Back

Shivam Tyagi

"Driving Opportuniti... • 1y

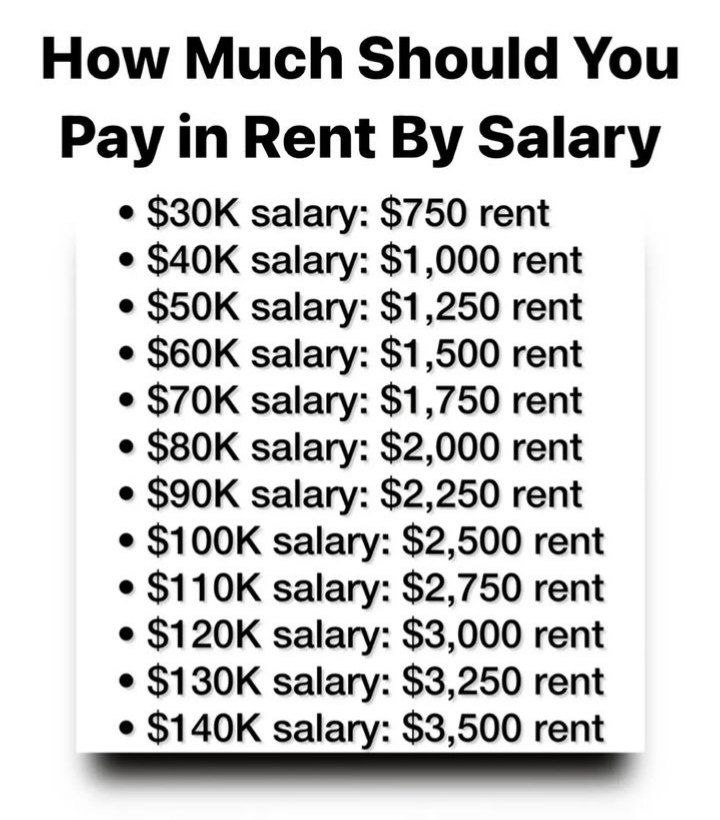

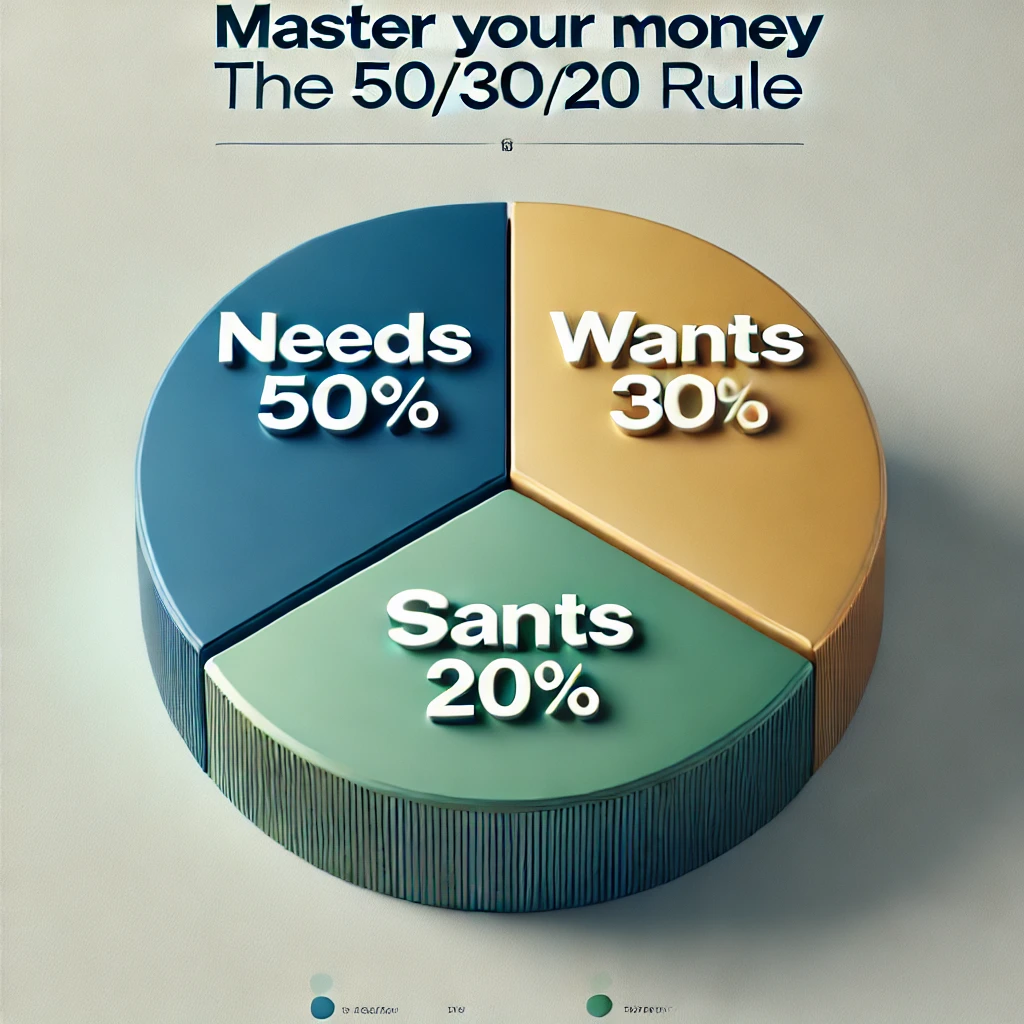

Struggling to budget your rent? A good rule of thumb is to keep your rent at **30% of your monthly income** or less. This ensures you have enough left for savings and other expenses!

Replies (5)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

I am 28 years old and have 32L in savings. 1L monthly expenses 3.2L monthly income through jobs other passive income sources. If I start saving 2L per month in the next 12 years 2.88 Cr. Let’s consider with job switches and increments this amount re

See MoreSurya Reddy

Every thing happens ... • 11m

hii guys, iam here to announce a startup idea which is useful for all it is mainly like transferring of money and it is mainly have a separate folders to your money (folders for money) for ex:- if your father send a 10000 rs for your monthly expenses

See MoreAnonymous

Hey I am on Medial • 1y

I started my accounting firm one year ago, I am not an CA but MBA with good experience in accounting but still struggling to get clients even struggling to pay rent and expenses, anyone who already faced the same situation or knows how to handle this

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)