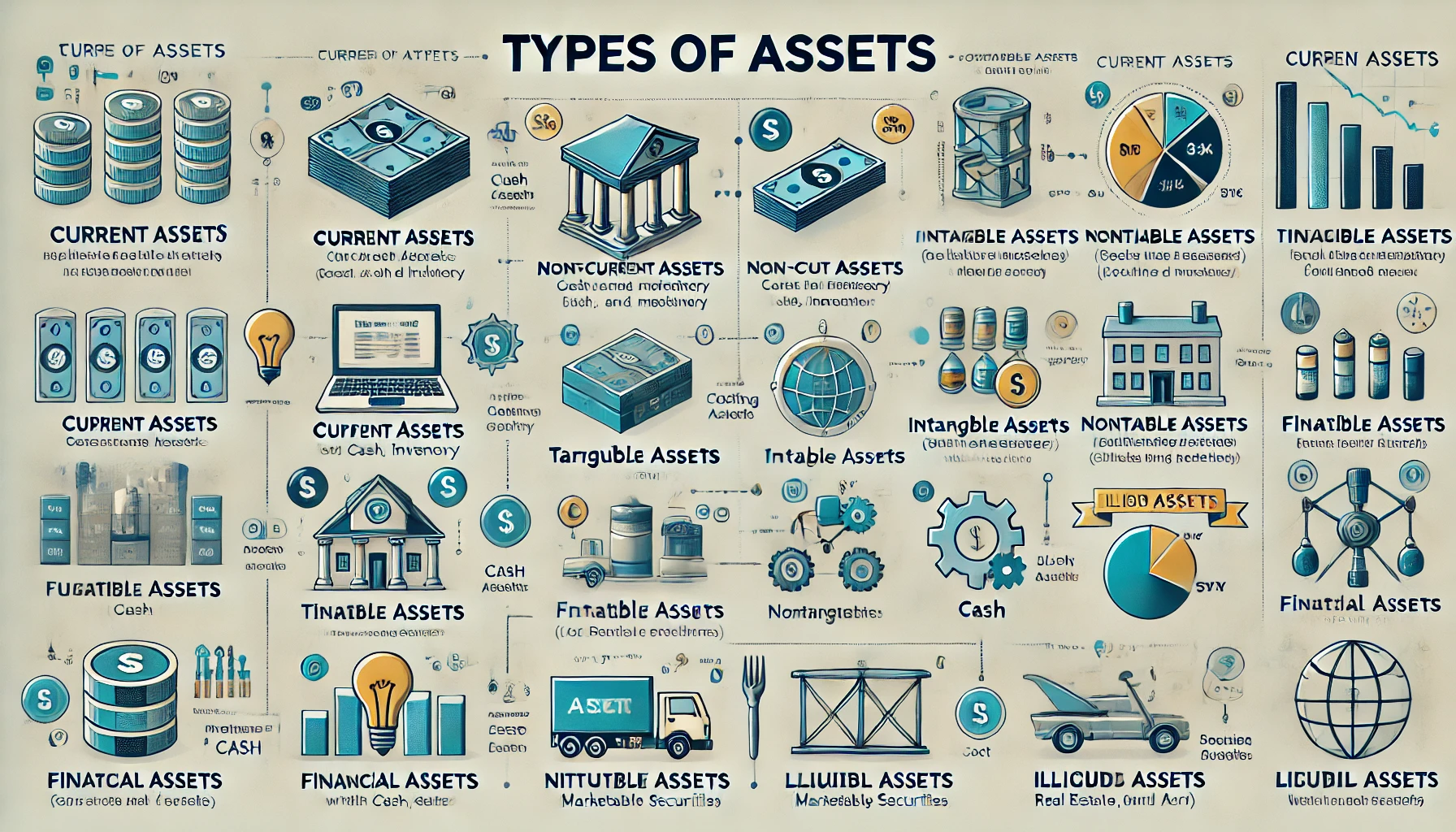

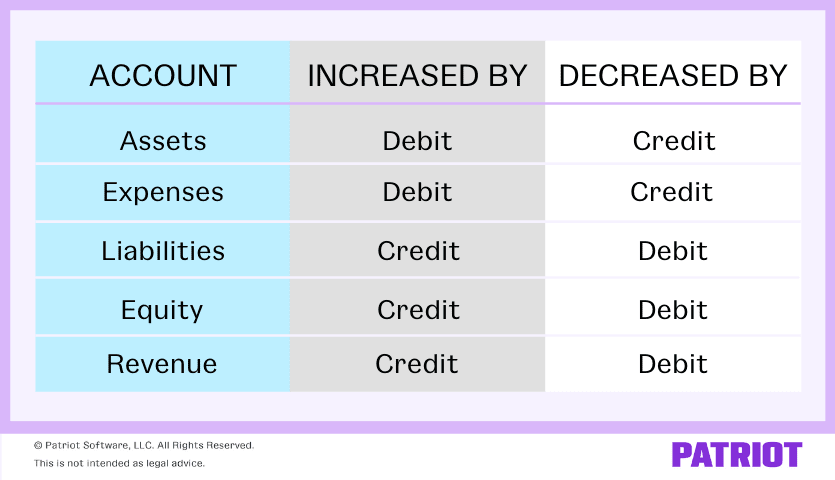

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Shivam Singh

"Igniting My Startup... • 1y

Fundamental Challenges of Finance #Valuation . How are financial assets valued? How should financial assets be valued? How do financial markets determine asset values? How well do financial markets work? #Management . How much should I save

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)